Diy13/iStock through Getty Photos Finance.” data-id=”2128672901″ data-type=”getty-image” width=”1536px” top=”1024px” srcset=”https://static.seekingalpha.com/cdn/s3/uploads/getty_images/2128672901/image_2128672901.jpg?io=getty-c-w1536 1536w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/2128672901/image_2128672901.jpg?io=getty-c-w1280 1280w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/2128672901/image_2128672901.jpg?io=getty-c-w1080 1080w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/2128672901/image_2128672901.jpg?io=getty-c-w750 750w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/2128672901/image_2128672901.jpg?io=getty-c-w640 640w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/2128672901/image_2128672901.jpg?io=getty-c-w480 480w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/2128672901/image_2128672901.jpg?io=getty-c-w320 320w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/2128672901/image_2128672901.jpg?io=getty-c-w240 240w” sizes=”(max-width: 768px) calc(100vw – 36px), (max-width: 1024px) calc(100vw – 132px), (max-width: 1200px) calc(66.6vw – 72px), 600px” fetchpriority=”excessive”/>

Finance.” data-id=”2128672901″ data-type=”getty-image” width=”1536px” top=”1024px” srcset=”https://static.seekingalpha.com/cdn/s3/uploads/getty_images/2128672901/image_2128672901.jpg?io=getty-c-w1536 1536w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/2128672901/image_2128672901.jpg?io=getty-c-w1280 1280w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/2128672901/image_2128672901.jpg?io=getty-c-w1080 1080w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/2128672901/image_2128672901.jpg?io=getty-c-w750 750w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/2128672901/image_2128672901.jpg?io=getty-c-w640 640w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/2128672901/image_2128672901.jpg?io=getty-c-w480 480w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/2128672901/image_2128672901.jpg?io=getty-c-w320 320w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/2128672901/image_2128672901.jpg?io=getty-c-w240 240w” sizes=”(max-width: 768px) calc(100vw – 36px), (max-width: 1024px) calc(100vw – 132px), (max-width: 1200px) calc(66.6vw – 72px), 600px” fetchpriority=”excessive”/>

The Inexperienced Dream is alive and properly because the push to attain Carbon Zero continues to dominate the air waves as a front-runner for environmental points. A part of the answer for a cleaner atmosphere is the change to Electrical Autos, the set up of photo voltaic panels and so on. Together with a myriad of business makes use of reminiscent of images, drugs, water purification and jewellery, the demand for silver is rising, which in flip places strain of silver costs.

There may be additionally the opportunity of one other Pandemic, which in flip may herald in varied types of lockdowns. Now, to make working from residence extra tolerable, the demand for a brand new flat display monitor for the pc and the demand for a big flat display for residence leisure may as soon as once more weigh heavy on the demand for silver.

Introduction

Given my expectation of upper silver costs, I’m positioning my portfolio to reap the benefits of this chance through the acquisition of a lot of good high quality silver producers.

In the present day we’ll take a fast take a look at only one silver mining inventory: Fortuna Silver Mines Inc .

Fundamentals

Fortuna Silver Mines Inc (NYSE:FSM) is a mining firm primarily based in Canada with 5 mines producing gold and silver in Argentina, Burkina Faso, Côte d’Ivoire, Peru, and Mexico. IT ought to be famous that there’s normally a sure factor of Geo-political threat in these areas, which ought to kind a part of your threat evaluation when investing in areas reminiscent of these.

Financials

The just lately issued report for Q1 2024 incorporates the next highlights:

The corporate has repaid $40 million on their credit score facility, taking the whole paid since Q3 2023 to $121 million, which isn’t any imply feat.

Over the last quarter, they’ve repurchased 1,030,375 shares at a mean value of $3.42 per share, totaling $3.52 million.

IT’s price noting that the repurchase of shares at $3.42 seems to be a well timed transfer because the share value at the moment is round $4.68

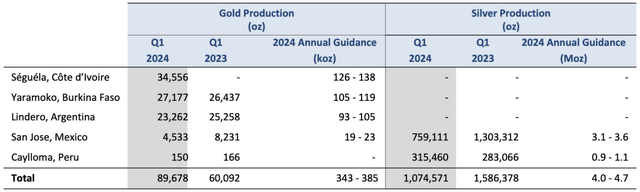

Of word within the table beneath is that Gold equal manufacturing, Gold manufacturing and Silver manufacturing are all up, 20%, 49% and 32%, respectively. We are able to additionally see that there was a big enchancment in Gold Manufacturing in comparison with 2023 and secondly Silver Manufacturing for 2024 was decrease by about one third compared with 2023 which is disappointing.

Fortuna Gold and Silver Manufacturing Desk (Fortuna Silver Q1 Monetary report)

Fortuna has a market Finance.yahoo.com/quote/FSM” rel=”nofollow”>capitalization of $1.435B, a 52-week buying and selling vary of $ 2.58 – $4.89, and an EPS (TTM) of -0.38. The liquidity is sweet with a mean quantity of 5,540,480 shares traded per day enabling traders to enter and exit this inventory with comfortably.

Fortuna’s Earnings per share (EPS) is a priority to me as IT is unfavourable at -0.38 Nevertheless, by comparability to its friends Endeavour Silver Corp. (EXK) 0.03, Silvercorp Metals Inc. (SVM) 0.1700, Hecla Mining Firm (HL) -0.14, First Majestic Silver Corp. (AG) -0.48, IT would seem to on par with this sector of the market.

