Technology AI for working instrument for knowledge evaluation Chatbot Chat with AI, utilizing Technology sensible robotic AI, synthetic intelligence to generate one thing or Assist remedy work issues.” data-id=”1515913422″ data-type=”getty-image” width=”1536px” peak=”1024px” srcset=”https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1515913422/image_1515913422.jpg?io=getty-c-w1536 1536w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1515913422/image_1515913422.jpg?io=getty-c-w1280 1280w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1515913422/image_1515913422.jpg?io=getty-c-w1080 1080w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1515913422/image_1515913422.jpg?io=getty-c-w750 750w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1515913422/image_1515913422.jpg?io=getty-c-w640 640w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1515913422/image_1515913422.jpg?io=getty-c-w480 480w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1515913422/image_1515913422.jpg?io=getty-c-w320 320w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1515913422/image_1515913422.jpg?io=getty-c-w240 240w” sizes=”(max-width: 768px) calc(100vw – 36px), (max-width: 1024px) calc(100vw – 132px), (max-width: 1200px) calc(66.6vw – 72px), 600px” loading=”lazy”/>

Technology AI for working instrument for knowledge evaluation Chatbot Chat with AI, utilizing Technology sensible robotic AI, synthetic intelligence to generate one thing or Assist remedy work issues.” data-id=”1515913422″ data-type=”getty-image” width=”1536px” peak=”1024px” srcset=”https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1515913422/image_1515913422.jpg?io=getty-c-w1536 1536w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1515913422/image_1515913422.jpg?io=getty-c-w1280 1280w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1515913422/image_1515913422.jpg?io=getty-c-w1080 1080w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1515913422/image_1515913422.jpg?io=getty-c-w750 750w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1515913422/image_1515913422.jpg?io=getty-c-w640 640w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1515913422/image_1515913422.jpg?io=getty-c-w480 480w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1515913422/image_1515913422.jpg?io=getty-c-w320 320w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1515913422/image_1515913422.jpg?io=getty-c-w240 240w” sizes=”(max-width: 768px) calc(100vw – 36px), (max-width: 1024px) calc(100vw – 132px), (max-width: 1200px) calc(66.6vw – 72px), 600px” loading=”lazy”/> Khanchit Khirisutchalual

This month-to-month article sequence exhibits a dashboard with mixture business metrics in Information Technology. IT can also function a top-down evaluation of sector ETFs like Technology Choose Sector SPDR Fund ETF (XLK) and First Belief Technology AlphaDEX® Fund ETF (NYSEARCA:FXL), whose holdings are used to calculate these metrics.

Shortcut

The subsequent two paragraphs in italics describe the dashboard methodology. They’re obligatory for brand spanking new readers to know the metrics. If you’re used to this sequence or if you’re wanting time, you possibly can skip them and go to the charts.

Base Metrics

I calculate the median worth of 5 basic ratios for every business: Earnings Yield (“EY”), Gross sales Yield (“SY”), Free Money Circulation Yield (“FY”), Return on Fairness (“ROE”), and Gross Margin (“GM”). The reference universe consists of giant firms within the U.S. inventory market. The 5 base metrics are calculated on trailing 12 months. For all of them, greater is best. EY, SY and FY are medians of the inverse of Worth/Earnings, Worth/Gross sales, and Worth/Free Money Circulation. They’re higher for statistical research than price-to-something ratios, that are unusable or non-available when the “one thing” is near zero or unfavourable (for instance, firms with unfavourable earnings). I additionally have a look at two momentum metrics for every group: the median month-to-month return (RetM) and the median annual return (RetY).

I desire medians to averages as a result of a median splits a set into a superb half and a foul half. A capital-weighted common is skewed by excessive values and the most important firms. My metrics are designed for stock-picking fairly than index investing.

Worth and High quality Scores

I calculate historic baselines for all metrics. They’re famous respectively EYh, SYh, FYh, ROEh, and GMh, and they’re calculated because the averages on a look-back interval of 11 years. For instance, the worth of EYh for {hardware} within the desk under is the 11-year common of the median Earnings Yield in {hardware} firms.

The Worth Rating (“VS”) is outlined as the common distinction in % between the three valuation ratios (EY, SY, FY) and their baselines (EYh, SYh, FYh). The identical approach, the High quality Rating (“QS”) is the common distinction between the 2 high quality ratios (ROE, GM) and their baselines (ROEh, GMh).

The scores are in proportion factors. VS could also be interpreted as the share of undervaluation or overvaluation relative to the baseline (optimistic is nice, unfavourable is dangerous). This interpretation should be taken with warning: the baseline is an arbitrary reference, not a supposed truthful worth. The components assumes that the three valuation metrics are of equal significance.

