Monty Rakusen

Pricey readers/followers,

When you’ve adopted my work to any extent over the previous few years, you already know that I am a giant investor in lots of areas that different buyers shun – one in every of them is cyclical commodities, together with metals – each treasured and semi-precious. Copper is one in every of them. I make investments each In European copper companies and recyclers and when IT involves the NA/SA-based copper trade, my selection goes to Southern Copper (NYSE:SCCO).

Why does the selection go to Southern Copper? That is what I will replace you on on this article, and present you why this firm has outperformed since I invested in IT.

The positives about this firm embrace being in a market-leading place within the copper area. I might additionally say that this firm has nice fundamentals and supplied you make investments on the proper or low-cost sufficient value, a very strong elementary upside.

Nevertheless, SCCO has not too long ago spiked – and the valuation is now far above the place I might contemplate the corporate engaging.

On this article, we’ll undergo the corporate’s newest outcomes and I will present you why I am shifting to “HOLD”.

Southern Copper – The corporate is qualitative

As I stated, Southern Copper is an NA/SA-based firm, and because the title suggests, the corporate will be traced again to South America moderately than North, with unique roots in Mexico by Minera Mexico, buying SA copper enterprise pursuits. The corporate’s standing as a majority-owned enterprise with 89% by a Mexican Mining Conglomerate known as Grupo Mexico is the very first thing that you must know right here.

The primary enterprise pursuits lie within the space of copper mining and smelting, and in contrast to different companies that I put money into with a multi-metal focus, this firm focuses solely on copper. The enchantment of copper is just like that of the enchantment I see in aluminum – IT‘s a steel that “permits” our trendy world. IT‘s present in every part from electrical/electronics to issues like shopper merchandise and equipment.

With the decline of China, I anticipated the worldwide copper demand to drop – and for a while IT has. To grasp simply how important China’s copper demand was, all you really want to do is understand that at occasions over the previous few years, the nation has been accountable for 40-50% of worldwide copper demand.

SCCO IR (SCCO IR)

Why is SCCO so related right here?

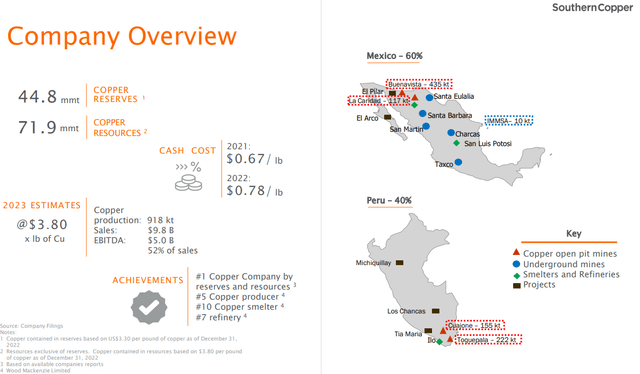

As a result of IT maintains the most important copper reserves of any firm within the trade, with full vertical integration and very skilled administration. These are all the time glorious qualities to start an organization overview with. On this case, we’re speaking about gross, working, and web margins, the place SCCO is above common in virtually each respect (Supply: GuruFocus/Tikr.com). The corporate additionally manages very compelling ROIC/ROE and different profitability metrics, to the place I can simply name this one of the financially profitable corporations within the copper sector on all the market.

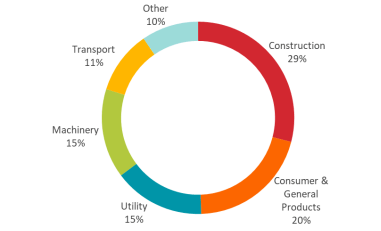

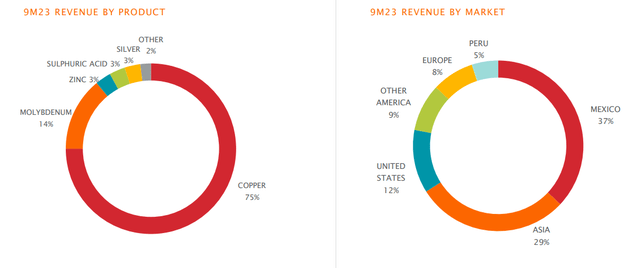

The corporate’s foremost threat is, certainly, its huge publicity to Asia and Mexico as markets is over 50% right here, with an expectation for a market surplus for the 12 months and a worldwide demand enhance of 1% for 2023. As a result of important demand decline from China, there may be an total uncertainty as to how the demand enhance from clear vitality applied sciences can weigh up this. Copper is used as follows, and you may perceive right here why the value shifts a lot with macro, resulting from building publicity and the like.

SCCO IR (SCCO IR)

Nevertheless, the corporate has the dimensions and the operations to work by cycles. IT has one of many lowest manufacturing prices on the market except for what I contemplate to be an above-average dividend historical past. Listed below are the corporate’s operations and a number of the working estimates.

SCCO IR (SCCO IR)

The corporate’s foremost opponents in Copper are the companies Freeport McMoRan (FCX), BHP Billiton, Glencore, Anglo American, Rio Tinto, and First Quantum. Not one of the European corporations I make investments revenue very near this, and SCCO’s 4 open pit mines at a really giant scale.

