deepblue4you/iStock by way of Getty Pictures

Thesis

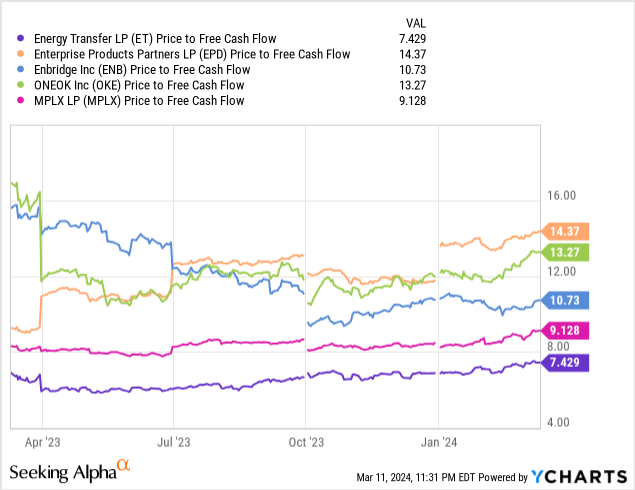

Power Switch (NYSE:ET) continues to be undervalued in comparison with the majority of the midstream trade. This discounted valuation is a results of adverse shareholder sentiment because of a distribution cutback in 2020. IT is my view that this stigma presents a possibility to purchase this high-yield inventory with much less threat than can be inferred if readers didn’t preserve an open thoughts and let the previous keep up to now.

I beforehand lined ET in Could 2023 with a BUY score. Since then, the corporate has continued to extend the distribution whereas additionally making a number of accretive acquisitions. The inventory has made some positive aspects in that point however has not stored up with the operational efficiency of the corporate, leading to underlying worth. In consequence, IT felt IT was applicable to carry out a deep dive to take away any issues which may be protecting traders on the sidelines.

This text will contact on ET’s historical past to look at a few of its earlier errors. We’ll then take a look at the self-prescribed drugs that ET took to enhance its monetary footing and increase its credit score metrics. Lastly, I’ll let the mathematics communicate for itself to indicate that ET is undervalued and has ample margin to proceed to lift the distribution.

Via this deep dive, I intend to indicate traders that analyzing the earnings assertion of an organization is the perfect methodology to seek out market betting returns. ET’s monetary footing is wholesome and warrants a BUY score.

Introduction

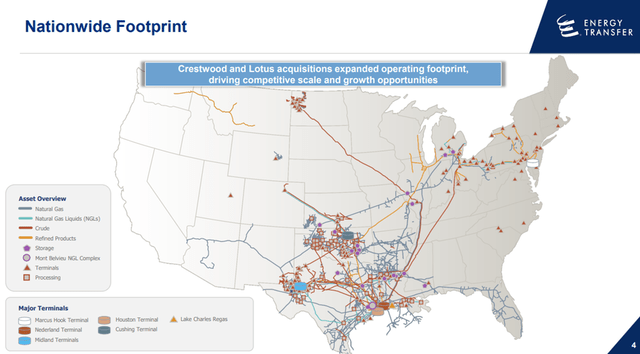

Power Switch is a midstream firm that participates within the transportation of pure gasoline, NGLs, crude oil, and refined merchandise. The corporate consists of 1000’s of miles of pipelines and related infrastructure to assist gasoline the world’s power wants.

ET Asset Map (ET Investor Presentation)

The Stigma

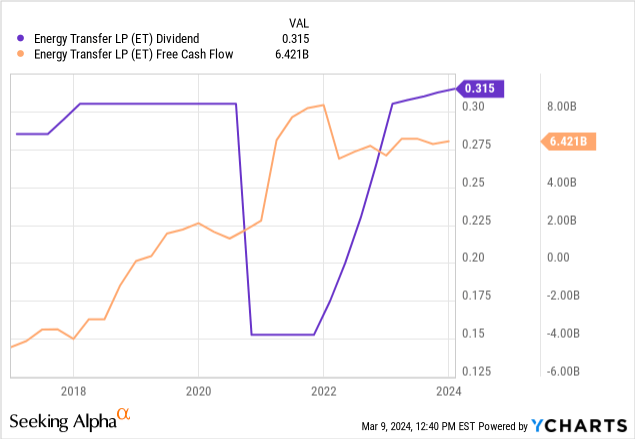

In 2020, ET minimize its dividend in half. This clearly had a adverse influence on the unit holder base and has left ET with a adverse stigma. Ache is a robust trainer, however on this case, IT might be blinding some traders from understanding Power Switch at its core.

