Technology revolution in world of cryptocurrency and digital Finance companies, connecting buyers to progress and stability of digital belongings” data-id=”1834307900″ data-type=”getty-image” width=”1536px” peak=”864px” srcset=”https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1834307900/image_1834307900.jpg?io=getty-c-w1536 1536w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1834307900/image_1834307900.jpg?io=getty-c-w1280 1280w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1834307900/image_1834307900.jpg?io=getty-c-w1080 1080w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1834307900/image_1834307900.jpg?io=getty-c-w750 750w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1834307900/image_1834307900.jpg?io=getty-c-w640 640w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1834307900/image_1834307900.jpg?io=getty-c-w480 480w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1834307900/image_1834307900.jpg?io=getty-c-w320 320w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1834307900/image_1834307900.jpg?io=getty-c-w240 240w” sizes=”(max-width: 768px) calc(100vw – 36px), (max-width: 1024px) calc(100vw – 132px), (max-width: 1200px) calc(66.6vw – 72px), 600px” fetchpriority=”excessive”/>

Technology revolution in world of cryptocurrency and digital Finance companies, connecting buyers to progress and stability of digital belongings” data-id=”1834307900″ data-type=”getty-image” width=”1536px” peak=”864px” srcset=”https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1834307900/image_1834307900.jpg?io=getty-c-w1536 1536w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1834307900/image_1834307900.jpg?io=getty-c-w1280 1280w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1834307900/image_1834307900.jpg?io=getty-c-w1080 1080w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1834307900/image_1834307900.jpg?io=getty-c-w750 750w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1834307900/image_1834307900.jpg?io=getty-c-w640 640w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1834307900/image_1834307900.jpg?io=getty-c-w480 480w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1834307900/image_1834307900.jpg?io=getty-c-w320 320w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1834307900/image_1834307900.jpg?io=getty-c-w240 240w” sizes=”(max-width: 768px) calc(100vw – 36px), (max-width: 1024px) calc(100vw – 132px), (max-width: 1200px) calc(66.6vw – 72px), 600px” fetchpriority=”excessive”/> LagartoFilm

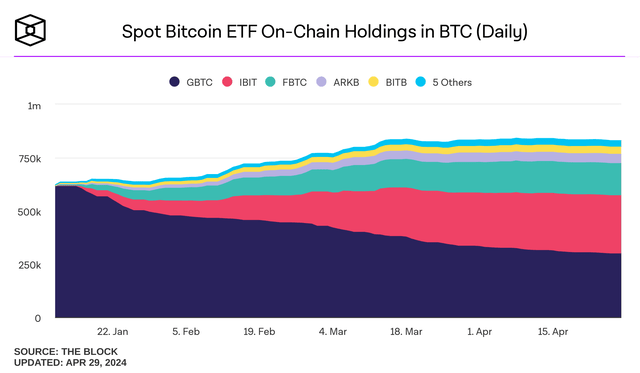

We’re now three months because the approval of spot Bitcoin (BTC-USD) ETFs in the US market. I do not suppose IT‘s a stretch to say these funds have been an infinite success from an AUM progress standpoint. Even after adjusting for the asset exodus from the Grayscale Bitcoin Belief ETF (GBTC), greater than 214k BTC in optimistic web move has come into these merchandise in three and a half months. That BTC has a nominal worth of over $13.1 billion as of article submission.

Spot ETF Holdings (The Block)

Regardless of all the success, extra not too long ago the funds have endured a bit little bit of BTC web outflow from a handful of the spot ETFs because the market digests the halving and varied different developments that would have an effect on Bitcoin’s demand.

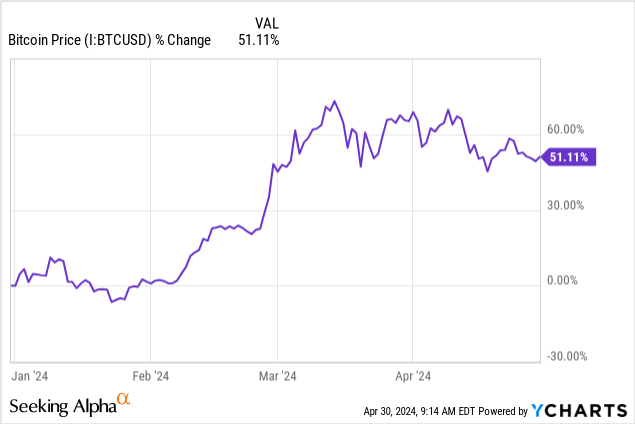

As speculators are seemingly taking off some threat following an amazing begin to the yr from a worth appreciation standpoint, I feel IT‘s an excellent time to re-examine among the necessary community metrics for Bitcoin and, as a byproduct of these metrics, the bull case for the Constancy Sensible Origin Bitcoin Fund (BATS:FBTC).