That isn’t to say that the corporate solely generates income from copper. Only a few corporations solely deal with “one” steel, on condition that if you mine Copper, you are additionally more likely to discover different issues in the identical pits/deposits – issues like Zinc, Silver, and Molybdenum in addition to byproducts of the method.

SCCO IR (SCCO IR)

The corporate’s outcomes for 4Q had been good – as defined by the rocketing valuation that we have seen for the enterprise. There was an anticipated, growing market deficit in 2024, together with decrease copper inventories, in truth, larger than anticipated (Supply: SCCO IR). Then again, the Chinese language financial system is, as the corporate says, recovering extra slowly than regular. I might go as far as to say IT‘s not recovering that a lot in any respect. As well as, Europe or a lot of Europe has entered a recession, with a possible so-called “mushy touchdown” within the US, or a small potential recession right here as properly.

So in brief, the corporate’s foremost KPI, the LME copper value, is up round 8 cents on the greenback – however there are nonetheless issues to be careful for.

Wanting on the firm’s outcomes you may count on this enterprise to generate important gross sales will increase and EBITDA will increase, The fact for 4Q on a YoY comparability is the precise reverse. EBITDA is down 35%, money prices are up, and web revenue is down greater than 50% for the quarter – however can be down 8% for the complete 12 months.

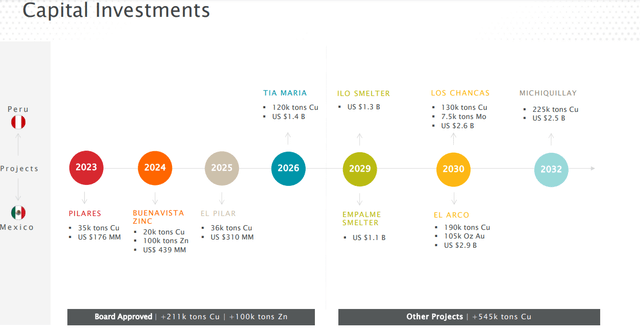

The corporate’s pipeline is likely one of the positives to think about right here – loads of issues are coming within the subsequent few years.

SCCO IR (SCCO IR)

As issues at the moment stand, the corporate yields round 3%, which is okay, however nothing to jot down house about given that you simply’re getting 4-5% from a financial savings account on an MMF in the present day.

The corporate has been known as by different buyers, together with analysts right here on In search of Alpha, because the “splendid copper miner”, and I might agree with that evaluation. The corporate’s potential to work by downcycles and actually see long-term upside on the proper value is excellent – and the corporate’s present upside is okay – IT‘s solely valuation that turns this firm considerably “bitter” by way of whole potential returns.

And valuation, should you comply with my work, you already know that is what I’m actually all about – let’s have a look at why SCCO is not all that spectacular from this angle any longer.

Southern Copper – The valuation is prohibitive at this level

Again after I final wrote about this text over a 12 months in the past, in a chunk you could find right here, I used to be very constructive concerning the firm. SCCO was low-cost, below $65/share, and I gave the corporate simply that $65/share as a result of the corporate’s progress outlook was pretty dangerous – so I did not assume that IT warranted a lot above that $65/share.

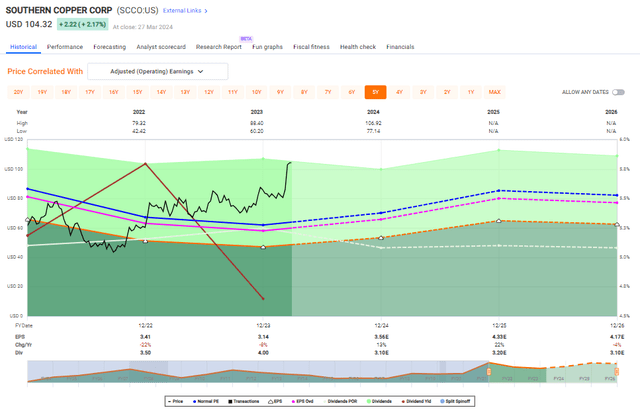

Shifting ahead till in the present day, the corporate’s forecasts in truth materialized worse than anticipated, however the valuation has climbed considerably since I made my final funding, defying gravity in a approach and at the moment at over $104/share.

SCCO Upside (F.A.S.T graphs)

I can be growing my value for SCCO right here, given the 2024E and 2025E estimates, which I do contemplate to be not fully unlikely. These estimates embrace a rise in EPS of 15% in 2024 and one other double-digit enhance in 2025E (Supply: FactSet/In search of Alpha). The value enhance I’m making use of relies partly on this enhance in earnings. On the similar time, you must keep in mind that this firm just isn’t actually precisely forecastable, so the rise would not symbolize the earnings enhance quantity/share. The corporate manages to overlook more often than not, over 60% of the time on a 1-year foundation with a ten% margin of error, that are unfavourable misses (that means beneath said/forecasted EPS).

