da-kuk

Tremendous Micro Laptop (NASDAQ:SMCI) inventory has been surging extremely for some time. Thus far, 2024 has been further good for SMCI’s stockholders. That is all because of the AI hype. Nonetheless, the market will not be absolutely irrational. The corporate’s gross sales and earnings are rising quick, and Tremendous Micro Laptop has a superb monetary place. However the inventory is very overvalued. So, I might charge the corporate’s inventory as a “maintain,” as a result of IT is neither a “purchase” as a consequence of its extreme valuations nor a “promote” due to its robust monetary place and profitability. On this article, I cannot attempt to guess SMCI’s future inventory value however will attempt to analyze the corporate’s views and its inventory’s honest worth as of as we speak.

Abstract of my earlier article on SMCI

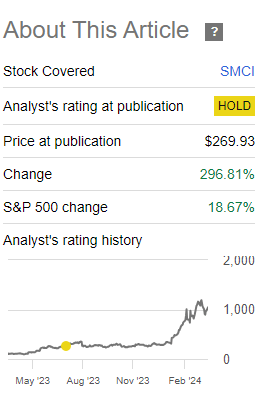

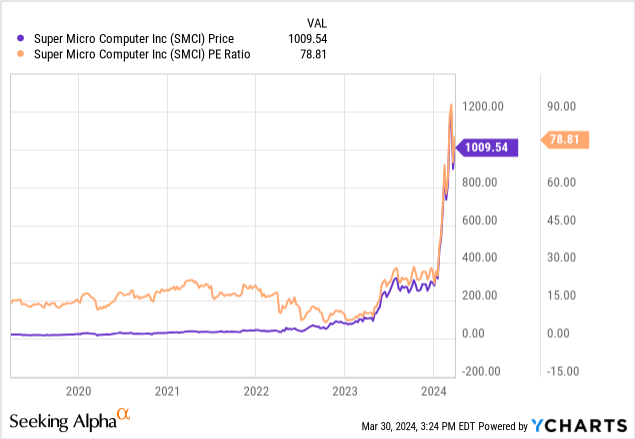

In my earlier article on SMCI, I used to be relatively cautious about the inventory when IT traded for $260 per share. Most buyers’ curiosity was because of the recognition of AI shares. As I’m scripting this, the inventory is buying and selling for $1062 per share.

Looking for Alpha

This, nevertheless, doesn’t imply that I used to be mistaken. I discussed that the corporate was in an excellent monetary place and was worthwhile too. However even at $260 per share, IT was overvalued, given the earnings and revenues IT had on the time. Furthermore, I discussed that earnings solely began rising considerably in 2021. Earlier than that, there was no apparent and sustainable development. Additionally, the revenue margins have been fairly low. Nonetheless, I didn’t say the shares had no upside potential. In actual fact, I rated the corporate as a “maintain’. On this article, I’ll analyze SMCI’s current developments and its valuations. In brief, not a lot has modified for the corporate. The margins usually are not extraordinarily excessive, and buyers are nonetheless overenthusiastic about AI shares, however the firm continues to be in an excellent monetary place. However SMCI’s inventory valuations have surged by nearly 300%, and the marketplace for AI servers SMCI produces has develop into extra aggressive.

SMCI’s 2Q 2024 earnings and administration’s outlook

In my opinion, SMCI’s current monetary outcomes don’t justify valuations. Let me clarify why.

Listed here are a couple of highlights of Supermicro’s earnings press release:

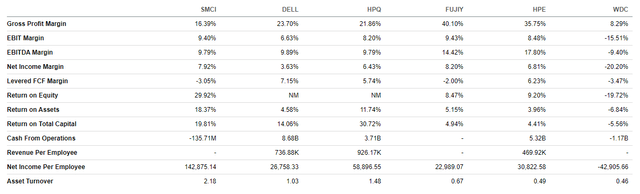

Despite the truth that Supermicro is taken into account to be a extremely worthwhile firm, the gross revenue margin for the second quarter of 2024 was simply 15.5%. The online revenue margin for 2Q 2024 was $296 million / $3.66 billion x 100 = 8,09%. SMCI’s internet revenue margin is excellent in comparison with friends, most notably Dell’s (DELL) and Western Digital Company’s (WDC) margins. Nonetheless, SMCI’s gross revenue margin is kind of low in comparison with its friends, most clearly FUJIFILM Holdings Company’s (OTCPK:FUJIY) and Hewlett Packard Enterprise’s (HPE) margins. Solely Western Digital Company’s (WDC) gross revenue margin is decrease.

