felixmizioznikov

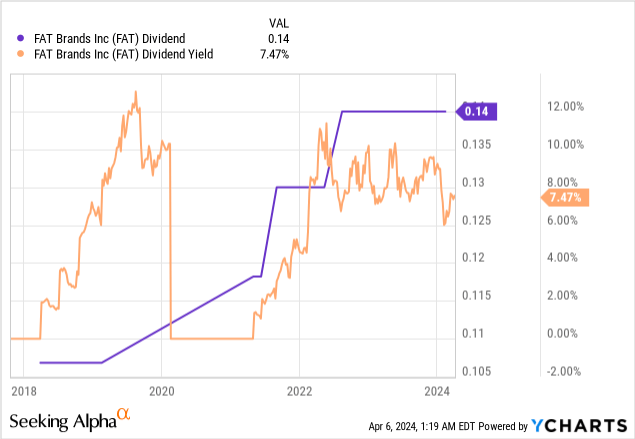

FAT Manufacturers (NASDAQ:FAT) has all the time provided a novel investing paradigm. IT‘s a loss-making $126 million market micro-cap firm providing a major dividend yield in opposition to a rising specter of debt and a liquidity place beset by consecutive quarters of money burn and a rising debt burden. FAT final declared a quarterly money dividend of $0.14 per share, left unchanged sequentially and $0.56 per share annualized for a 7.47% dividend yield. FAT owns 18 quick informal and informal eating restaurant manufacturers together with Twin Peaks, Smokey Bones, Fatburger, and Johnny Rockets. The corporate is in intense progress mode with its opening of 125 new shops in 2023 set to be adopted by an extra 150 items in 2024 in opposition to a growth pipeline of 1,200 items.

I used to be bearish on the commons and the Sequence B preferreds after I final lined the ticker. Whereas each are up since then, the underlying bearish thesis has remained sticky. FAT generated fiscal 2023 fourth-quarter income of $158.6 million, up a outstanding 52.8% over its year-ago comp and beating consensus estimates by $8.2 million. Whole income for 2023 at $480.5 million was up 18% year-over-year with FAT now buying and selling for 0.26x occasions its 2023 gross sales. Nonetheless, the corporate’s long-term debt burden stays a fabric barrier to worth creation right here, ending the fourth quarter at $1.1 billion, up $152 million from the year-ago comp. Additional, there’s one other $42.6 million in present debt each set in opposition to money and money equivalents together with restricted money of $76.3 million on the finish of the fourth quarter. There may be one other $15.58 million in non-current restricted money.

Stockholders’ Deficit, Dividend Protection, And Money Burn

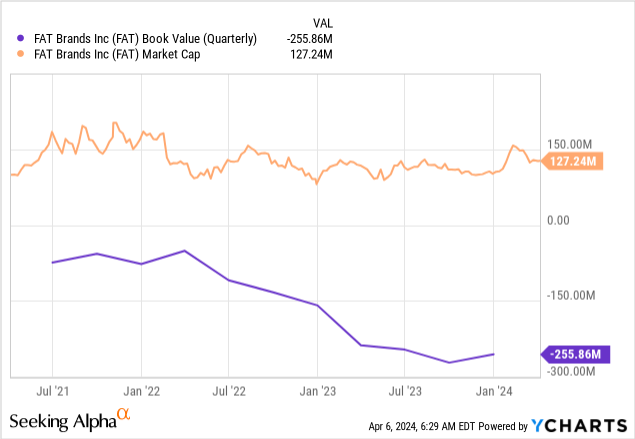

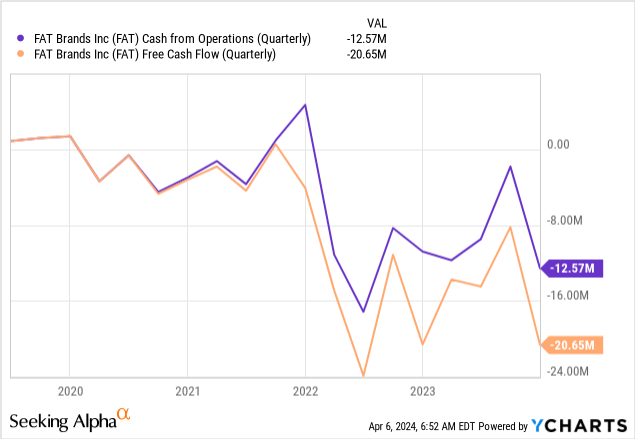

FAT’s whole stockholders’ deficit stood at $255.86 million on the finish of the fourth quarter, a deterioration from a deficit of $159.18 million a 12 months in the past. This deficit is being pushed by continued losses as inflation, increased wage prices, and better curiosity expense on debt get aggregated. FAT spent a fabric $33.3 million in the course of the quarter on paying curiosity on its debt with adjusted EBITDA at $27 million in the course of the fourth quarter, up from $19.6 million a 12 months in the past. Internet revenue was damaging at $26.2 million in the course of the fourth quarter. This determine was an enchancment from a lack of $70.8 million within the year-ago interval. IT means the corporate’s $2.34 million per quarter dividend has no protection, rendering IT completely precarious and its continued payout an anomaly in opposition to its money burn and the sustained progress of its long-term debt.

Money from operations was damaging at $12.57 million in the course of the fourth quarter, up from a burn of $10.8 million a 12 months in the past with FAT’s whole money burn throughout 2023 at $35.6 million. This burn profile has not improved in opposition to the ramp-up in working items for the reason that pandemic. The Fed’s battle with inflation has made FAT’s debt dearer at an important stage of its progress. Whereas it will finally be parred again this 12 months, probably on the June FOMC assembly, FAT’s underlying profitability is about to stay damaging for some time. The corporate’s present liquidity steadiness offers sufficient runway for greater than a 12 months of operations however the continued use of debt to broaden this runway presents a considerable danger for FAT.

The Twin Peaks IPO Liquidity Occasion

FAT is seeking to offload its fast-growing model Twin Peaks by means of an IPO anticipated within the second half of 2024, with administration stating throughout their fourth-quarter earnings name that they hope IT is a 2024 third-quarter occasion. There have been 14 new Twin Peaks lodges opened in 2023 to convey its whole on the fourth quarter finish to 109 lodges. FAT solely acquired the model in 2021 and has since expanded items by 33%. The corporate’s progress pipeline contains an extra enlargement of 113 lodges. Twin Peaks is FAT’s strongest model with an AUV at roughly $6 million. The momentum behind the model led FAT to acquire Smokey Bones in October final 12 months to transform roughly 61 areas into Twin Peaks lodges. The uncertainty would be the IPO worth for Twin Peaks with the model essentially included inside the $126 million market cap zeitgeist for FAT.

There may be roughly $272 million of Twin Peaks debt held on FAT’s steadiness sheet that could possibly be shed within the occasion of the unit IPO, however this quantities to roughly 25% of its whole debt burden. The post-IPO entity would wish to boost lots of of thousands and thousands in further fairness on high of the debt for the deal to make a fabric distinction to the trajectory of FAT’s at present torrid funding profile. Therefore, each the widespread shares and the preferreds stay a promote with continued quarters of money burn set to see FAT’s liquidity dip additional and debt balloon.