MicroStockHub

That is what dividend investing is all about! Investing in dividend shares permits you to earn dividend earnings, one of the best passive earnings stream! Bias, you higher consider IT.

Time to dive into Lanny’s February 2024 dividend earnings outcomes! Have been data set? Love the top of the 12 months Dividend Tally, because the retirement account is pumped up. Virtually to monetary freedom? At some point and one month at a time!

Dividend Revenue

Dividend Revenue is the fruit from the labor of investing your cash within the inventory market. Additional, Dividend Revenue is my main car on the street to Monetary Freedom, which you’ll be able to see by means of my Dividend Portfolio.

How do I analysis & display for dividend shares prior to creating a purchase order? I exploit our Dividend Diplomat Inventory Screener and commerce on Ally’s funding platform (certainly one of our Monetary Freedom Merchandise) and on SoFi (SOFI).

I additionally mechanically make investments and max out, pre-tax, my 401(ok) by means of work and my Health Financial savings Account. This enables me to save lots of a ton of cash on taxes (aka 1000’s), which permits me to speculate much more. As well as, all dividends I obtain are mechanically being reinvested again into the corporate that paid the dividend, aka Dividend Reinvestment Plan or DRIP for brief. This takes the emotion out of timing the market and builds onto my passive earnings stream!

Rising your dividend earnings takes time and consistency. Investing as usually, and early, as you possibly can permit compound curiosity (aka dividends) to work its magic. I’ve gone from making $2.70 in a single month in dividend earnings to properly over… $10,000+ in a single month. My dividend earnings document was set in December of 2021. Was IT damaged this month? The ability of compounding and dividend reinvestment is a superb part to the portfolio. Every month, whether or not huge or small, I proceed to report the passive earnings that dividend investing gives me. Why?

*Not pictured is my spouse’s dividend earnings above*

I wish to present you that dividend investing makes IT attainable to attain monetary freedom and/or monetary independence. All of us begin someplace, however persistently investing, compounding (reinvesting) dividends and retaining IT easy, means that you can be in a considerably higher place than most. Additional, if I can develop this portfolio and earnings stream, you can too.

Dividend Revenue – February 2024

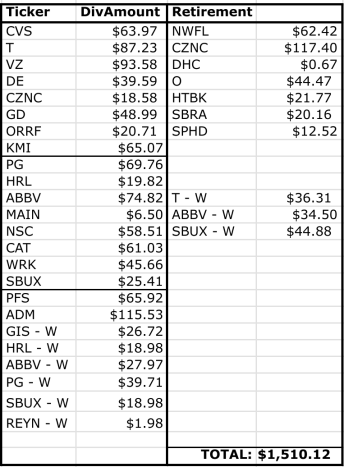

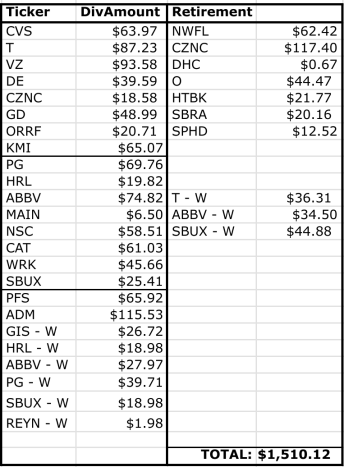

Now, on to the numbers… In February, we (my spouse and I) acquired a dividend earnings complete of $1,510.12. The primary month going over $1,500 for the 12 months and IT solely took February, comfortable about that.

The quantity and variety of shares listed beneath present you what IT means to purchase and maintain for the long run. A lot of the positions I’ve owned for years, letting dividend development and reinvestment do its factor. That is what dividend investing for monetary freedom is all about. The passive earnings stream is rising at a speedy tempo.

2023 was up 24%. Two months down in 2024 and the S&P 500 is already up 8%, setting all-time highs nearly every day now.

The Fed has now paused for five months, as they let knowledge and the rate of interest hikes they’ve finished during the last 2 years actually sink in. Expectations are price cuts subsequent 12 months. Will IT be 2? Will IT be 3? Who is aware of, I flip off the noise and preserve investing.