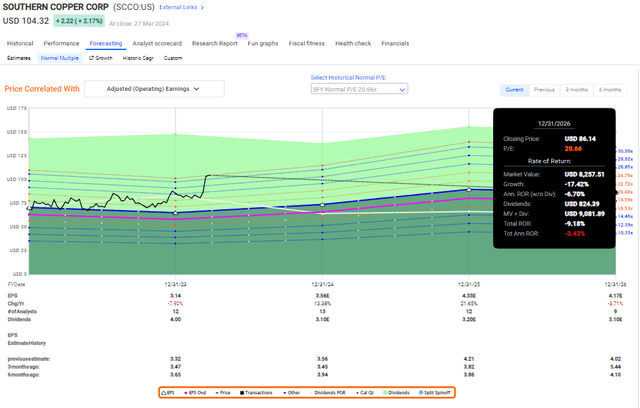

Even, in truth, should you had been to forecast the corporate at one thing of a 5-year common at 20.5x, the returns that you simply’d get right here can be unfavourable by way of TSR.

SCCO F.A.S.T graphs upside (F.A.S.T graphs)

And, in truth, most who comply with this firm by way of analysts have lengthy since “left the boat”, with the common value goal for the corporate coming no larger than $74/share (Supply: S&P World). The vary is broad – a low finish of $47 and a excessive finish of $130, making IT virtually 3x from the low-end value goal. At the moment, solely one out of 17 analysts following SCCO has the corporate at a purchase ranking, and given the present valuation, I might say that this analyst is one thing of a “copper bull”. The corporate in the meantime earns a complete of 12 underperform/SELL scores from analysts right here, making IT greater than 50% of all analysts viewing the corporate more likely to underperform (Supply: S&P World).

As I see IT, whereas this firm is extremely qualitative, there may be completely no argument for the corporate buying and selling at these multiples. We’re at the moment at over 32x P/E for a 3%-yielding copper enterprise, albeit at a BBB+ ranking – however nonetheless not justified, as I see issues right here.

I imagine the probably end result should you had been to “BUY” the corporate in the present day can be a unfavourable fee of return – until the corporate continues to defy as I stated, gravity. That isn’t one thing I’m prepared to wager on.

The scores from different SA analysts in addition to Wall Road and in addition the SA Quant system verify this, all of which have a “HOLD” or a “SELL” ranking. I do not use “SELL” scores besides in corporations that I imagine are in misery – and SCCO is definitely not in misery.

Based mostly on what I at the moment count on SCCO to generate by way of returns, I might not estimate the corporate above a 20x P/E on a 2024E foundation, and that will increase my share value goal to $73/share. However past that, I’m unwilling to think about the enterprise at what the market “calls for” for the corporate in the present day, and due to that, I say that that is now a “HOLD”.

Why 20x? SCCO has seen some success over the previous few many years as a commodity enterprise due to through-cyclical stability. IT has by no means actually seen a unfavourable earnings or fundamentals, not even throughout the worst occasions or the GFC. Due to this, I view the longer-perspective historic multiples as maybe the perfect indication for a long-term honest worth estimate – and once we exit to the 20-year common, we discover an round 20-21x P/E, the place I’m going to the decrease finish to remain conservative. IT additionally represents a double-digit low cost to the corporate’s belongings – and past that, why I contemplate the corporate larger than different mining enterprise, is as a result of this firm is the most important on the planet with a really strong IG ranking at BBB+. That’s the reason I say that 20x P/E is “honest” right here for the long run.

My thesis for the corporate is up to date for the 2024E interval and now displays this as follows.

Thesis

- This firm is a wonderful play on Copper mining, and one of the attention-grabbing copper corporations on the market primarily based on its belongings and the corporate forecasts and progress. The corporate’s profitability KPIs are a number of the best possible in all the copper enterprise on a worldwide scale, and I might purchase this firm any day at a extra conservative valuation.

- Fundamentals are strong – and the corporate’s historical past offers us with a comparatively forecastable type of excessive and low goal, permitting us to find out when to purchase and promote with relative accuracy (going by historic numbers, not less than) – even when that is influenced by the standard volatility of a commodity firm within the copper area, the place SCCO “performs”.

- For now, I contemplate the corporate to be clearly overvalued – I might give the corporate a “HOLD” ranking right here however with a transparent draw back to a PT of $73/share, and loads of potential for unfavourable RoR.

- Due to this, I’ve rotated my modest place within the firm and would steer clear of right here, all issues thought of.

Keep in mind, I am all about:

- Shopping for undervalued – even when that undervaluation is slight and never mind-numbingly huge – corporations at a reduction, permitting them to normalize over time and harvesting capital positive aspects and dividends within the meantime.

- If the corporate goes properly past normalization and goes into overvaluation, I harvest positive aspects and rotate my place into different undervalued shares, repeating #1.

- If the corporate would not go into overvaluation however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

- I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed below are my standards and the way the corporate fulfills them (italicized).

- This firm is total qualitative.

- This firm is basically secure/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is at the moment low-cost.

- This firm has a sensible upside primarily based on earnings progress or a number of enlargement/reversion.

I neither imagine the corporate to be low-cost, nor IT to have a sensible upside at this valuation. To me, the corporate may be very clearly a “HOLD” right here.