The Good Brigade/DigitalVision by way of Getty Photos

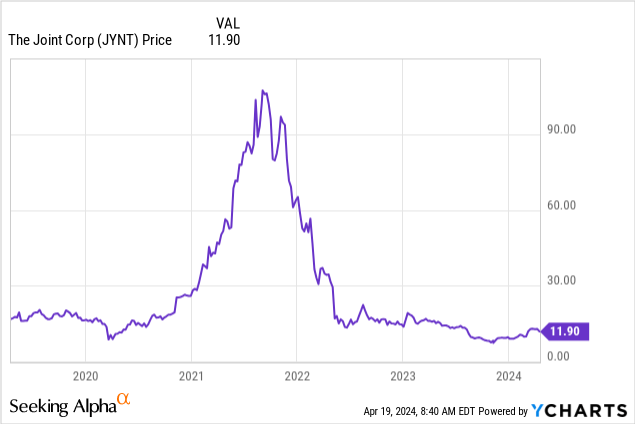

Since my final replace, the share value of The Joint Corp (NASDAQ:JYNT) has seen some progress. Nonetheless, the inventory remains to be down by 88% from its peak in 2021. Market sentiment in direction of the inventory stays subdued. Following the current This autumn earnings name, I consider JYNT nonetheless presents a shopping for alternative attributable to its future earnings potential. The current strategic shift to enhance margins additionally provides to its attraction. I’ll define my reasoning for this evaluation under.

Enterprise replace

JYNT concluded 2023 with sturdy progress and operational growth. System-wide gross sales rose by 11% to succeed in $488 million, whereas income climbed to $117.7 million. The corporate’s adjusted EBITDA additionally noticed a constructive motion, ending the 12 months at $12.2 million. Operational metrics had been equally spectacular, with complete affected person visits growing to 13.6 million from 12.2 million within the earlier 12 months, and new affected person therapies rising to 932,000 from 845,000. Notably, 36% of those new sufferers had been first-time guests to any chiropractic service, highlighting JYNT’’s position in increasing the market attain of chiropractic care.

Regardless of a slowdown in comparable gross sales progress to 4% from 9% in 2022 and a lower within the variety of franchise licenses bought—from 75 to 55—the corporate aggressively expanded its clinic community. By year-end, The Joint Corp operated 935 clinics, up from 838, together with 800 franchised and 135 company-owned or managed clinics, representing a considerable improve from the earlier 12 months’s totals of 712 and 126, respectively.

The enterprise appears reaching a plateau as earlier narrative has been weakened.

Whereas JYNT displayed general progress in 2023, there are indications that the growth tempo could also be moderating. The 4% improve in comparable gross sales for clinics operational for greater than 13 months demonstrates that the enterprise mannequin retains its progress potential and has not but hit a saturation level. This constant efficiency in comparable gross sales might improve investor confidence, probably boosting franchise license gross sales sooner or later. Nonetheless, the sale of franchise licenses stays a problem, with solely 55 issued final 12 months, 58% of which had been to current franchisees, pointing to a decreased inflow of latest entrepreneurial curiosity in comparison with prior years.

New affected person counts have additionally dipped, falling 6% from the earlier 12 months, underscoring a slowdown. This shift means that JYNT’s growth momentum has certainly paused, with broader financial components equivalent to rising rates of interest and excessive employment ranges impacting shopper conduct greater than beforehand anticipated. This contrasts with earlier beliefs that chiropractic care, as a Health service centered on managing ache and bodily well-being, can be largely resilient to macroeconomic fluctuations. The administration’s current feedback have highlighted these financial challenges as important hurdles affecting the corporate’s progress trajectory.

The refranchise technique will get a smaller share of earnings, however not dangerous information for shareholders

In November 2023, JYNT introduced plans to refranchise the vast majority of its corporate-owned clinics, a transfer that diverges from its earlier technique of increasing company clinics as a key progress lever. Proudly owning and working worthwhile clinics immediately allowed JYNT to seize a bigger share of system-wide earnings, thus enhancing money stream to shareholders. Nonetheless, managing company clinics comes with its personal set of uncertainties and operational dangers, which might probably result in important losses if not managed successfully.

Opting to refranchise these clinics seems to be a strategic pivot towards minimizing capital expenditures and maximizing margins. Nonetheless, this shift means relinquishing direct advantages equivalent to gaining firsthand insights into enterprise tendencies, experimenting with new clinic merchandise, and sustaining strict management over model high quality. This technique is likely to be seen as a type of ‘intentional downsizing’ and might be interpreted as a insecurity within the sustainability of proudly owning extra clinics immediately, particularly in mild of escalating physician prices inside the trade—a priority that appears more and more difficult to handle.

On the constructive facet, this strategic shift permits JYNT to transition from an aggressive progress mode to a extra conservative harvesting mode. By transferring the operational prices and complexities to franchisees, JYNT stands to stabilize its earnings.

RD acquisition can provide instant elevate on earnings

The aforementioned improve in money stream may be allotted in direction of the reacquisition of Regional Developer (RD) territories. At present, JYNT doesn’t plan to broaden its RD territories additional. Though JYNT collects 7% of franchise product sales in royalties, they’re required to remit 3% of those product sales to the RDs, which represents a considerable portion of their income. In an effort to retain a higher share of those royalties, JYNT reacquired one RD area in 2023, lowering the full variety of RD territories to 17. IT is anticipated that the share of royalties paid to RDs will proceed to lower, which ought to improve JYNT’s profitability. This strategic shift is projected to probably add one other $15 million in pure earnings for JYNT, marking a big step in direction of optimizing its monetary mannequin.

Backside Line

Total, The Joint Corp (JYNT) stays a robust enterprise. The administration is keenly attuned to trade tendencies and has strategically opted to refranchise their company portfolio. Whereas the enterprise will proceed to promote licenses and intention to fill geographic gaps, the anticipated variety of new franchised clinics for 2024 is projected to be between 60 and 75—a noticeable lower from the 104 opened in 2023. The corporate remains to be poised for continued progress, albeit at a slower tempo. Its well-managed working capital and lack of long-term debt place IT to probably grow to be a money cow within the brief time period, which is undoubtedly a constructive improvement.

Nonetheless, from a long-term perspective, this technique might be seen as much less favorable. If the enterprise’s final aim is to construct as much as 1,800 clinics, with system-wide income probably doubling to round $1.1 billion, the revenue from a 9% royalty plus a 2% advertising payment would yield JYNT roughly $130 million in income—solely barely greater than its present ranges. As a result of all of those are franchising income, round half of those income might be working revenue which result in round 65M earnings energy. At 170M present market cap, I feel the inventory remains to be a purchase.