Anna Webber

Traders shopping for Block, Inc. (NYSE:SQ) at present ranges are taking two monumental dangers – one associated to the expansion shares extra broadly and one associated to the enterprise particularly.

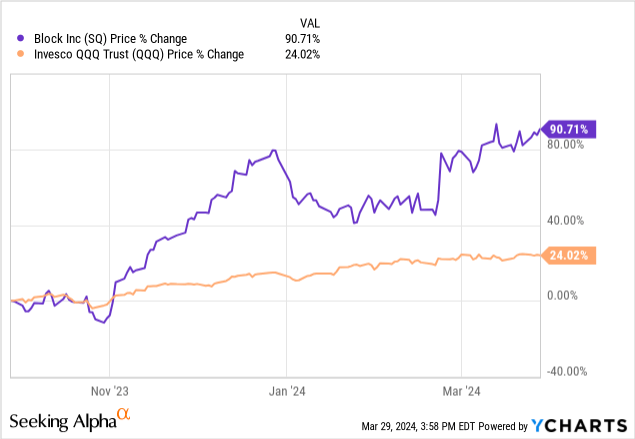

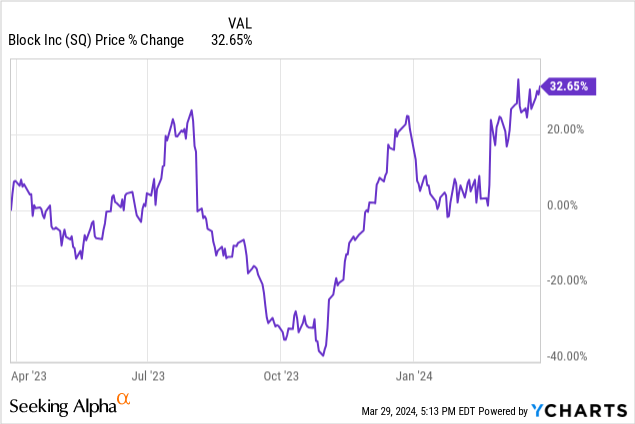

These, nevertheless, are arduous to conceptualize because the inventory skyrocketed by greater than 90% over the previous 6-month alone, when the Invesco QQQ Belief ETF (QQQ) appreciated by solely 24% throughout the identical interval.

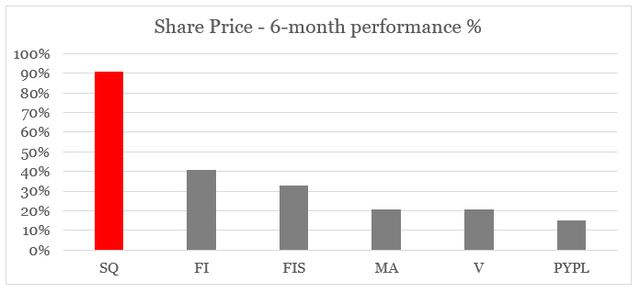

This efficiency makes IT almost unattainable for buyers chasing momentum to correctly account for dangers. IT additionally creates the phantasm that SQ has probably the greatest enterprise fashions within the sector since IT has considerably outperformed all different friends within the digital funds house.

ready by the creator, utilizing information from Searching for Alpha

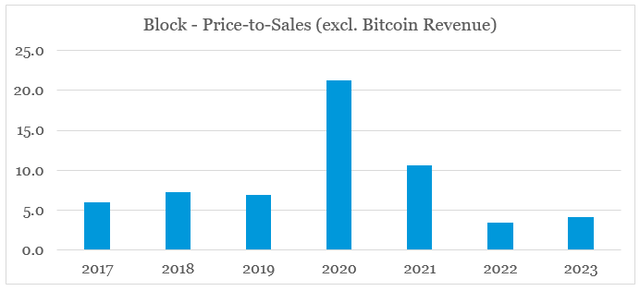

On high of all that, on the floor issues are additionally wanting good for SQ. When adjusting complete income for bitcoin operations (due to the income from bitcoin being reported on a gross foundation), we may simply be led to the conclusion that SQ is buying and selling at a reduction as its value/gross sales a number of is now at one in every of its lowest ranges lately.

ready by the creator, utilizing information from SEC Filings and Searching for Alpha

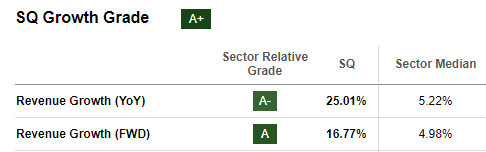

Anticipated income progress stays excessive, though IT‘s considerably decrease than the final yr reported one and can also be closely influenced by bitcoin operations.