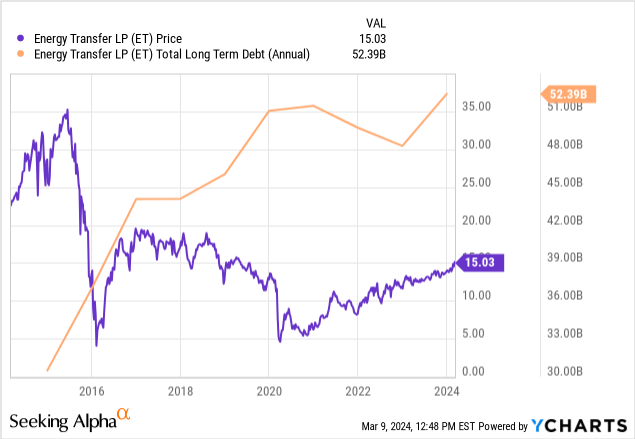

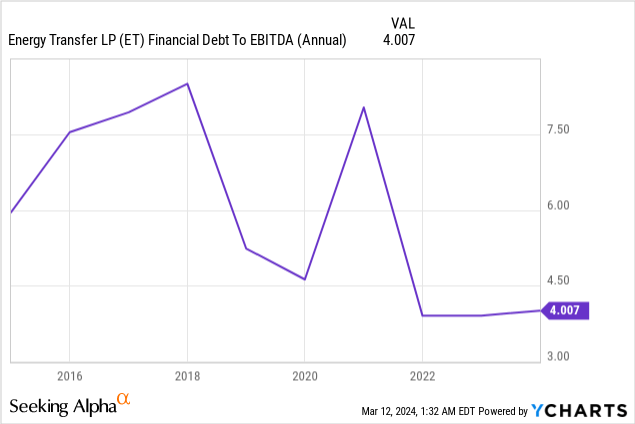

After the door was opened by the distribution minimize, this stigma positive aspects velocity after we begin previous worth efficiency. At present, ET sits a lower than half of its 2015 highs. The story appears even worse when how the debt has climbed over the past decade. The bears should be on to one thing right here.

Clearly, there may be some reality behind the bear case for ET. However is ET actually the odd man out right here?

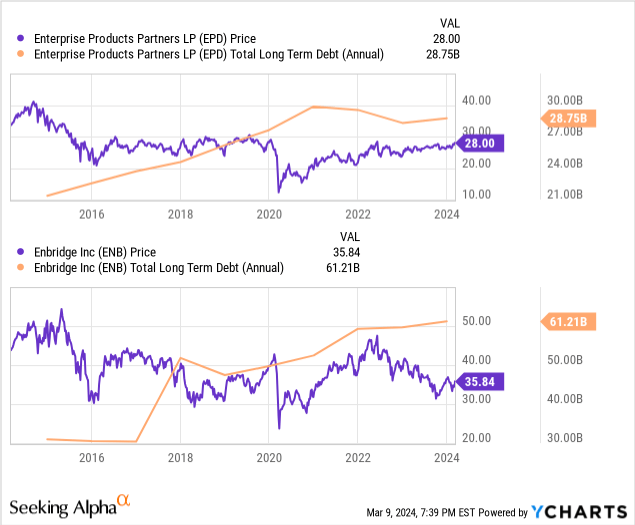

When evaluating the worth efficiency and debt profile of EPD and Enbridge (ENB), we discover practically similar charts for the final decade. Simply to make certain, I in contrast a number of different large-cap midstream firms and located comparable ends in ONEOK (OKE) and MPLX (MPLX). So clearly, ET isn’t an outlier however truly following the identical practices as the majority of the midstream trade.

