Editor’s observe: Looking for Alpha is proud to welcome Lake Geneva Investor as a brand new contributor. IT‘s straightforward to change into a Looking for Alpha contributor and earn cash on your greatest funding concepts. Energetic contributors additionally get free entry to SA Premium. Click on right here to seek out out extra »

Gold Underperforms In Instances Of Low Curiosity Charges And Unfastened Financial Coverage

A key argument for gold’s attraction is that the resurgence of Quantitative Easing (QE) and Zero Curiosity Fee Coverage (ZIRP) will increase its worth. This is smart, as devaluing fiat foreign money usually enhances the price of exhausting belongings.

Going one step additional, throughout low rate of interest durations, zero-yield belongings like gold theoretically ought to change into extra interesting in comparison with these with a yield. As an illustration, if rates of interest had been at 10%, gold’s alternative value could be important as a result of 10% yield loss. However at ~2% curiosity, the hole narrows to simply 2%, making gold extra enticing.

Nonetheless, this has not occurred when taking a look at previous knowledge.

Common FED Charges, 1940 to 2023 (Creator’s elaboration of information from the St. Louis Fed)

The chart above shows common US federal funds rates of interest over the previous 84 years, with highlights in yellow indicating:

- A really free financial interval from 2008 to 2023, marked by Quantitative Easing post-2008 recession and the introduction of ZIRP coverage.

- A free financial interval from 1940 to 1960, throughout and after World Conflict II, when the US (and Europe) maintained low rates of interest to stimulate and rebuild the economic system.

- A decent financial interval from 1965 to 1985, overlaying the excessive inflation period of the Seventies, Volcker’s insurance policies, and the US greenback’s departure from the gold normal.

Gold ought to be anticipated to excel throughout the first two durations of free financial coverage, whereas probably underperforming equities within the tight financial surroundings of 1965 to 1985. But, the information contradicts these expectations:

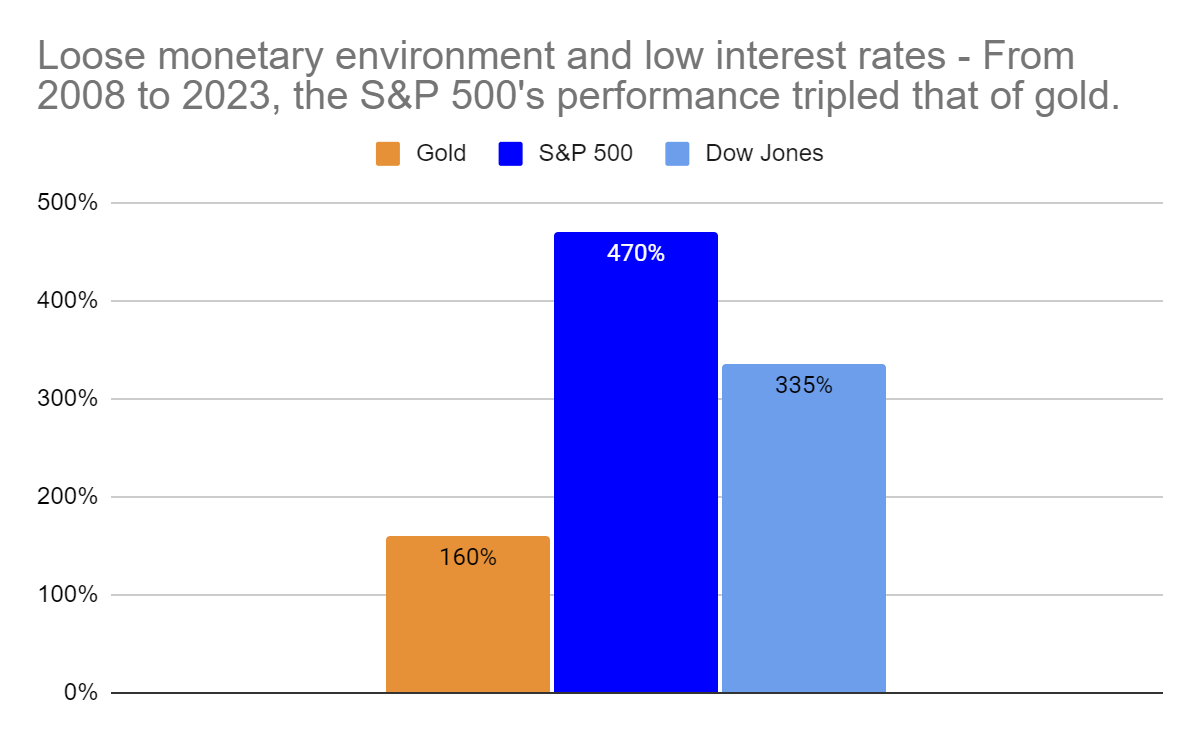

Cumulative efficiency of gold vs. S&P 500, 2008 to 2023 (Creator’s elaboration of Macrotrends.com knowledge)

Yearly efficiency of gold vs. S&P 500, 2008 to 2023 (Creator’s elaboration of Macrotrends.com knowledge)

Up to now 15 years (from 2008 to 2023), the S&P 500 and Dow Jones have carried out respectively at +470% and +335%. Gold, compared, has solely carried out at +160%, regardless of having reached all-time highs.

Cumulative efficiency of gold vs. Dow Jones, 1940 to 1960 (Creator’s elaboration of Macrotrends.com knowledge)

Yearly efficiency of gold vs. Dow Jones, 1940 to 1960 (Creator’s elaboration of Macrotrends.com knowledge)

From 1940 to 1960, gold, once more, underperformed. From 1940 to 1960, gold’s price decreased from 750 USD / Oz to 370 USD / Oz, whereas the Dow Jones has carried out at +461%. Notice that I’m utilizing the Dow Jones as a comparability for this time interval as a result of the S&P 500 was solely launched in 1957.

Cumulative efficiency of gold vs. S&P 500, 1965 to 1985 (Creator’s elaboration of Macrotrends.com knowledge)

Yearly efficiency of gold vs. S&P 500, 1965 to 1985 (Creator’s elaboration of Macrotrends.com knowledge)

Throughout 1965 to 1985, a interval that includes the best rates of interest within the final 84 years, gold truly outperformed the S&P 500.

Information exhibits that the extra financial coverage is free, the extra gold underperforms relative to equities (whereas its nominal worth expressed in fiat foreign money will increase). How does this make sense? The explanations are in the end debatable and rooted within the human conduct of market gamers, however these are dynamics which may clarify IT:

- In an surroundings with low rates of interest and the specter of inflation, traders could merely choose to chase returns and take larger danger. This trumps the truth that a rational investor ought to choose gold, given the restricted alternative value. Traders usually are not at all times rational, and between 2010 and 2020 they usually most well-liked to put money into unprofitable startups reasonably than in gold or in dividend shares.

- During times of free financial coverage, gold’s nominal worth expressed in fiat foreign money goes up. The extra gold’s nominal worth goes up, the extra miners extract gold. This exerts a downward strain that retains gold’s costs artificially low and determines its underperformance. The last word difficulty right here is that gold just isn’t actually scarce and will be mined at will.

- Gold is an asset that doesn’t generate a money stream. In a yield-starved financial surroundings, traders could choose belongings that generate a money stream and that may adapt rapidly to inflation. An organization can increase its costs, a landlord would possibly improve its lease. Gold doesn’t have an identical mechanism and might solely depend on its perceived shortage to thrive in an inflationary surroundings.

When you imagine that QE and ZIRP usually are not reversible and that a technique or one other the US will hold spending far more cash than IT can afford, then gold just isn’t the asset it’s best to select. You may nonetheless argue that issues could be completely different subsequent time, however knowledge to date has at all times proven that the loser the financial coverage is, the worst gold performs relative to different belongings.

Gold Is Not Scarce In Nature

The World Gold Council has discovered that humanity mined roughly 212,582 tonnes of gold all through historical past, with two-thirds of this complete extracted since 1950.

The BBC estimates that roughly 50,000 tonnes of gold are presently reachable and will be mined with relative ease. This determine represents 20% of all gold, and IT is named “below-ground inventory” of gold. Nonetheless, that is solely gold that we now have in present, current mines. Even barring any technological enhancements, new mines might be opened in new areas of the world to mine extra gold.