Looking for Alpha

As reported within the press launch, as of December 31, 2023, whole money and money equivalents have been $726 million, and whole financial institution debt was solely $376 million. Because of this the corporate’s monetary place is good as a result of its internet debt is detrimental. Though the corporate is financially sound, its inventory continues to be buying and selling too excessive.

Charles Liang, President and CEO of Supermicro, mentioned, “We continued to show our market management in fiscal Q2 2024, reporting report income outcomes of $3.66 billion and year-over-year development of 103%.” “Whereas we proceed to win new companions, our present finish prospects proceed to demand extra of Supermicro’s optimized AI laptop platforms and rack-scale Whole IT Options. As our progressive options proceed to achieve market share, we’re elevating our fiscal 12 months 2024 income outlook to $14.3 billion to $14.7 billion.“

In different phrases, the administration says the corporate’s market share is excessive and rising due to its progressive options. Let’s check out among the firm’s rivals and examine their market shares to SMCI’s.

Supermicro’s market share

| Firm Identify | Revenues | Market Share | Market Share | Market Share |

| 12 Months Ending | 12 Months | MRQ | A Quarter Earlier than | |

| This fall 2023 | This fall 2023 | This fall 2023 | Q3 2023 | |

| Tremendous Micro Laptop Inc | 9,250.70 | 4.70% | 6.00 % | 4.56 % |

| Adtran Holdings Inc | 820.74 | 0.42% | 0.45% | 0.00% |

| Casa Methods Inc | 249.41 | 0.13% | 0.10% | 0.12% |

| Cambium Networks Corp | 264.41 | 0.13% | 0.07% | 0.13% |

| Dell Applied sciences Inc | 102,301.00 | 51.99% | 59.29% | 47.93% |

| Quanta Inc. | 0.62 | 0.00% | 0.00% | 0.00% |

| Hewlett Packard Enterprise Firm | 28,081.00 | 14.27% | 11.07% | 15.83% |

| HP inc | 53,075.00 | 26.97% | 21.60% | 29.68% |

| Kopin Company | 41.22 | 0.02% | 0.01% | 0.02% |

| Pure Storage Inc | 2,278.88 | 1.16% | 1.25% | 1.48% |

| Quantum Corp | 406.61 | 0.21% | 0.15% | 0.23% |

| Trans lux Company | 17.38 | 0.01% | 0.01% | 0.01% |

| SUBTOTAL | 196,786.97 | 100% | 61,042.08 | 100% |

Supply: CSI Market

As you possibly can see from the desk under, SMCI has a a lot increased market share in comparison with its smaller rival corporations. Nonetheless, the corporate’s market share continues to be considerably decrease than its bigger rivals, specifically Hewlett Packard, HP, and Dell. SMCI’s greater rivals are additionally doing nicely. For instance, Finance.yahoo.com/information/dell-reports-sales-top-estimates-211226846.html” rel=”nofollow”>Dell reported a backlog surge for its AI servers and urged that extra development is but to return. This high-tech firm reported a 40% quarter-over-quarter rise in AI server orders.

Dell has already made substantial progress within the space of AI servers. The corporate reported an enormous backlog for its synthetic intelligence servers and mentioned that extra development is coming. The tech big reported a Technology/dell-beats-fourth-quarter-revenue-estimates-signaling-pc-market-recovery-2024-02-29/” rel=”nofollow”>40% quarter-over-quarter enhance in AI server orders. So, Dell appears to be a severe competitor to SMCI on this space. These two corporations can enter a value conflict. This can seemingly result in decrease earnings for each of them. Furthermore, Hewlett Packard is also entering the AI server business, which can imply much more pricing stress and decrease revenue margins.