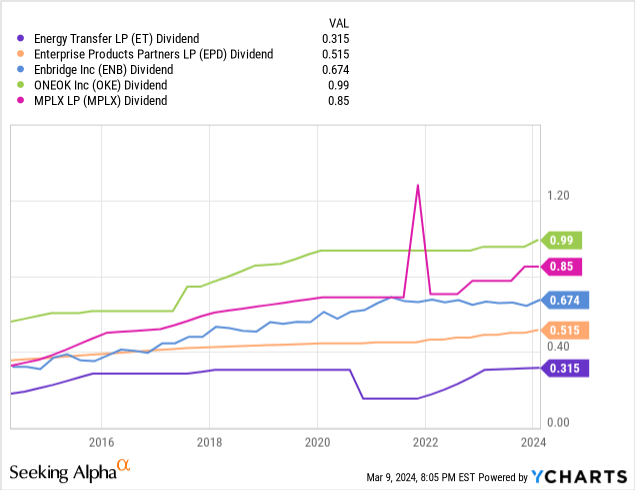

After exhibiting that ET isn’t distinctive in share worth efficiency or debt accumulation, our high-level bear case towards ET has now been boiled down to 1 variable. A distribution minimize. Going again 10 years, ET is the one firm within the group to take action.

Since many traders within the midstream house are reliant on their investments as types of earnings, IT is pure to hunt consistency. To deal with this, we are going to dive into what necessitated this minimize, and what allowed the distribution to be restored in comparatively quick order.

The Drugs

Hindsight is at all times 20/20. However trying again, IT should not actually have been all that shocking that the distribution at the moment was not sustainable. 2019 marked the primary 12 months the corporate was free money circulation constructive. At the moment, ET was considerably levered, with a debt-to-EBITDA ratio of roughly 5.25x.

With minimal free money circulation, fast debt development, and financial uncertainty from the pandemic, ET was confronted with a downgrade to its credit standing from the score companies. With over $50 billion in debt on the time, even a 1% improve in rates of interest would have vital monetary implications. ET selected the quickest remedy to the issue; to chop the distribution by 50%. This allowed ET to unencumber $1.7 billion yearly and allocate these funds to the steadiness sheet.

Chairman and CEO Kelcey Warren mentioned the rationale for the distribution minimize within the Q3 2020 convention name.

The discount of the distribution is a proactive resolution to strategically speed up debt discount as we proceed to deal with reaching our leverage goal of 4 instances to 4.5 instances on a score company foundation and a stable funding grade score.

We anticipate that the distribution discount will lead to roughly $1.7 billion of more money circulation on an annualized foundation that will likely be immediately used to pay down debt balances and maturities. This can be a vital step in Power Switch’s plan to create extra monetary flexibility and reduce our cap – value of capital. As soon as we attain our leverage goal, we’re returning extra capital to unitholders.

The impact of this resolution was rapid. By the top of the next 12 months, the corporate repaid $6.3 billion in debt and commenced restoring the distribution. By the top of 2022, the distribution had been restored to prior ranges and its leverage ratio had been lowered to the vary of roughly 4X.

The Math

Now IT‘s time to sort out that pesky notion that ET is about as much as repeat its distribution-cutting methods. We’ll begin with how ET expects 2024 to unfold.

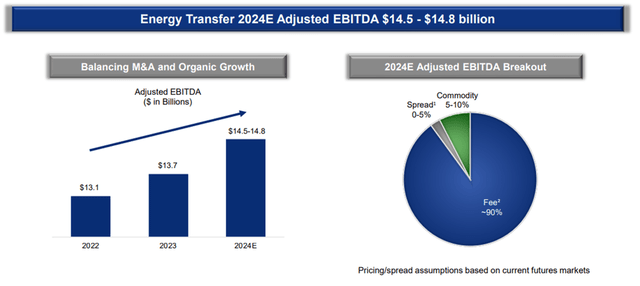

The corporate initiatives that the brand new 12 months will carry a 7% improve in EBITDA. This improve is especially attributed to a full operational 12 months of its acquisitions of Crestwood Companions and Lotus Midstream.

The corporate additionally plans to spend roughly $2.5 billion on natural development initiatives in 2024. The majority of this spending will likely be allotted to NGL export (55%) and pure gasoline transportation (25%) initiatives.

