Utilizing an Olympics reference, Chevron Company NYSE: CVX failed to stay the touchdown when IT reported second-quarter earnings earlier than the market opened on August 2. The corporate delivered a blended report, with income coming in barely increased than anticipated however earnings coming in lighter on account of decrease refining margins and pure fuel costs.

(As of 08/1/2024 ET)

- 52-Week Vary

- $139.62

▼

$171.70

- Dividend Yield

- 4.27%

- P/E Ratio

- 14.04

- Worth Goal

- $185.59

As is incessantly the case with power shares, there’s extra nuance to the headline quantity whenever you have a look at the main points. For instance, earnings in the US manufacturing phase had been up 31% year-over-year to $2.16 billion on account of increased gross sales volumes and oil costs. However worldwide manufacturing was down by roughly 30% YoY, resulting in the earnings miss.

The outcomes again up the corporate’s prior announcement that IT generated home manufacturing development of 35% by its belongings within the Permian and Denver-Julesburg (DJ) basins. Moreover, the corporate estimates manufacturing to extend by 10% within the Permian in FY25.

Nonetheless, macroeconomic Information can also be seemingly at play right here. The July Jobs quantity got here in a lot weaker than anticipated, which was maybe foreshadowed by earnings weak point from stalwarts like McDonald’s Corp. NYSE: MCD. That’s more likely to hold stress on crude oil costs and hold a lid on CVX inventory.

The Hess Merger is Nonetheless Probably however on Maintain

For a lot of 2024, Chevron continues to be on monitor to shut its merger with Hess Co. NYSE: HES. Shareholders have permitted the merger of each firms. Nonetheless, IT’s being held up on account of a dispute with Exxon Mobil Co. NYSE: XOM over the standing of the Stabroek deepwater discipline in Guyana.

Earlier this 12 months, Chevron chief govt officer Mike Wirth introduced that the 2 firms agreed to arbitration. Nonetheless, these proceedings gained’t even start till 2025, which suggests IT might be late into 2025 earlier than the merger might be finalized.

Chevron’s Transfer: Goodbye California, Hey Texas

In different information, Chevron introduced IT was transferring its company headquarters to Houston, Texas from California. The corporate says all company features will transfer within the subsequent 5 years. Nonetheless, Wirth might be relocating to Houston by the top of the 12 months.

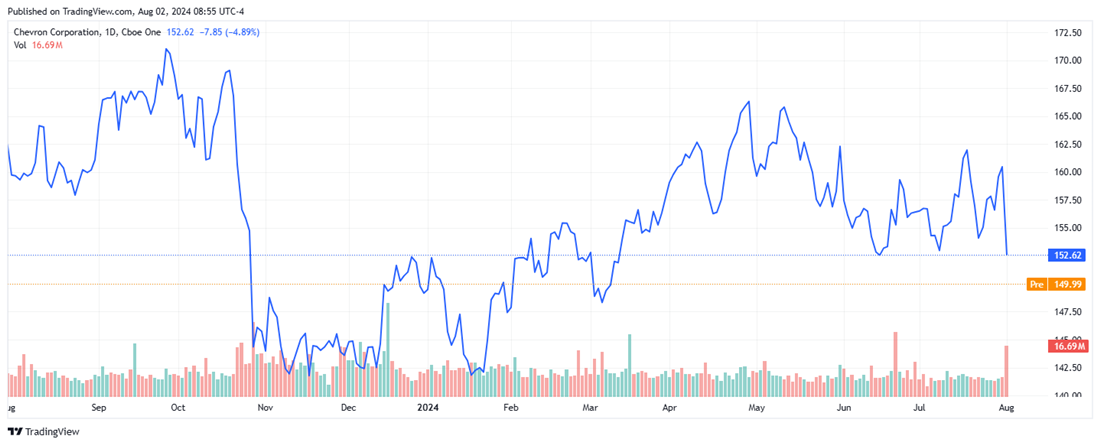

CVX Inventory is Down, However the Funding Case Stays Intact

The earnings miss was foreshadowed as CVX inventory dropped 5% the day earlier than the earnings report. And with a 2.3% achieve for the 12 months, the inventory trails the market badly. The August 1 sell-off is pushing the inventory all the way down to a key help stage of round $150. If IT breaks that stage, a retesting of the corporate’s 52-week lows could possibly be in play.

You’ll be able to count on extra volatility in CVX inventory, because the short-term outlook for oil is carefully tied to shifts in regulatory and financial insurance policies. Chevron’s future drilling operations might broaden relying on evolving trade rules and financial components.

The underside line is that merchants might discover higher alternatives within the oil sector. However when you’re a long-term investor, Chevron continues to supply strong worth. The corporate continues to generate vital free money movement, which IT delivers to shareholders. The corporate is a dividend aristocrat that has elevated its dividend for 37 consecutive years. IT’s additionally within the midst of a $75 billion share buyback program.

Earlier than you contemplate Chevron, you may need to hear this.

MarketBeat retains monitor of Wall Road’s top-rated and greatest performing analysis analysts and the shares they advocate to their shoppers each day. MarketBeat has recognized the 5 shares that high analysts are quietly whispering to their shoppers to purchase now earlier than the broader market catches on… and Chevron wasn’t on the record.

Whereas Chevron presently has a “Reasonable Purchase” score amongst analysts, top-rated analysts consider these 5 shares are higher buys.

View The 5 Shares Right here

Click on the hyperlink under and we’ll ship you MarketBeat’s information to investing in electrical car applied sciences (EV) and which EV shares present probably the most promise.

👇Observe extra 👇

👉 bdphone.com

👉 ultraactivation.com

👉 trainingreferral.com

👉 shaplafood.com

👉 bangladeshi.help

👉 www.forexdhaka.com

👉 uncommunication.com

👉 ultra-sim.com

👉 forexdhaka.com

👉 ultrafxfund.com

👉 ultractivation.com

👉 bdphoneonline.com

👉 Subscribe us on Youtube