SMCI is counting on gross sales development to get extra worthwhile. So, the corporate can expertise issues if income development slows down. In response to the corporate’s steerage, whole income for the third quarter of 2024 will vary from $3.7 billion to $4.1 billion. If we examine this to SMCI’s $3.66 billion in Q2 FY24 income, the outlook suggests a quarter-over-quarter development charge might be between 1.1% and 12%. So, the expansion charge is not going to be too excessive, even in keeping with the administration’s personal projections.

Low quarterly development charges will finally result in low development for the whole 12 months 2024. That growth will reduce the corporate’s internet earnings beneficial properties. Tremendous Micro Laptop should exceed analysts’ expectations to stay a development inventory within the eyes of buyers as a result of the market already expects gross sales to be as excessive as $4.1 billion. Allow us to take a look on the quarterly development historical past.

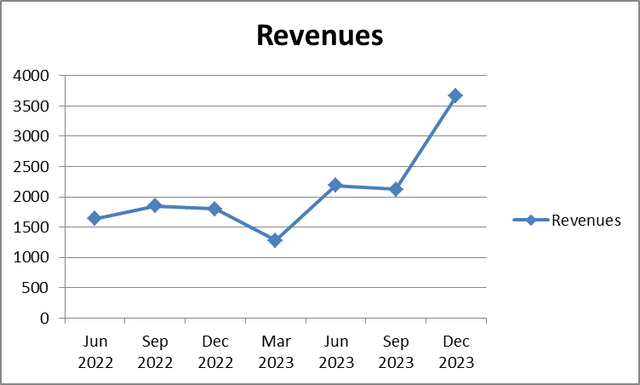

Quarterly revenues

| Jun 2022 | Sep 2022 | Dec 2022 | Mar 2023 | Jun 2023 | Sep 2023 | Dec 2023 | |

| Revenues | 1636 | 1852 | 1803 | 1283 | 2185 | 2120 | 3665 |

Supply: Ready by the writer primarily based on Looking for Alpha’s information

Quarterly revenues

Ready by the writer primarily based on Looking for Alpha’s information

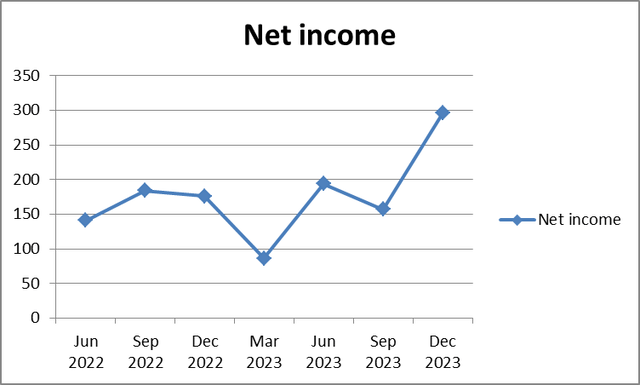

Quarterly internet earnings

| Jun 2022 | Sep 2022 | Dec 2022 | Mar 2023 | Jun 2023 | Sep 2023 | Dec 2023 | |

| Web earnings | 141 | 184 | 176 | 86 | 194 | 157 | 296 |

Supply: Ready by the writer primarily based on Looking for Alpha’s information

Quarterly internet earnings

Ready by the writer primarily based on Looking for Alpha’s information

Tremendous Micro’s earnings and gross sales development over the previous 12 months have been principally because of the September 2023-December 2023 interval. For the remainder of the interval lined, internet earnings and income development have been flat. In my “valuations” part, I’ll examine Tremendous Micro’s earnings and gross sales development to its inventory value beneficial properties.