2024 EBITDA Estimates (ET Investor Presentation)

To know how all of this suits into the soundness of the distribution, we have to analyze the varied elements of the ET funds and the way IT impacts distributable money circulation. Under, I’ve created a desk to show the important thing objects from my ET monetary mannequin.

| 2024 Estimate | |

| EBITDA | $14.50B |

| Curiosity Expense | ($2.84B) |

| Tax Expense | ($0.34B) |

| Progress CAPEX Expense | ($2.60B) |

| Upkeep CAPEX Expense | ($0.84B) |

| Distribution to Non-Controlling Pursuits | ($1.86B) |

| Distribution to Frequent Unit Holders | ($4.24B) |

| Remaining FCF | $1.94B |

On this mannequin, I’ve included the next assumptions:

- Low-end EBITDA steering.

- Excessive-end CAPEX spending steering.

- 10% improve in upkeep CAPEX, curiosity expense, and Non-Controlling Distributions.

Given the quantity of conservatism constructed into the mannequin, there’s a truthful diploma of margin to make sure the distribution is protected. In reality, ET is projected to have $1.9B of discretionary funds that may be allotted to the steadiness sheet or acquisitions.

Underneath the worst-case situation I’ve modeled, the corporate nonetheless maintains distribution protection of roughly 1.5x. If the conservatism is eliminated, the protection improves to roughly 1.65x. Each of those values are broadly thought of wholesome for an MLP-structured enterprise.

With 90% of ET’s anticipated EBITDA structured round fee-based contracts and minimal commodity publicity, I conclude there may be little threat to the distribution within the foreseeable future.

Worth Proposition

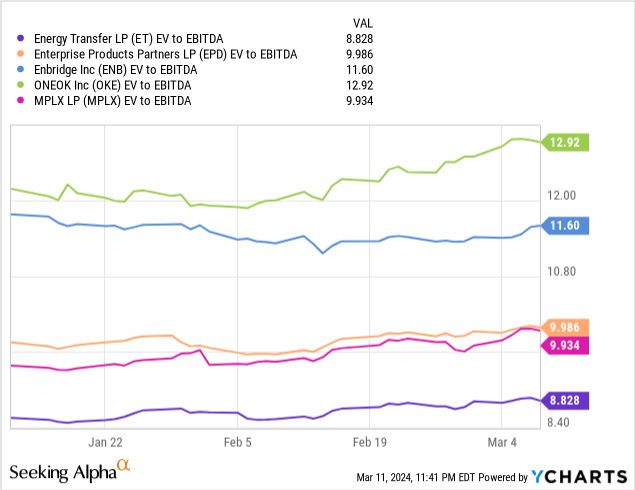

To show the worth proposition of ET, I’ll once more give a comparability to the overall midstream subject. Utilizing the identical peer group, IT may be seen that ET trades at a number of multiples decrease in each worth to free money circulation and EV to EBITDA.

I discover the EV to EBITDA metric to be probably the most insightful on this case. Enterprise worth incorporates each market cap and the overall debt on an organization’s books. This metric helps to both penalize or reward an organization primarily based on its debt/money profile. Regardless of the notion that ET is over-leveraged, IT nonetheless scores very effectively. In reality, ET trades at a full a number of decrease than EPD, which arguably has the perfect steadiness sheet within the trade.

Buying and selling at a decrease EV to EBITDA ratio would indicate that Power Switch is on a slower development trajectory or has degrading monetary fundamentals. With $2.5 billion value of initiatives underneath development and practically $2 billion in unallocated FCF, IT is tough to subscribe to that narrative.

As an alternative, I subscribe to the notion that point heals all wounds. As we transfer additional away from the distribution minimize, its adverse results will regularly diminish. I imagine as ET continues to rebuild its observe report for EBITDA and distribution development, the corporate will expertise a number of expansions that can shut the hole with its friends.

Experiencing one extra turn-in multiplier would yield a share worth of $18.30/share on the midpoint of the projected 2024 EBITDA. This may indicate a 22% upside to the present share worth. I’d anticipate this transition to be gradual, probably taking one other 12 months to 18 months of distribution will increase to totally persuade traders that ET is a dependable distribution payer.

For my final level on worth, I might like to handle the frequent false impression that the ET (or the midstream sector normally) is only a excessive yield or a bond substitute. As famous earlier, ET is investing roughly $2.5 billion this 12 months in natural development initiatives. This comes after $1.6 billion and $1.9 billion spent in 2023 and 2022 respectively.

