A current Peterson-KFF brief discovered that round 20 million adults have unpaid medical payments, with 14 million owing a minimum of $1,000. Data from the Survey of Earnings and Program Participation places the whole determine at greater than $220 billion. Healthcare suppliers should discover methods to streamline affected person monetary help screening, to assist sufferers and stop unpaid payments piling up from uncompensated care. Many sufferers who can be eligible for monetary help miss out on much-needed reductions on account of outdated screening processes, leaving their unpaid payments to linger in accounts receivable.

Automated presumptive charity screening provides a cheap resolution for healthcare suppliers to modernize the method and scale back avoidable write-offs. Affected person monetary help software program may assist suppliers in fostering compassionate affected person experiences, by figuring out people in want of assist and effectively guiding them in the direction of applicable monetary help pathways.

The hidden penalties of medical debt

Rising prices, surprising medical emergencies and lack of insurance coverage are the primary culprits within the rising downside of medical debt. Although Health-insurance-exchanges-2024-open-enrollment-report-final.pdf” goal=”_blank” rel=”noopener”>uninsured charges have dropped, hundreds of thousands of insured Individuals stay with out enough protection: excessive deductibles and co-payments depart many people “underinsured” with out-of-pocket prices they can’t afford. Suppliers find yourself shouldering the prices, resulting in income loss, operational pressure, and impaired capability to ship high-quality care.

In some circumstances, the burden of a person’s medical debt could also be initially hid from the Health system, papered over with bank card payments and loans. However IT doesn’t stay hidden for lengthy: medical debt turns into merely “debt,” as households reduce on meals and clothes, fall behind on different family payments, and even declare chapter. The repercussions can escalate for sufferers and suppliers as sufferers decide out of additional care, which finally causes their medical wants – and prices – to spiral. Making a extra compassionate monetary expertise for sufferers will assist keep away from these ripple results, with advantages for suppliers, too.

Who’s eligible for affected person monetary help packages?

Sufferers who can’t afford to pay could also be eligible for assist by way of a affected person monetary help program. These packages, supplied by suppliers, charities and authorities companies, alleviate the monetary pressures on sufferers by masking some or the entire price of care within the type of partial or full reductions. Suppliers can provide sufferers Information and assist early of their healthcare journey to assist them entry such packages. The problem is determining who’s eligible.

Eligibility standards for monetary help is commonly complicated, masking the person’s earnings, family earnings and dimension, financial savings and medical want. Gathering and analyzing this information utilizing handbook processes could be time-consuming and infrequently result in gaps and inaccuracies. These insufficient screening processes lead to missed alternatives to attach sufferers with the monetary help they want, and threat falling foul of charity care laws and insurance policies.

On-demand webinar: Hear how Eskenazi Health boosted Medicaid charity approvals by 111% with monetary assist automation.

Easy methods to use information to establish sufferers eligible for monetary help

As a substitute of asking the affected person to fill out a stack of varieties and manually checking information in opposition to the Federal Poverty Degree to find out eligibility for charity care, suppliers can get the solutions they want utilizing information analytics and automation.

Affected person Monetary Clearance automates eligibility checks previous to service to see if sufferers qualify for monetary help packages. IT makes use of Experian information and analytics to foretell the affected person’s means to pay and calculate the best-fit fee plan based mostly on particular person wants and circumstances. IT additionally generates scripts for employees to make use of when working the device and serving to sufferers discover help, which makes for a extra compassionate expertise.

Alex Liao, Product Supervisor for Affected person Monetary Clearance at Experian Health, says, “Many sufferers are unaware that they’re even eligible for monetary help and need assistance to navigate the method. Discussing private funds may also be uncomfortable, so IT’s not unusual for sufferers to keep away from sharing Information that might really result in them getting assist. Automating presumptive charity screening is extra environment friendly and dependable. IT’s additionally much more compassionate than the previous means of amassing varieties and paperwork. Affected person Monetary Clearance pulls collectively credit score Information and demographic information to find out whether or not the affected person qualifies with out lengthy, drawn-out discussions. Sufferers get the assistance they want and suppliers can scale back dangerous debt directly.”

Case research: Uncover How UCHealth wrote off $26 million in charity care with Affected person Monetary Clearance.