Searching for Alpha

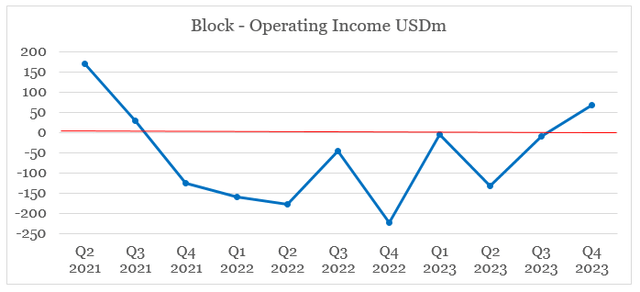

Lastly, the corporate reported a tiny working revenue over the past quarter which supplies buyers hope that Block may quickly turn out to be a extremely worthwhile progress inventory.

ready by the creator, utilizing information from Searching for Alpha

Other than the plain issues with all that, there are two main points with the bullish thesis. At first, you shouldn’t decide the standard of the enterprise and potential future returns based mostly on latest share value efficiency. Even worse, within the case of SQ the inventory has been closely influenced by outdoors forces, that are bringing valuations of many progress shares to unsustainable ranges. Secondly, SQ enterprise mannequin has not modified a lot over the previous yr and IT appears that the slight enchancment in profitability comes with vital risk-taking by Sq.’s administration.

Share Worth Pushed By Momentum

Once we zoom again a yr, Sq.’s inventory value return will not be as spectacular as IT was in the course of the previous 6 months. As IT occurs October of final yr marked a backside in SQ share value and this wasn’t a fluke.

Furthermore, as we see on the graph under, SQ inventory has been extraordinarily unstable which needs to be a significant pink flag for buyers that issues should not as clean as IT may appear.

As a matter of truth, SQ share value deeply in adverse territory by early November of final yr. The inventory then shortly reversed its course and has been persistently going up since then.

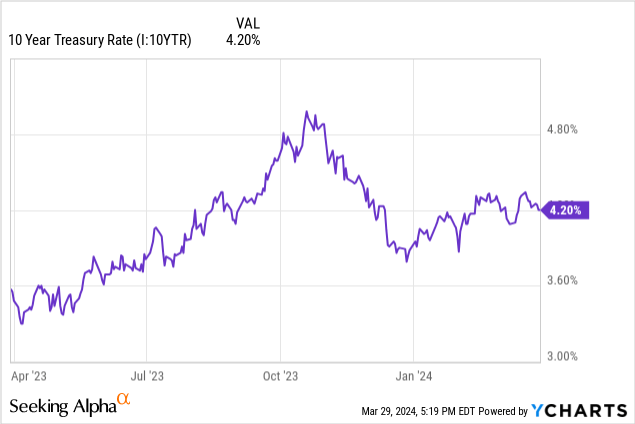

Sadly, share value return since 1st of November has little to do with precise enterprise efficiency. In truth, IT was the U.S. Treasury Quarterly Refunding Announcement from early November that had a profound affect on all progress shares by impacting the time period premium and long-dated bond yields.

I not too long ago confirmed how that is impacting progress shares specifically and why IT is a significant threat for the present momentum. In that regard, SQ has been closely influenced by these developments because the inventory has been rising at double digit charges for fairly a while and isn’t but worthwhile. This considerably will increase its length and leads to very excessive variance of returns based mostly on expectations about future monetary situations.

Fading Development And Threat Taking

When IT involves Block’s enterprise itself, issues haven’t modified materially over the previous yr and as progress in sure areas slows down, the administration has a really sturdy incentive to tackle extra threat with the intention to meet its progress targets.

As a place to begin, Sq. is now confronted with vital slowdown in income progress as IT‘s anticipated to additional slowdown in FY 2024.

(…) we anticipate Money App to develop sooner than Sq. however for progress to reasonable from 2023 as we lap pricing modifications and different initiatives that improved our value construction.

Supply: Block This autumn 2023 Earnings Transcript

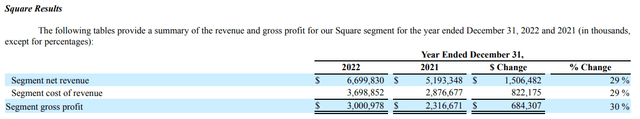

The explanation why I say it’s because the phase grew at almost 30% in 2022.

Block 10-Okay SEC Submitting

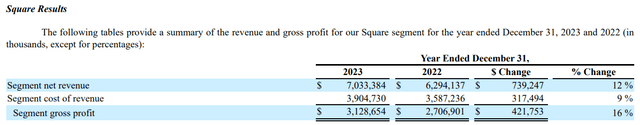

Than in 2023, the whole Sq. phase skilled a notable slowdown to solely 12% on an annual foundation (see under). If we add the greater than 3% inflation in the course of the interval, we’ve actual income progress of under 10%.

Block 10-Okay SEC Submitting

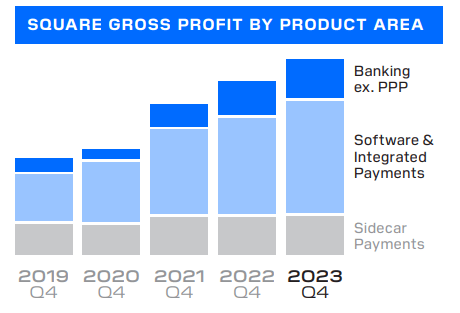

To offset this slowdown, Block’ administration is now making a stronger push to banking and loans, which is at present the important thing progress driver for Sq.’s gross revenue.

