yalcinsonat1

No, Jay Powell didn’t do a cheerful dance on the post-FOMC press convention, however the Fed chair was feeling good on Wednesday and IT confirmed. And why not?

The large takeaway from the much-anticipated “dot plot” – the Abstract Financial Projections representing Committee members’ greatest guesses concerning the economic system and rates of interest – was the upward revision in progress expectations.

After rising 3.2 % within the fourth quarter final yr (and three.1 % for 2023 total), the median FOMC projection for 2024 actual GDP progress is 2.1 %, up considerably from the 1.4 % median estimate within the final set of SEP numbers final December.

And sure, with that greater progress estimate got here expectations of considerably stickier inflation, with the core PCE now projected to be 2.6 % this yr, in comparison with the December ’23 estimate of two.4 %.

On that time, although, Powell’s usually tight-lipped countenance practically broke out right into a smile as he pronounced that “we’ll get inflation again to 2.0 %, we’ll completely get there.” Mic drop.

Breaking the Doom Cycle

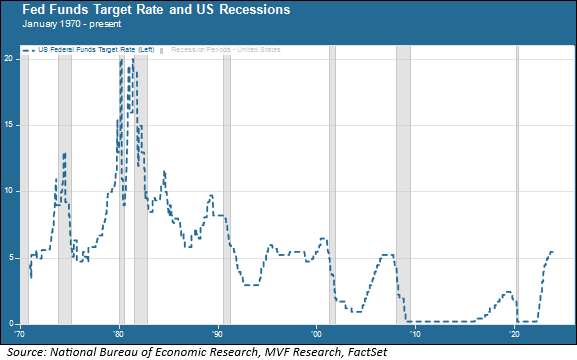

Powell is a scholar of historical past, and figuring out the historical past of Fed financial tightening cycles previous is what offers the Fed chair simply trigger for a little bit of joyfulness. Take into account the story informed within the chart under, of all of the financial cycles since 1970.

These gray columns you see within the chart signify intervals of US recession. Virtually each main tightening cycle since 1970 has resulted in recession, together with the sharp downturns of 1973 and 1980, and the Nice Recession of 2008.

This chart explains why the traditional knowledge amongst economists at first of 2023 was so uniformly of the view {that a} recession was on the horizon.

However this time, or so IT seems for now anyway, is totally different. In reality, whereas Fed officers at the moment are more and more comfy utilizing the time period “smooth touchdown” to explain the tip of the 2022-23 tightening cycle, the phrase heard extra continuously on the Road now could be “no touchdown” – as in, not even a slowdown.

We’re undecided that the Road is any extra on course about this than they’ve been with their rate of interest minimize fantasies of late, however we’ll concede that the information pointing to a marked slowdown within the economic system haven’t proven up but in any significant method (though a current upward pattern in bank card and auto Loan delinquencies could also be an indication of issues to return).

About These Charge Cuts

What had merchants ready with breathless anticipation greater than the rest, in fact, was to see whether or not the Committee members’ estimates final December for 3 2024 charge cuts had been nonetheless intact.

They had been (and markets reacted accordingly), with a couple of particular person dots transferring up however the median staying put at three cuts. The primary of those might, plausibly, occur in Could though we predict the June assembly, which can coincide with the subsequent batch of SEP numbers, can be extra seemingly.

We might doubtlessly see one other charge minimize in July, then a self-imposed blackout interval forward of the November presidential election with that third minimize occurring in December. That is nothing greater than an opinion on our half so please don’t take IT to coronary heart – and many might change between from time to time.

IT’s additionally value noting, although, that charge minimize estimates for 2025 and 2026 tightened up a bit, such that in response to the FOMC median projection, the Fed funds charge will keep elevated and never fall under 3.0 % till after 2026.

When you have a look at the Fed funds historical past on the above chart, this situation would most carefully resemble that of the mid-Nineteen Nineties, after the speed hike that started in 1994 after which stayed elevated till the dot-com crash of 2000 led to a recession in 2001.

In reality, that 1994 charge hike, whereas not practically as steep because the 2022-23 cycle, is the one obtrusive exception to the arduous touchdown occasions of different intervals.

What adopted, as everyone knows, was a interval of sustained financial energy, natural progress and the lagged impact of a productiveness increase from earlier technological improvements.

Jay Powell is aware of that historical past doesn’t repeat itself, however he’s certainly hoping for a really robust rhyme this time round.

Editor’s Notice: The abstract bullets for this text had been chosen by In search of Alpha editors.