Right here is the breakdown of dividend earnings for the month, between taxable and retirement (far proper column, below “Retirement”) accounts. As well as, “W” means my spouse’s account:

Massive telecom carried fairly a little bit of weight right here. These two dividend shares of AT&T (T) and Verizon (VZ) introduced in $180 in passive earnings in February. These funds have been additionally reinvested, selecting up extra shares within the 6.5-7.50% dividend yield vary, including extra earnings. Will we be at $200 earlier than the 12 months is over?

IT‘s additionally value noting the large dividend fee from Archer-Daniels-Midland (ADM). ADM is a dividend king, with now over 50 years of rising dividends. They at the moment are going by means of an accounting scandal and are in a tough patch due to IT. Nonetheless, they introduced an enormous dividend enhance even after self-reporting the occasion. Hoping this performs out properly for us shareholders.

I additionally break up out my retirement accounts within the far proper column, and the taxable account dividends are within the left two columns. The retirement accounts are composed of HSA investments, ROTH and Conventional IRAs, in addition to our work 401(ok) accounts. In complete, the retirement accounts introduced in a complete dividend earnings quantity of $395.10 or 26% of the dividend earnings complete. This nonetheless left over $1,100+ within the taxable account. Onerous to get these non-quarter-end months to $2,000, I inform you. Subsequent 12 months, possibly?

Dividend Revenue 12 months-Over-12 months Comparability

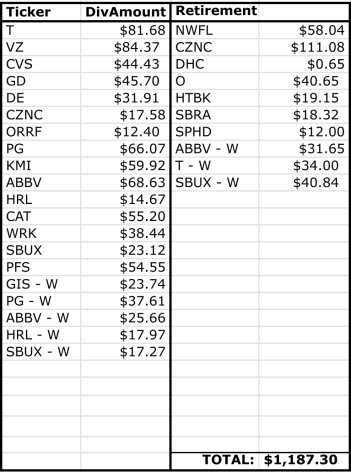

2023:

2024:

Our dividend earnings is up… $322.82, a 27% enhance from final 12 months. That beat inflation, proper? I consider so, I believe inflation was 3.4% for the 12 months.

My CVS dividend is up nearly $20 since final 12 months, since grabbing extra shares in 2023, in addition to a pleasant dividend enhance of 10% final 12 months. Love IT.

Archer-Daniels is on this month versus being in March, which is skewing the outcomes barely. Subsequently, March will not be together with ADM.

John Deere’s (DE) dividend fee elevated by 24% for 2 causes. One, dividend reinvestment, after all. However the greatest purpose is the not 1, not 2, however 3 dividend will increase in 2023 alone. A uncommon time to be a John Deere investor, certainly.

In complete, if we preserve this development price up – we’re speaking over $1,900 in ahead earnings in 2025 for February, which can nonetheless put me 2 years away from $2,000, dang IT!

Dividend Will increase

I acquired 7 dividend will increase in February 2024, 2 greater than the earlier month of January. Dividend investing is right here to remain, child!

One of the best dividend enhance beneath? Jackson Monetary (JXN) for positive. Given the state of asset administration and cash administration, reminiscent of T. Rowe Worth (TROW), Franklin Investments, and many others. I didn’t have excessive expectations. Nonetheless, JXN got here by means of with a 13% banger!

One other one to say is in my spouse’s taxable inventory account. TJ Maxx (TJX) had a shock enhance of 13% as properly. Given the state of retail, a rise above the speed of inflation is a large win, not to mention a 13% elevate.

In complete, dividend will increase created $73.86 in further passive dividend earnings. I would wish to speculate $2,110 at a 3.50% dividend yield in an effort to add that earnings. Thanks for the will increase, as I did not need to provide you with the capital to create that type of earnings!

Dividend Revenue Conclusion & Abstract

The secret is to use what you study by means of monetary schooling. The subsequent steps are to maximise each greenback for funding alternatives and stay life by yourself phrases. Subsequently, my plan is to exhibit that dividend earnings is usually a income engine. A income engine that means that you can take back control of your life. A income engine that will help you attain monetary freedom. Dividend investing, when you study the suitable manner, turns into simpler and begins to immensely make sense!

Excited concerning the future, little doubt. Moreover, the entire investing from final 12 months and strikes this 12 months present that my intention to save 60% of my earnings, and making every dollar count, has supplied the dividend development.

As at all times, thanks for stopping by, go away your feedback and questions beneath. Good luck and comfortable investing, everybody!

Editor’s Be aware: The abstract bullets for this text have been chosen by Searching for Alpha editors.