Software program and built-in funds gross revenue grew 17% yr over yr within the fourth quarter of 2023, whereas gross revenue from our banking merchandise, which primarily embody Sq. Loans, On the spot Switch, and Sq. Debit Card, grew 28% yr over yr.

Supply: Block Shareholder Letter 2023

We may see this pattern on the graph under, the place Banking seems to be on observe to turn out to be the principle driver of Sq.’s gross revenue progress. As such, IT is not any shock that Block’s administration is more likely to prioritize its efforts on this space.

Block’s Shareholder Letter

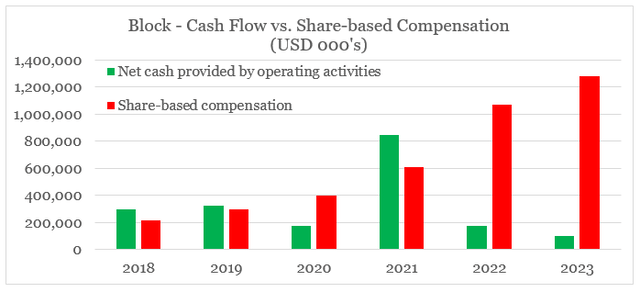

In my view this creates vital threat for shareholders as the big quantity of stock-based compensation creates incentives for pursuing riskier progress alternatives with the intention to meet targets. To not point out that stock-based compensation expense skyrocketed in 2023 by greater than 19% and now dwarfs Block’s tiny quantity of free money circulate from operations.

ready by the creator, utilizing information from SEC Filings

In 2023, about $500m of the money outflow from operations was resulting from extra originations/purchases of loans than repayments/forgiveness which was a lot larger than the outflow of $74m reported in 2022. IT seems that Block is expending considerably by means of providing extra loans as total progress of Sq. slows down. In fact, this creates threat of irresponsible borrowing when contemplating that Sq. loans are principally unsecured.

The enterprise loans supplied by Sq. Loans are usually unsecured obligations of our sellers, and they aren’t assured or insured in any method.

Supply: Block 10-Okay SEC Submitting

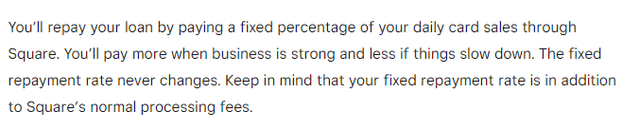

What’s extra is that the way in which these loans are supplied makes underperforming loans much less seen as struggling debtors merely repay decrease quantities, however that doesn’t imply that their situation would enhance over time.

Sq. Assist Web site

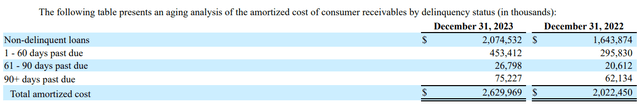

Examine this to Block’s purchase now pay later phase, the place delinquency and underperforming loans are reported.

Loan portfolio” contenteditable=”false” loading=”lazy”/>

Loan portfolio” contenteditable=”false” loading=”lazy”/>Block’s SEC Submitting

As well as, the mixture of those two companies and their bigger share of Block’s gross revenue {dollars} makes the corporate closely uncovered to the wellbeing of the U.S. shopper, which has been in an excellent situation lately on the again of fiscal and financial stimulus. Ought to these situations change, the downward threat for Block can be monumental.

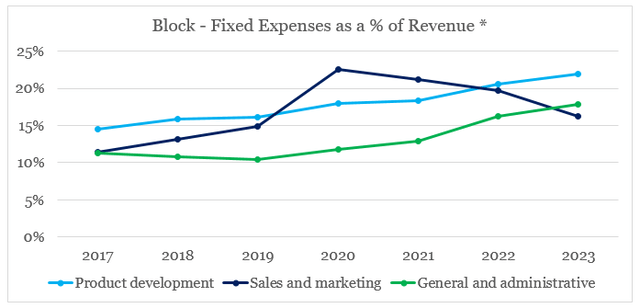

Lastly, the corporate seems to be struggling to cut back the share of its mounted prices to complete gross sales (excluding bitcoin income) because the drop in gross sales and advertising was offset by will increase in product improvement and basic & administrative bills.

ready by the creator, utilizing information from SEC Filings

This reaffirms my preliminary view on the corporate that top and sustainable GAAP profitability can be very arduous to attain.

Conclusion

Traders chasing momentum are actually uncovered to restricted upside and vital draw back threat as 2024 progresses. Block share value is true within the epicentre of this pattern and as such efficiency over the previous 6-month interval will not be indicative of future anticipated returns. The enterprise continues to be struggling to attain profitability and the probabilities of extra risk-taking actions by means of lending is growing. With all that in thoughts, I retain a ‘promote’ score on SQ.