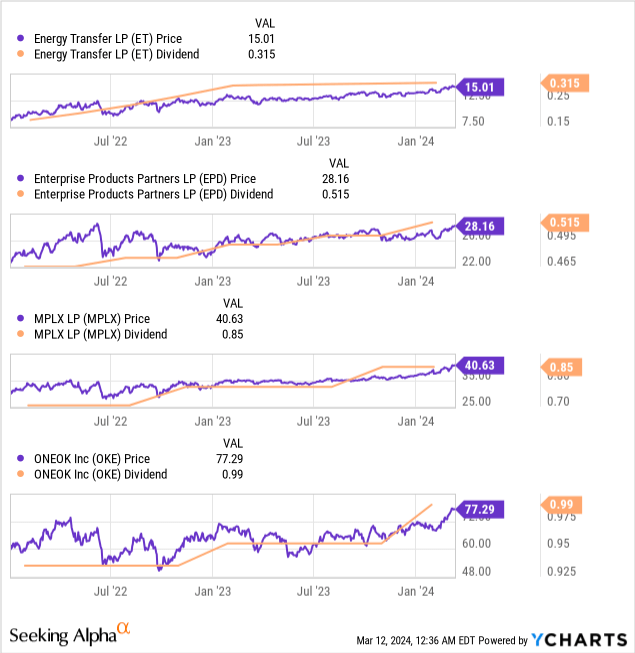

These investments are made to proceed to develop the partnership and fund distribution development. Distribution development interprets into capital appreciation as the upper yield attracts extra traders. As proven under, over the past two years, the midstream house has skilled capital appreciation because the respective firms have grown the distribution.

One ought to anticipate that so long as ET is ready to proceed to put money into natural development and/or acquisitions, the distribution ought to proceed to develop. This may drive capital appreciation over the long run.

Dangers

Basically, the midstream sector has low draw back threat with the safety that’s afforded by take-or-pay model contracts. Nonetheless, interruptions to regular free money manufacturing can intrude with each operational and distribution development.

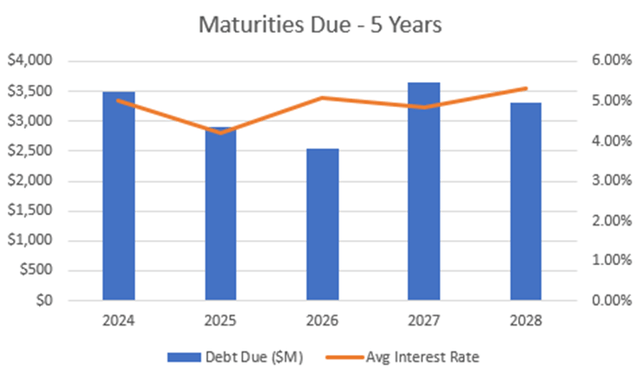

Over the subsequent 5 years, ET’s annual debt maturities vary from $2.5 billion to $3.6 billion. This stage exceeds the quantity of FCF obtainable after the distribution and CAPEX spent to retire all the maturing debt. Due to this fact, some quantity of refinancing will likely be required.

The common rates of interest on the maturing debt are within the ballpark of 5%. Given the elevated rate of interest surroundings, substitute debt might be costlier thus driving up curiosity bills.

In its present type, curiosity bills accounted for roughly 19% of ET’s 2023 EBITDA. Due to this fact, adjustments on this space can have a really measurable influence. Extra curiosity bills will compress each the chance for distribution development and distribution protection.

ET Debt Maturities (ET 10-Ok report)

Abstract

On this article, I overviewed a few of the frequent misconceptions concerning ET as each an organization and a inventory. The resounding conclusion I have to make is that the pessimism that surrounds ET is inappropriate, and the corporate’s financials are sound.

This misunderstanding of the corporate represents a gorgeous valuation for a high-yielding firm. At present costs, the inventory yields 8.4% and the monetary mannequin signifies ample margin exists to help distribution development, acquisitions, and debt discount.

In consequence, I fee Power Switch as a BUY on the present share worth of $15.01/unit as of three/12/24.