Main Catalysts in The Rearview

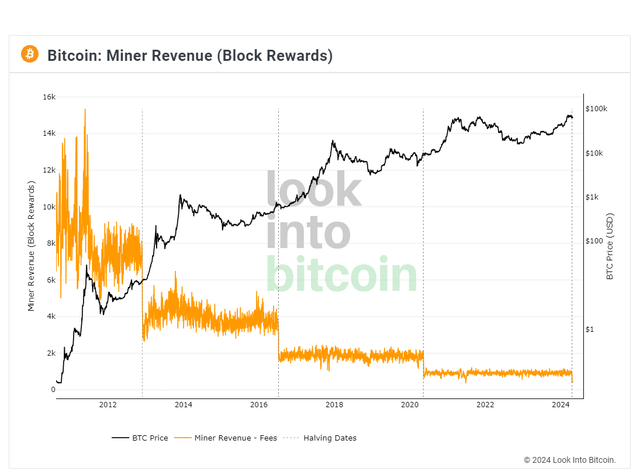

After all, the approval of spot ETFs was an necessary catalyst for absorbing funding capital demand. The opposite facet of the availability/demand relationship has additionally been impacted this yr by means of Bitcoin’s block reward halving on April twentieth. IT‘s been well-covered at this level, however to shortly summarize; Bitcoin was designed to solely ever have 21 million cash. For validating transactions, miners have usually been paid by means of new coin issuance from that 21 million fastened provide – this is called the “block reward subsidy.” Each 4 years Bitcoin’s block reward subsidy is reduce in half.

Bitcoin Miner Rewards (Look Into Bitcoin)

Traditionally, Bitcoin’s worth will increase to new all-time highs 12-18 months following a halving occasion resulting from diminishing provide whereas demand for BTC has usually risen by means of a worth mania that ensues. The argument might definitely be made that a lot of Bitcoin’s post-halving worth run already occurred due partly to the approval of the spot ETFs. I am personally not within the camp that the cycle highs have been made. Nonetheless, I’m within the camp that the cycle excessive will doubtless disappoint these on the lookout for $400k-$500k BTC costs subsequent yr.

The Case Towards Self-Custody

As a digital asset, BTC is designed to not require custodians or intermediaries. Spawning from cypherpunk ethos, self-custody is definitely the complete level of Bitcoin. However because the years have gone on, the meant utility of BTC has morphed from peer to look forex to “digital gold” that ought to be “HODL’d” slightly than spent. We will definitely debate if this variation in route has been useful for long run adoption or not, however IT‘s the truth of the scenario and the tradeoffs that include custody versus self-custody play into selections about Bitcoin that we make as particular person buyers and speculators.

Contemplate that using custodians has lengthy been seen because the dangerous technique to personal Bitcoin. “Not your keys, not your cash” being the mantra in current cycles to indicate that blowups at centralized corporations like Celsius (CEL-USD), FTX (FTT-USD), and Voyager (VGX-USD) aren’t indicative of Bitcoin’s failure however slightly a failure of human determination making. I wish to be clear about this; I’m nonetheless of the view that BTC ought to be self-custodied if the person holder has the means to take action. However we should acknowledge that if Bitcoin’s base layer is not going to scale for wider utilization, common transaction charges will certainly rise when charges turn out to be the first incentive mechanism for Bitcoin miners because the block reward continues to say no. This may have a long run influence on the viability of self-custody if really decentralized scaling networks do not (or cannot) attain a important mass.

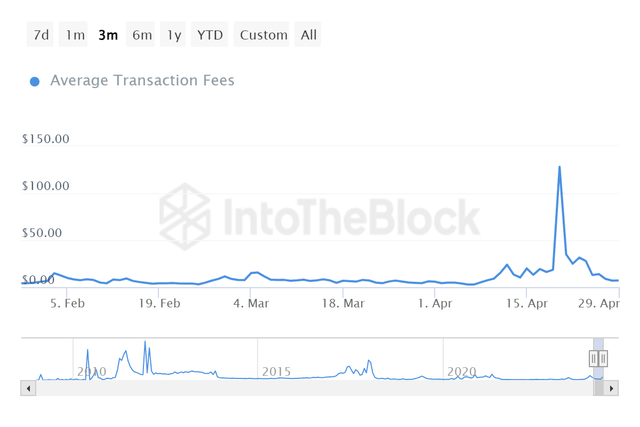

We’re already seeing what can occur with transaction charges throughout instances of excessive community demand:

Bitcoin Common Transaction Charges (IntoTheBlock)

On April twentieth, the common transaction payment to maneuver BTC on the community was over $128 – up virtually 600% from the prior day. This monumental spike was as a result of launch of the Runes protocol on Bitcoin. The hype round that challenge has since subsided. Nonetheless, for the complete week following the launch of Runes, the common transaction payment was bigger than $22. We did not see a single-day common transaction payment worth underneath $10 till April twenty seventh. And for some added context, the common payment between April 1st and April nineteenth was about $10.60.