Present knowledge

The subsequent desk exhibits the metrics and scores as of writing. Columns stand for all the information named and outlined above.

|

VS |

QS |

EY |

SY |

FY |

ROE |

GM |

EYh |

SYh |

FYh |

ROEh |

GMh |

RetM |

RetY |

|

|

{Hardware} |

-47.19 |

-36.08 |

0.0031 |

0.5498 |

0.0340 |

2.96 |

33.00 |

0.0344 |

0.9598 |

0.0369 |

6.28 |

40.84 |

9.87% |

71.67% |

|

Comm. Equip. |

-8.87 |

10.98 |

0.0283 |

0.2839 |

0.0292 |

20.56 |

60.87 |

0.0312 |

0.2672 |

0.0382 |

16.42 |

62.88 |

-3.21% |

-15.75% |

|

Digital Equip. |

-13.44 |

-12.72 |

0.0370 |

0.5564 |

0.0360 |

15.38 |

20.72 |

0.0401 |

0.7579 |

0.0383 |

13.35 |

34.93 |

1.04% |

12.70% |

|

Software program |

-25.52 |

11.26 |

0.0204 |

0.1051 |

0.0249 |

22.96 |

81.95 |

0.0249 |

0.1575 |

0.0333 |

18.10 |

85.65 |

0.69% |

22.10% |

|

Semiconductors |

-34.72 |

1.30 |

0.0282 |

0.1537 |

0.0208 |

27.02 |

58.28 |

0.0441 |

0.2264 |

0.0325 |

24.73 |

62.45 |

-0.20% |

6.20% |

|

IT Companies |

-32.31 |

9.43 |

0.0322 |

0.1630 |

0.0188 |

30.40 |

58.68 |

0.0366 |

0.3026 |

0.0307 |

27.01 |

55.20 |

1.45% |

15.80% |

Worth And High quality chart

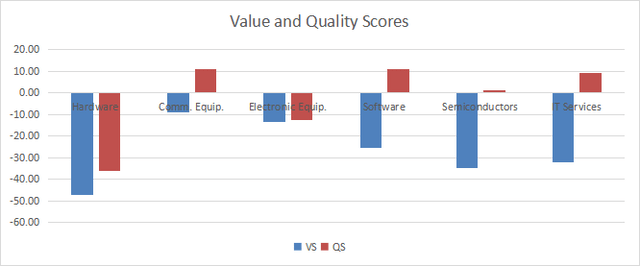

The subsequent chart plots the Worth and High quality Scores by business (greater is best).

Technology” contenteditable=”false” loading=”lazy”/>

Technology” contenteditable=”false” loading=”lazy”/>Worth and High quality in Technology (chart: creator; knowledge: Portfolio123)

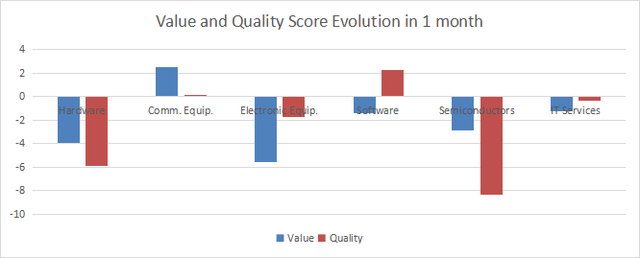

Evolution since final month

The worth rating has marginally improved in communication tools and deteriorated in different industries. The standard rating has improved a bit in software program and deteriorated in {hardware} and semiconductors.

Rating variations (chart: creator; knowledge: Portfolio123)

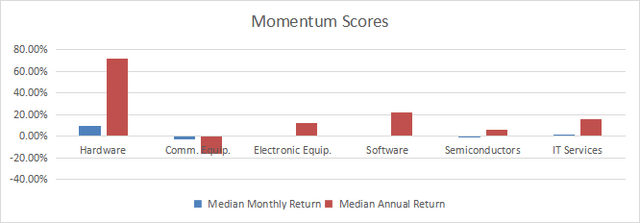

Momentum

The subsequent chart plots momentum scores based mostly on median returns.

Technology” contenteditable=”false” loading=”lazy”/>

Technology” contenteditable=”false” loading=”lazy”/>Momentum in Technology (chart: creator; knowledge: Portfolio123)

Interpretation

The Information Technology sector as a complete is overvalued by about 30% relative to 11-year averages in accordance with my S&P 500 month-to-month dashboard. Nonetheless, the extent of overvaluation varies throughout subsectors: lower than 15% for communication tools and digital tools, and greater than 25% in different industries. High quality might partly offset overvaluation in communication tools, and to a lesser extent in software program and IT companies. {Hardware} is the least engaging subsector, with each worth and high quality scores far under the historic baseline.

Quick information on FXL

First Belief Technology AlphaDEX® Fund ETF began investing operations on 5/8/2007 and tracks the StrataQuant® Technology Index. IT has 97 holdings and an expense ratio of 0.62%, whereas XLK has a 0.09% price.

As described by First Trust, the index begins from the Russell 1000 Index. Constituents are given a development rating and a price rating based mostly on quantitative elements. Every firm retains just one rating (development or worth) based mostly on its fashion designation by Russell. Then, shares within the Technology sector are ranked in accordance with their scores. The larger of the highest 75% or 40 shares is chosen within the fund’s underlying index. Constituents are divided into quintiles and the top-ranked quintiles get the next weight. Shares are equally weighted inside every quintile. The index is reconstituted quarterly. In abstract, FXL selects and chubby shares trying engaging relative to their friends concerning both worth or development.