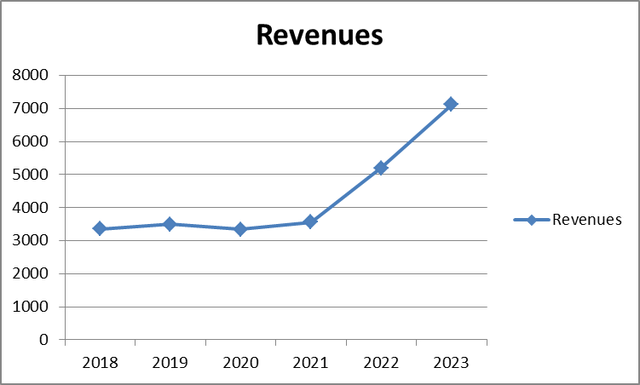

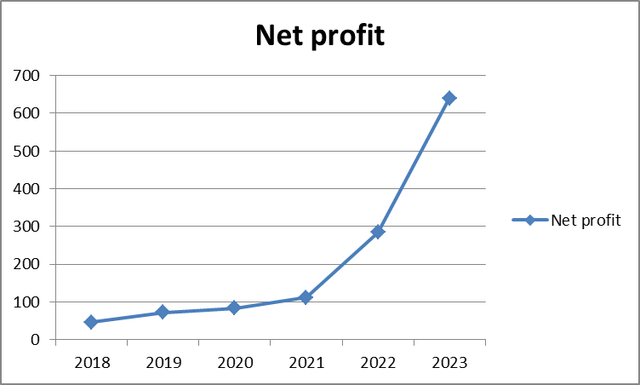

Lack of sustainability can also be seen within the annual revenues and revenue graphs under. In different phrases, gross sales and earnings have solely began rising after 2021, due to AI. Earlier than that, there was no apparent progress.

Annual revenues

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Revenues | 3361 | 3500 | 3339 | 3557 | 5196 | 7124 |

Supply: Ready by the writer primarily based on Looking for Alpha’s information

Annual revenues

Ready by the writer primarily based on Looking for Alpha’s information

Annual earnings

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Web revenue | 46 | 72 | 84 | 112 | 285 | 640 |

Supply: Ready by the writer primarily based on Looking for Alpha’s information

Annual earnings

Ready by the writer primarily based on Looking for Alpha’s information

Between 2021 and 2023, the whole internet revenue rise was about 500%, which is nice however nonetheless not spectacular sufficient, given the share value development.

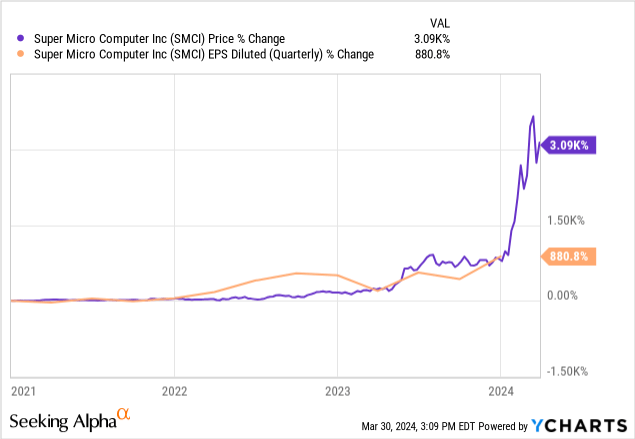

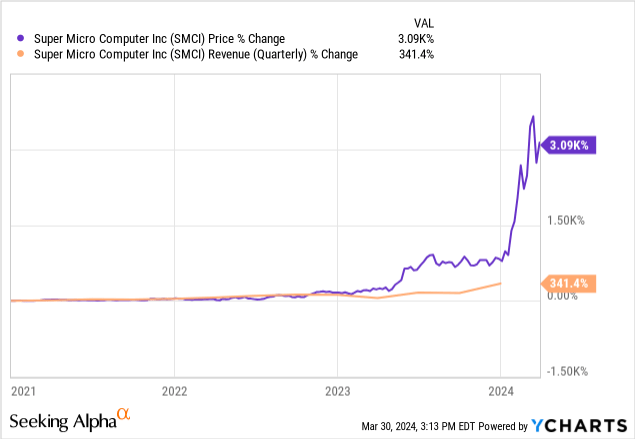

Valuations

Tremendous Micro Laptop’s valuations are extraordinarily excessive, particularly if we examine the corporate’s inventory value to its gross sales.