The actual query is, how a lot gold can humanity entry with present Technology? We will get to a determine following this logic:

- From a geological standpoint, gold’s rarity stands at ~4 components per billion. Sources for this determine embrace the 1991 examine by Crocket, J.H. titled “Distribution of gold within the Earth’s crust – Gold metallogeny and exploration”, the Australia governmental company “Geoscience Australia” and the University of California, Berkeley. Which means that 4 components of gold will be discovered for every 1 billion a part of the Earth’s crust. On condition that the mass of Earth’s crust is at 2.6 * 1022 kg, there are roughly 400 billion tonnes of gold accessible on our planet. For reference – given Earth’s floor is 510 million sq. kilometers, that’s sufficient gold to cowl the entire floor of our planet with a 4 meter thick layer of gold.

- A lot of this gold is past our present technological attain – however how a lot will be extracted with present Technology? Contemplating the world’s deepest mine in South Africa extends 3.9 km underground, let’s assume that, with adequate financial incentive, we will extract all gold from as much as 4 km beneath the Earth’s floor. Present estimates counsel there are 122 billion tonnes of gold within the first 4 KM of Earth’s crust. That is over 550 thousand instances the quantity of gold mined in human historical past.

- This determine contains gold in Earth’s crust beneath the oceans. We will mine oceans for gold with present Technology, however to stay conservative, let’s assume we will solely mine gold from land. On condition that 30% of Earth is roofed by land, then 36 billion tonnes of gold could be accessible to us (30% of 122 billion). This determine is 162 thousand instances the quantity of gold that has ever been mined.

- IT is cheap to imagine that new gold mines is not going to be opened in city areas, pure parks and areas with energetic volcanoes. So, let’s restrict that quantity by an additional 10%, all the way down to 150,000% (150 thousand instances) the quantity of gold that has ever been mined.

To recap, humanity immediately can simply extract 20% of the entire gold that IT has ever mined so far. On prime, counting on present Technology and given sufficient financial incentive, humanity can entry ~ 150,000% extra gold than what has ever been mined.

To be clear, this determine does NOT think about:

- The likelihood we’d entry gold from asteroids within the close to future, as Neil Degrasse Tyson talked about in a 2017 interview.

- The likelihood we might begin digging deeper and deeper to entry extra gold, as Technology improves.

Irrespective of the precise figures – whether or not we’re speaking about 150,000% or 50,000% and even 10,000% – for the dimensions of humanity immediately, gold is simply not that scarce. There are sufficient accessible gold reserves on Earth to obliterate the rarity of gold itself.

Gold Provide Will increase With Demand – No Matter The Nominal Price To Extract IT