The subsequent desk lists the highest 10 holdings with their weights and a few basic ratios. Collectively, they signify 20.8% of asset worth, and the most important place weighs 2.66%. Subsequently, the portfolio is well-diversified and dangers associated to particular person firms are a lot decrease than for capital-weighted ETFs like XLK, the place Apple Inc. (AAPL) and Microsoft Corp. (MSFT) collectively signify over 40% of asset worth.

|

Ticker |

Identify |

Weight% |

EPS development %TTM |

P/E TTM |

P/E fwd |

Yield% |

|

VRT |

Vertiv Holdings Co |

2.66% |

2597.67 |

63.04 |

32.43 |

0.13 |

|

NVDA |

NVIDIA Corp. |

2.44% |

585.45 |

73.59 |

35.10 |

0.02 |

|

NTNX |

Nutanix, Inc. |

2.28% |

83.57 |

N/A |

58.99 |

0 |

|

DASH |

DoorDash, Inc. |

2.27% |

60.72 |

N/A |

558.95 |

0 |

|

CRWD |

CrowdStrike Holdings, Inc. |

2.13% |

146.22 |

869.56 |

80.34 |

0 |

|

CRM |

Salesforce, Inc. |

1.93% |

1938.34 |

69.99 |

30.08 |

0.54 |

|

NET |

Cloudflare, Inc. |

1.89% |

6.87 |

N/A |

156.67 |

0 |

|

NOW |

ServiceNow, Inc. |

1.81% |

425.71 |

88.39 |

56.52 |

0 |

|

DDOG |

Datadog, Inc. |

1.71% |

180.56 |

928.45 |

83.43 |

0 |

|

HPE |

Hewlett Packard Enterprise Co. |

1.70% |

125.59 |

11.52 |

8.91 |

3.11 |

Knowledge calculated with Portfolio123

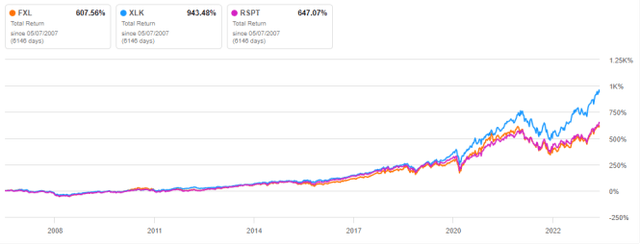

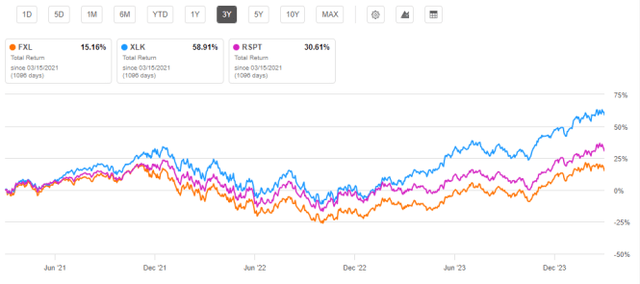

Since its inception, FXL has underperformed XLK, and IT is shortly behind the Invesco S&P 500® Equal Weight Technology ETF (RSPT).

FXL vs. XLK, RSPT, since Could 2007 (Searching for Alpha)

FXL has additionally been lagging each benchmarks during the last 12 months:

FXL vs. XLK, RSPT, 12-month return (Searching for Alpha)

In abstract, FXL is a well-diversified Technology ETF favoring shares with both development or worth traits. The thought seems nice for traders prepared to keep away from the focus in mega-caps of in style Technology ETFs like XLK. Nonetheless, the technique has did not deliver extra return since 2007.

Dashboard Checklist

I exploit the primary desk to calculate worth and high quality scores. IT can also be utilized in a stock-picking course of to examine how firms stand amongst their friends. For instance, the EY column tells us that an IT companies firm with an earnings yield above 0.0322 (or worth/earnings under 31.06) is within the higher half of the business concerning this metric. A Dashboard Checklist is shipped each month to Quantitative Threat & Worth subscribers with essentially the most worthwhile firms standing within the higher half amongst their friends concerning the three valuation metrics on the similar time. The shares under are a part of the listing despatched to subscribers just a few weeks in the past based mostly on knowledge accessible at the moment.

|

EXTR |

Excessive Networks, Inc. |

|

CARS |

Automobiles.com Inc. |

|

TEL |

TE Connectivity Ltd. |

|

NXPI |

NXP Semiconductors N.V. |

|

GEN |

Gen Digital Inc. |

|

IDCC |

InterDigital, Inc. |

IT is a rotational mannequin with a statistical bias towards extra returns in the long run, not the results of an evaluation of every inventory.

Technology-sector-dashboard-for-march?supply=feed_all_articles”>