But in addition, the quarterly diluted EPS gained 880.8% versus SMCI’s inventory value beneficial properties of 3090%.

The quarterly revenues solely rose by 341.4% versus SMCI’s inventory value surge of 3090%.

If we take a look on the firm’s price-to-earnings (P/E) ratio, we are going to see that IT is sort of 79 and is simply barely off SMCI’s excessive of about 90. That is actually excessive as a result of the S&P 500’s common is just about 23. SMCI’s common P/E was once 20-30 earlier than this 12 months’s inventory value surge. So, if we take the typical P/E and multiply IT by 2023’s EPS of $12.09, SMCI’s inventory ought to now commerce for $241.8 to $362.7 per share. And that will not be low-cost however relatively affordable. You may argue that 2024 could be significantly better than 2023 by way of earnings. However IT continues to be not clear as a result of 2024 will not be over but.

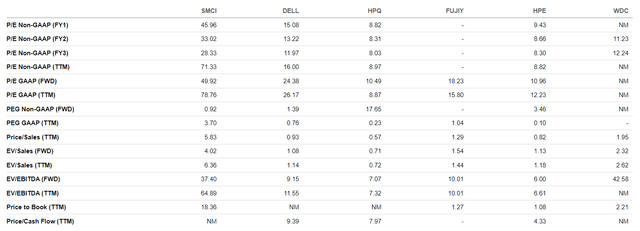

If we check out the corporate’s rivals, we are going to clearly see that SMCI’s P/E, P/S, EV/EBITDA, and P/B ratios are considerably increased than its rivals. SMCI’s P/E GAAP (TTM) of virtually 79 is thrice increased than DELL’s. SMCI’s P/S ratio can also be beautiful in comparison with its friends. IT is sort of 6, while all of its rivals is lower than 2. However the strangest indicator is SMCI’s P/B ratio, which is increased than 18. For instance, HPE’s is only a bit over 1.

Looking for Alpha

I imagine that SMCI’s inventory is extraordinarily overvalued, each traditionally and in comparison with its friends.

Draw back dangers

The corporate has the next draw back dangers:

- SMCI inventory is priced as if the corporate doesn’t have any competitors. However that may change in the long run. So, the inventory value would go down considerably.

- SMCI doesn’t have a really excessive revenue margin. IT can get even decrease if gross sales development slows down.

- A recession can occur at any time. Overvalued shares like SMCI will seemingly depreciate probably the most.

Upside dangers

The upside dangers are as follows:

- AI presents loads of development potential for corporations like SMCI. Nonetheless, IT will not be totally clear who will “get there first.”.

- The corporate’s monetary place is secure. That is essential in instances of disaster.

- SMCI has not too long ago proven nice gross sales and revenue development and has develop into a very fashionable inventory for buyers. So, if development continues, its valuations will nonetheless keep excessive.

Conclusion

Since my final article, the corporate has proven good efficiency by way of revenues and earnings development. However I do earnestly assume that Supermicro’s inventory value development has far exceeded its EPS and gross sales progress. So, due to the market’s curiosity in synthetic intelligence, the inventory has acquired ridiculously overvalued. However I’m not saying that SMCI is an instantaneous promote. The inventory can nonetheless rise if the corporate continues to report development. And IT is inconceivable to say when a inventory rally for a extremely widespread tech firm might be over. Nonetheless, IT appears that the marketplace for AI servers is rising aggressive. I imagine 2024 could be even higher than 2023 by way of earnings and gross sales, because the administration expects of their outlook, however there are dangers they may contact the decrease finish of the steerage due to stiffer competitors. This could be fairly a disappointment for the corporate’s buyers. So, my score is “maintain.”