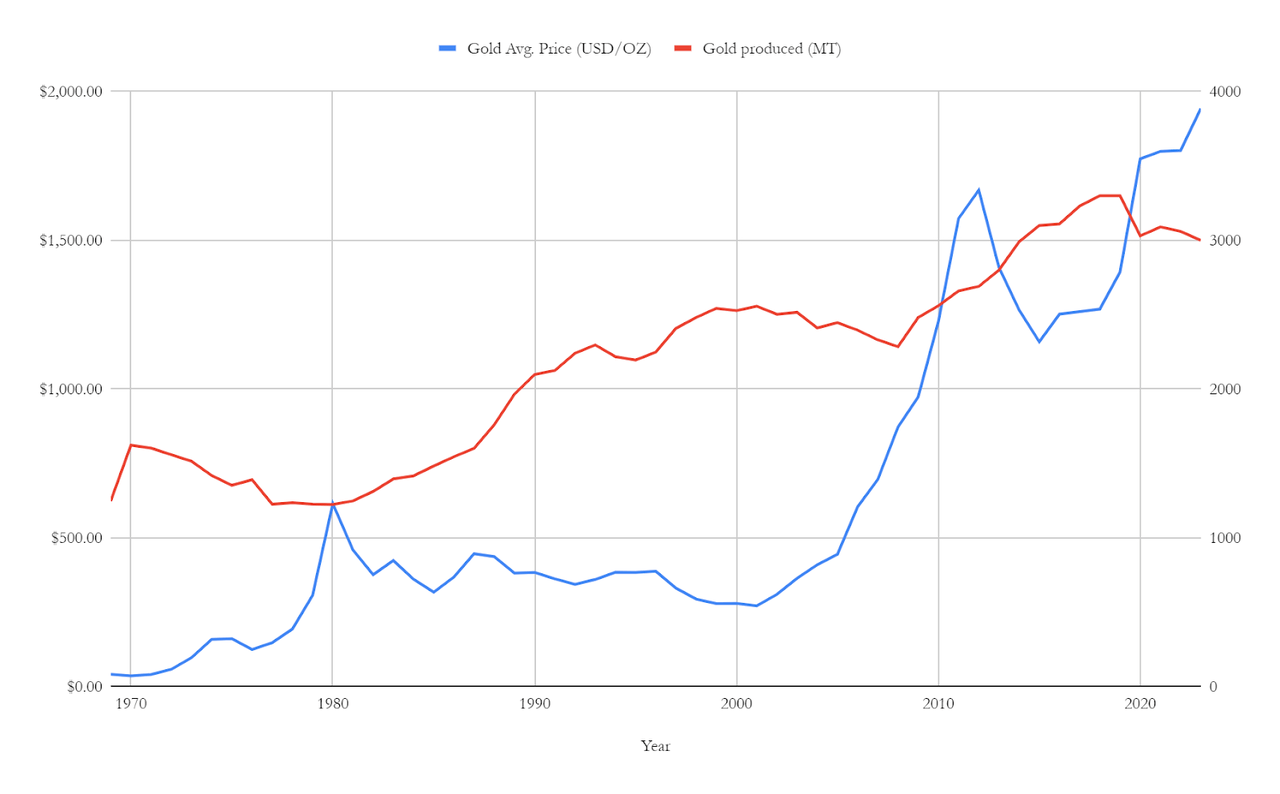

One argument for gold’s worth is that top mining prices will restrict its provide. But, historic knowledge, proven within the chart evaluating gold costs to mining output from 1969 to 2023, refutes this declare.

Information exhibits that gold’s manufacturing has elevated with its worth (Creator’s elaboration of publicly accessible knowledge)

Gold manufacturing has steadily risen over the previous 60 years. Merely put, so long as gold costs warranted, miners have persistently raised wages, opened new mines, and upgraded tools to extract extra gold.