Utilizing affected person monetary help Technology to create compassionate affected person experiences

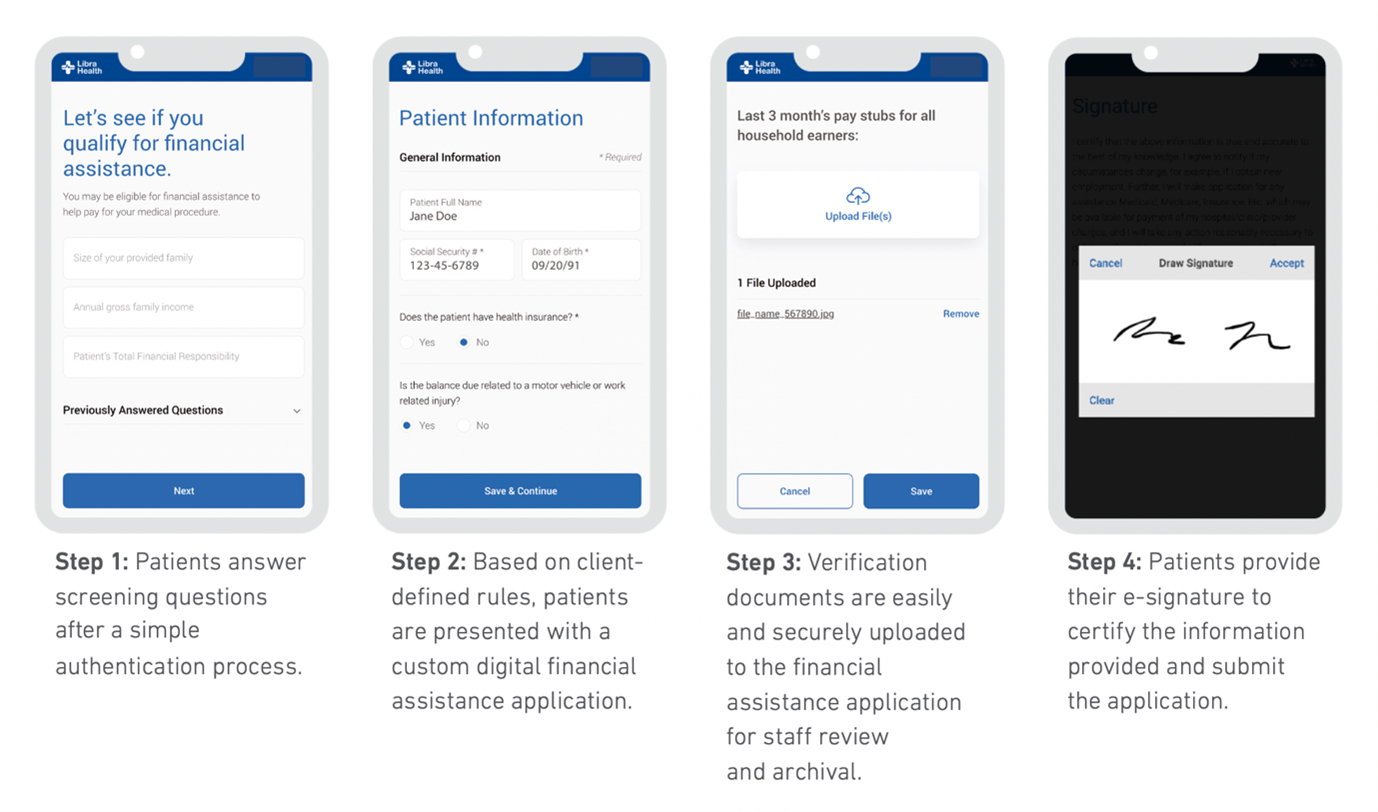

As Liao notes, many sufferers really feel awkward or hesitant when discussing their monetary scenario with a stranger. Moreover, sufferers are more and more on the lookout for digital channels to deal with their administrative duties. Experian Health’s Self-Service Affected person Monetary Clearance possibility provides sufferers a easy and extra non-public technique to full eligibility checks, each time and wherever IT fits them. Utilizing a cell and web-based platform, sufferers can fill out screening varieties and add supporting paperwork, then get real-time standing updates with out having to name up their suppliers. Information is saved securely so workers can test utility standing as wanted.

How Self-Service Affected person Monetary Clearance works

Self-Service Affected person Monetary Clearance places sufferers in management, so extra people full their functions and discover out in the event that they’re eligible for monetary help. This frees up workers to concentrate on different revenue-generating duties that require their consideration. With a cheap, compassionate and handy possibility on the desk, is IT time to say goodbye to paper-based presumptive charity checks?

Discover out extra about how Affected person Monetary Clearance helps suppliers scale back dangerous debt and enhance the affected person expertise by shortly and accurately checking eligibility for charity care.