All of this issues as a result of shifting BTC out and in of self-custody requires paying these charges. A $10 transaction payment is completely tremendous for bigger worth transactions. However for almost all of individuals to justify holding BTC in self-custody, these charges are excessive.

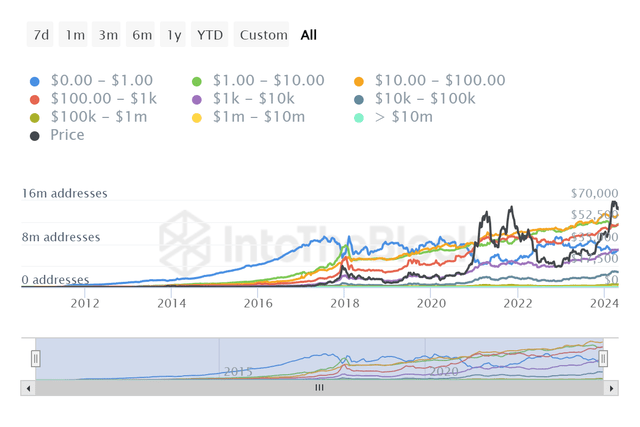

Bitcoin Tackle Worth Cohorts (IntoTheBlock)

At $10 common charges, almost 19 million of the 54+ million non-zero Bitcoin pockets addresses are paralyzed. At $100 common charges, almost 60% of on-chain pockets addresses cannot transfer funds. That is severe threat and exhibits why the ETF choice would possibly truly make extra sense for smaller-value HODLing.

Contemplate a speculator who desires to purchase $5,000 in BTC. Doing so by means of an change would require an upfront payment after which an extra payment to take custody. If we use $10 as an our base case for common transaction charges and 25 bps as our base case for annual ETF expense, IT takes 5 years to make self-custody more cost effective than merely shopping for the ETF:

| Investor-Absorbed Charges | Self-Custody | FBTC |

|---|---|---|

| Coinbase (COIN) payment | $50.0 | – |

| Community payment | $10.0 | – |

| 1 yr Custody Cost | – | $12.5 |

| Whole | $60.0 | $12.5 |

Supply: Analyst estimates

Then if the self-custody holder desires to promote, they are going to pay these charges once more. The cherry on high of all of that is the FBTC allocation can simply be held in a tax advantaged account like a Roth IRA and pay no capital positive factors taxes on asset appreciation.

Reiterating My FBTC Purchase Name

Although I like a few the opposite funds as properly, I keep that FBTC is my private choice for Bitcoin ETF publicity. The payment waiver for FBTC remains to be dwell at present although that waiver will expire on the finish of July. Following that waiver, the fund’s expense ratio shall be 0.25%. This isn’t the most affordable expense ratio of the spot BTC ETFs. Nonetheless, IT is definitely nonetheless aggressive and I think Constancy’s payment could in the end turn out to be the most affordable over time as a result of IT has a important benefit over virtually each different spot ETF supervisor – IT would not depend on Coinbase to custody the asset. That is what I stated again in January:

Whereas I’ve virtually no concern about Coinbase from a blockchain competency standpoint, utilizing Coinbase for custody does add an extra ingredient of potential threat just by nature of IT being a 3rd get together. Once more, I do not view this as a big threat, however I do suppose IT provides Constancy a long run edge since custody is being accomplished in-house by means of a subsidiary enterprise. Though charges have turn out to be a little bit of a race to the underside for these ETFs, at a sure level that added layer for these different ETFs could in the end require a bigger price to the investor.

My pondering goes like this; as extra retail buyers and/or speculators purchase BTC by means of ETFs slightly than immediately by means of firm’s like Coinbase, Coinbase might want to substitute misplaced income from its retail change enterprise. I think the corporate will look to lift custody charges on the asset managers who’re counting on Coinbase for the acquisition and storage of the BTC held within the ETFs. Since Constancy is basically self-storing, the danger of payment hikes down the road is probably going decrease in comparison with different ETF suppliers.

Closing Abstract

There are huge tradeoffs in going lengthy BTC through ETFs like FBTC which are necessary to think about as properly. The investor is on the mercy of market hours and may’t essentially promote after they wish to if an exit is desired throughout the weekend or throughout a weekday night. Moreover, FBTC holders aren’t in the end in charge of the BTC represented by their shares. However there isn’t any excellent resolution to Bitcoin publicity in 2024, for my part. As I’ve illustrated, self-custody clearly has dangers, notably for smaller worth holders, and IT‘s not troublesome to see how IT may be far dearer to HODL on-chain. Given my perception that miners would require transaction charges to incentivize long-term community safety and the potential tax-advantages of shopping for FBTC in a Roth account, I feel FBTC is a stable choice for long-term Bitcoin publicity.