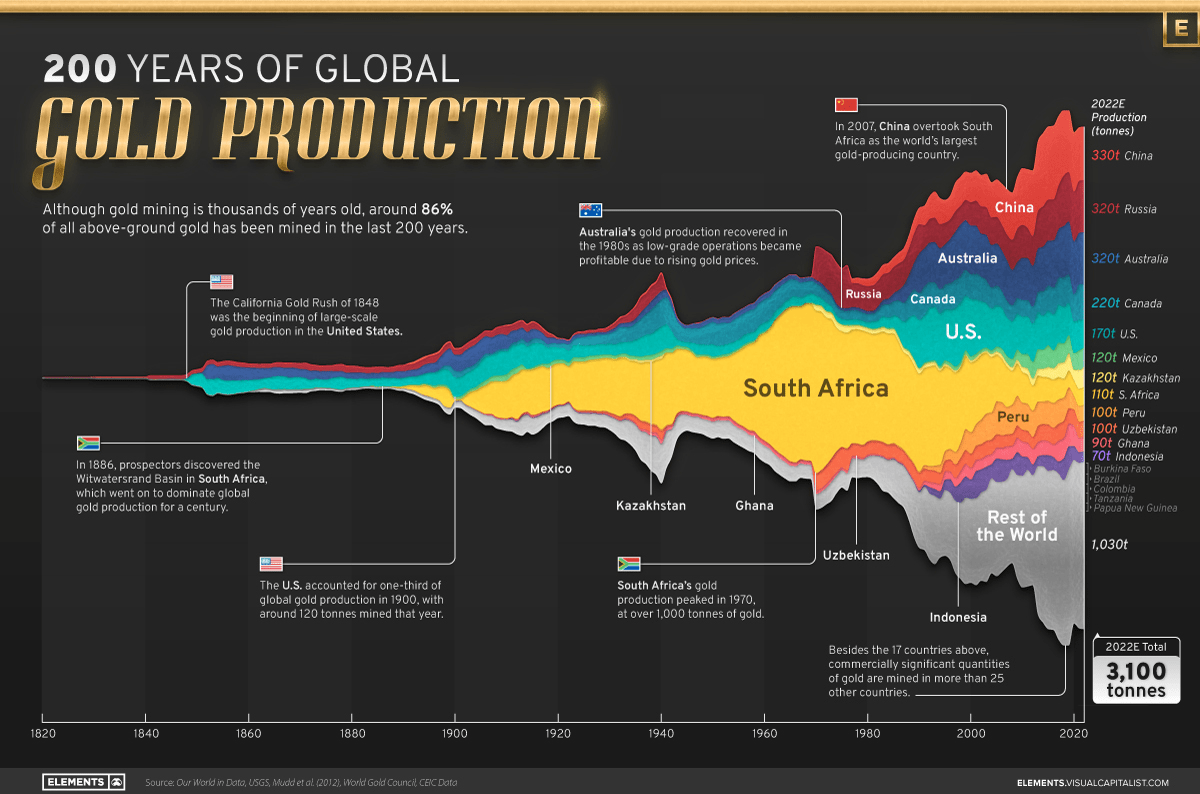

This phenomenon is clearer if we have a look at a broader timeframe. Just lately, a chart was printed by Visualcapitalist.com, displaying gold manufacturing for the final 200 years.

Gold’s manufacturing for the previous 60 years has skyrocketed (Visualcapitalist.com)

Gold manufacturing has skyrocketed within the final 200 years:

- Roughly 375 tonnes of gold have been mined throughout the “gold rush” within the 1840s and 1850s within the USA. For distinction, 3,100 tonnes of gold have been mined in 2023 alone.

- Roughly 86% of gold has been mined within the final 200 years, in line with Visualcapitalist.com.

- Roughly 66% of gold has been extracted since 1950 in line with the World’s gold council.

To conclude, the connection between gold’s worth and its manufacturing underscores a basic financial precept: demand and provide. As costs climb, the inducement to mine gold will increase, resulting in larger manufacturing ranges. This has at all times been the case for the final 200 years, and there’s no cause why the identical dynamics shouldn’t apply for the foreseeable future.

Gold Is One Technological Disruption Away From Fast Obsolescence

Investing in gold carries an additional danger: a sudden technological breakthrough might practically immediately make gold out of date.

Humanity has, to date, developed exponentially. The primary Homo sapiens appeared someplace in Africa round 250,000 years in the past. We have now then proceeded to dwell as follows:

- For 96% of our time, we lived as hunter-gatherers.

- For 3% of our time, we lived in what we now think about historical, agriculture-based civilizations.

- For 0.8% of our time, we lived in agriculture-based civilizations that we at the very least know one thing about.

- 0.08% of our time, we lived after the Industrial Revolution.

- For 0.01% of our time we are actually residing in a world with relative peace, no widespread famines and the best lifestyle in historical past.

The human mind just isn’t wired to actually perceive and grasp what exponential development means – in spite of everything, there may be little or no exponential development in nature.

Now, again to gold… gold labored effectively for the previous 10,000 years (4% of humanity’s time on Earth), however can IT hold working for the subsequent 10,000? That is extraordinarily unlikely. A multi-planetary species that may simply mine asteroids would discover gold to be simply too straightforward to retrieve to have any worth. IT could be like if, immediately, we had been to make use of salt as a retailer of worth. Salt has traditionally been very costly to provide and was used to pay salaries, therefore the foundation of the fashionable phrase to outline a stipend given to an worker. Right now, IT is nearly accessible at any time for reasonable by anybody residing on Earth. Courtesy of our technological evolution.

I perceive that 10,000 years is a time horizon that’s probably a bit too lengthy for the typical Looking for Alpha reader. So, when will gold die? IT could also be prior to you assume.