Taking a fast take a look at Searching for Alpha Quant Rating this inventory is Ranked in Sector 41 out of 278 and by way of Valuation IT is a B+ which isn’t too shabby. Fortuna can be ranked in third place out of the highest 9 silver producers which is encouraging. By way of the highest materials shares IT is ranked 42nd out of 279 and has a valuation of A-. IT ought to be famous although that the Prime Supplies Shares contains a few of the largest corporations on the planet reminiscent of BHP Group Restricted (BHP) which has a market capitalisation of $151 billion and is due to this fact troublesome to guage towards an organization with a $1.4 billion market capitalization.

Fortuna Silver Mines Inc is listed on the NYSE: FSM and on the TSX: FVI.

A Fast Look At The Chart Of A Fortuna Silver Mines Inc

Fortuna Silver Corp (FSM) Progress Chart (Google Finance)

Observe that the relative power index (RSI) and the Transferring Common Convergence/Divergence indicator (MACD) are firmly within the overbought zone suggesting a correction could possibly be on the playing cards. After a foul begin to the 12 months FSM has rallied in type as this tiny sector springs to life

A Golden Crossover has simply been fashioned which is normally a really optimistic indicator, nonetheless, on this case a whole lot of progress has already been made which tends to negate the Golden Crossover.

The next desk compares Fortuna Silver with three related silver producers over a six-month interval and we are able to see that this inventory has held its personal with a rise of 69.61%.

Fortuna Silver Corp (FSM) In contrast With Its Friends (Google Finance)

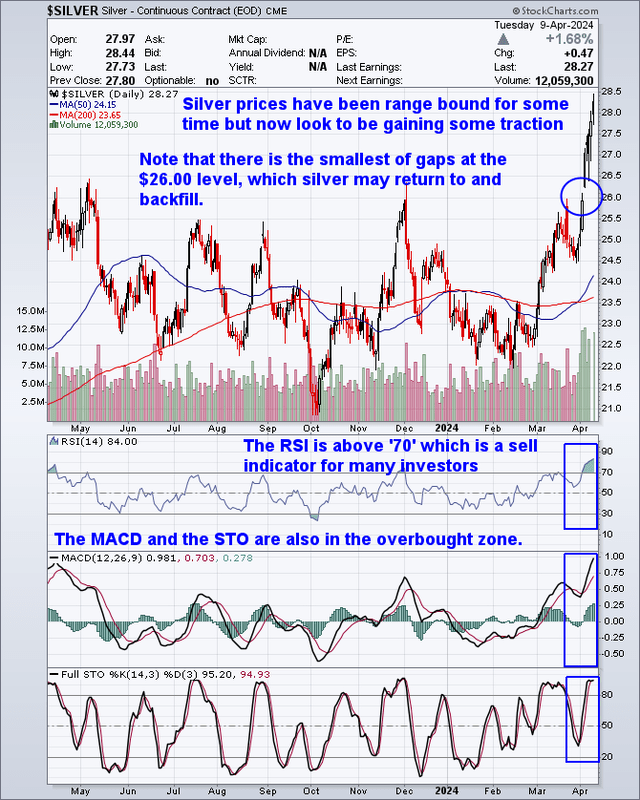

A Fast Look At The Chart Of Silver Costs

The technical indicators within the overbought zone. Additionally word that there’s the smallest of gaps on the $26.00 stage, which silver could return to and backfill.

This chart is an effective instance of when to purchase and promote as indicated by the RSI. Final October, we are able to see that IT dipped beneath the ’30’ stage and promptly rallied. In December, IT popped up above the ’70’ stage and rapidly retreated. The RSI (Relative Energy Index) now stands at ‘84’ which some merchants will think about to be a Promote indicator, so go gently when inserting your trades.

A One 12 months Progress Chart Of Silver TA by Bob Kirtley (Stockcharts)

Conclusion

Gold has been making new all-time highs of late, however silver costs are nonetheless solely half of their all-time highs of round $50/Oz. The present Gold/Silver Ratio is 83.91 and in 2012 IT flirted with 30, so possibly a reversion to decrease ranges for this ratio is on the playing cards.

I can’t say that this inventory is the most effective in school, however IT does seem like maintaining with its friends and, rightly or wrongly, I’m Lengthy on Fortuna Silver Corp.

On condition that Fortuna has risen so quick in such a short while, I’ll think about buying a couple of Put Choices as insurance coverage towards a sudden sell-off moderately than cut back my place as that now just isn’t the time to be out of this Silver Bull Market which is simply beginning to achieve some momentum.

As all the time, attempt to layer into your trades and construct your place in an orderly method and be ready for sudden corrections which may shake traders into promoting their inventory as this white-knuckle trip continues with some gusto.

For the report, I’ve been lengthy bodily gold and silver for a lot of years and likewise personal a portfolio of shares within the treasured metals sector, together with:

Sandstorm Gold Ltd. (SAND), Wheaton Treasured Metals Corp. (WPM), Agnico Eagle Mines Restricted (AEM) and SSR Mining Inc. (SSRM). Endeavour Silver Corp (EXK) First Majestic Silver Corp. (AG) Silvercorp Metals Inc. (SVM) IMPACT Silver Corp. (IPT:CA)

It’s essential to have a remark so please add IT to the commentary and I’ll do my greatest to handle each considered one of them because the dialogue is such a profit for all involved in these endeavors.