Take Fracking. IT is usually introduced for example of a disruptive Technology that modified the world’s geopolitical panorama. Earlier than fracking applied sciences turned accessible, the USA was a internet importer of fuel and oil. In 2020, the USA became a complete petroleum exporter for the primary time since 1949, in line with the US Vitality Information Administration.

The obvious instance of technological disruptions that might render gold out of date in a single day is asteroid mining:

- Astroforge, a pioneering startup, launched into its inaugural mission to a rocky physique in 2023, and so far, the mission appears successful in reaching its goal.

- In 2021, NASA awarded contracts to 4 firms to extract small quantities of lunar regolith – which is anticipated to occur in 2024.

- Though asteroid mining remains to be in its nascent levels, think about the potential: “Asteroid Psyche,” positioned within the asteroid belt, is believed to comprise IT-wont-make-us-richer/260482/” rel=”nofollow”>gold value roughly 700 quintillion USD at immediately’s costs. When in comparison with the present gold market cap of 13 trillion USD, the sheer quantity of gold accessible on Psyche might, if tapped, successfully make gold redundant.

In any case, for gold to lose its standing as a reserve asset, there doesn’t must be a sudden, technological disruption. That is simply an added degree of danger. Even when mining Technology stays precisely the identical as IT is immediately for the subsequent 100 years, there may be technically sufficient gold to be mined with present Technology to deliver its worth to (near) zero.

Different Arguments For Gold’s Underperformance

Inhabitants Development

Gold advocates would possibly declare {that a} rising international inhabitants boosts gold demand and its worth. Certainly, in growing nations-where most inhabitants development occurs-gold is extra accessible than actual property or different belongings tied to monetary establishments. Nonetheless, this argument faces a number of limitations:

- IT doesn’t change the elemental difficulty that gold just isn’t scarce and will be mined at will, as we now have seen beforehand.

- Folks in growing international locations have restricted spending and saving energy.

- Folks in growing international locations are gaining rapid access to banking, in line with the world financial institution. So, IT is cheap to anticipate that demand will improve for different asset courses as effectively.

Extra importantly, as soon as once more, knowledge refutes this thesis. The world has grown by almost 1 billion folks within the final 15 years. But, this has been a timeframe the place gold has underperformed relative to different belongings, as we now have seen beforehand.

Authorities Intervention

Gold proponents argue that governments and establishments, holding important reserves of the steel, could intervene to stop its worth from declining. One potential technique they might make use of is prohibiting the extraction of latest gold.

This presents a tangible political danger. But, the problem lies within the necessity for worldwide cooperation amongst governments to make such a measure efficient. There’s at all times the potential for a dissenting authorities selecting to take advantage of gold mining for its personal benefit, as historical past has proven. As an illustration, historical Roman Emperors like Nero debased their foreign money by diminishing the dear steel content material in cash, and Great Britain within the sixteenth and seventeenth century clipped and debased silver cash to fund wars. Contemplating how polarized the world is immediately, IT is tough to assume that governments worldwide might agree on a ban on gold mining and really adhere to IT.

Extra importantly, gold’s position as a reserve asset is anchored in belief, which itself stems from its shortage. Politically imposing scarcity-and by extension, trust-in an asset is sort of pointless. IT would shift gold’s basis from its inherent shortage to a dependence on political help, making IT indistinguishable from fiat currencies.

Gold’s Use As A Collateral

Gold presently serves as a major collateral within the international economic system, with establishments and governments leveraging IT to safe credit score. But, I anticipate its position as collateral will decline as swiftly as its comparative underperformance to different belongings intensifies.

The essence of gold as a reserve asset lies in belief. Ought to IT change into more and more obvious that gold just isn’t as scarce as as soon as believed, establishments could change into more and more reluctant to just accept IT as collateral. This might probably result in a liquidation disaster for gold, marked by establishments now not recognizing its worth.

Gold’s Precise Shortage

Lastly, think about that there’s a lengthy record of minerals which might be way more scarce than gold in nature. For instance:

- Platinum group minerals are extra scarce than gold at 1 half per billion or much less

- Osmium is extra scarce than gold at 1.5 components per billion

- There are 70 rare-earth supplies, from Scandium to Lutetium, which might be all extra scarce than gold

- After all, many of those parts are scarce however do not need different traits wanted to make them good candidates as reserve belongings – akin to portability, sturdiness, divisibility, fungibility and extra. Nonetheless, there are actually tens of minerals which have all these traits and have a better diploma of shortage than gold

So, why gold? As a result of 10,000 years in the past, IT struck a steadiness between being mineable with the Technology of the time and never too simply obtained. IT‘s unreasonable to assume that as a contemporary civilization, we must always adhere to a regular set by ancestors from agricultural societies.

Dangers To My Thesis

Governments Would possibly Artificially Restrict Gold Mining

Whereas a complete, international ban on gold mining could seem impractical and futile, governments might nonetheless choose to mitigate gold’s potential decline ought to IT start to falter as a worldwide reserve asset. Governments may additionally impose a ban on gold mining for causes that stretch past controlling its provide, akin to environmental issues.

Even {a partially} applied ban by sure governments might considerably impression and constrict gold’s provide, thus representing a political danger value contemplating.

A Extreme Recession Would possibly Make Gold Extra Interesting In The Quick Time period

Gold’s efficiency lagged behind equities in periods of relaxed financial coverage. But, IT usually excelled in instances of recession (see chart beneath). As traders shrink back from equities, they often flip to gold as a protected haven, at the very least within the brief to medium time period.

Ought to a extreme recession impression the worldwide economic system within the close to future, gold might outperform equities briefly. Though my long-term outlook on gold stays bearish, this potential for short-term outperformance is a danger investor, significantly these nearing or in retirement, ought to bear in mind.

Gold’s nominal efficiency throughout recessions (Visualcapitalist.com)

Accessing Gold Would possibly Be Extra Troublesome Than I Assumed

Figuring out precise figures for the quantity of gold accessible to us is difficult as a result of shortage of scientific analysis on the topic. In composing this text, I began with gold’s abundance in nature. I’m satisfied that for a technologically superior civilization, gold’s rarity-at 4 components per billion-isn’t an element of adequate shortage.

Adopting what I think about conservative estimates concerning our technological functionality to extract gold, I’ve concluded that, with present Technology, we will entry roughly 150,000% extra gold than has ever been mined.

But, opening new gold mines could show harder than I assumed. The 150,000% estimate incorporates a considerable margin of security. Even when this determine had been overstated by 90%, IT implies that we might nonetheless entry 15,000% extra gold than has traditionally been mined-a amount adequate to problem the perceived worth of gold. Nonetheless, acknowledging this potential overestimation in my assumptions is essential, as IT impacts the core argument of my thesis: the true abundance, reasonably than shortage, of gold.

Conclusion – Money Stream Producing Property Are Preferrable

The core drawback with gold is its lack of true shortage; as its worth rises, mining can improve accordingly. This results in its historic underperformance in comparison with equities, particularly in free financial circumstances, the place its nominal worth surges extra quickly.

I view gold as unsuitable for medium to long-term traders, anticipating its eventual abandonment as a worldwide reserve asset. Although this will happen far sooner or later, I regard gold as an inferior asset more likely to underperform in comparison with these producing money stream, even within the medium time period.

Therefore, my choice for belongings that generate money stream over gold, particularly these adaptable to inflation, like actual property or equities. Rental earnings can rapidly alter, and firms can swiftly adapt their pricing. Conversely, bonds are extra influenced by central financial institution selections and slower to reply to rate of interest modifications.

Put merely, in a situation the place fiat foreign money’s reliability is in query, my belief leans in the direction of firms and landlords who can improve costs in response to inflation. I’m skeptical of counting on gold’s shortage to successfully fight inflation.

On this article, I’ve not touched on one thing that some would possibly think about an elephant within the room: Bitcoin. I imagine Bitcoin is simply too immature of an asset to attract conclusions on whether or not IT might change gold as a reserve asset. Most significantly, Bitcoin doesn’t generate a money stream, precisely like gold. Bitcoin, for my part, stays an attention-grabbing albeit speculative guess.