This Week

This was a kind of weeks we’ve seen from time to time within the final yr (and particularly since late October) the place markets fear about synthetic intelligence (AI). There have been two flavors of concern:

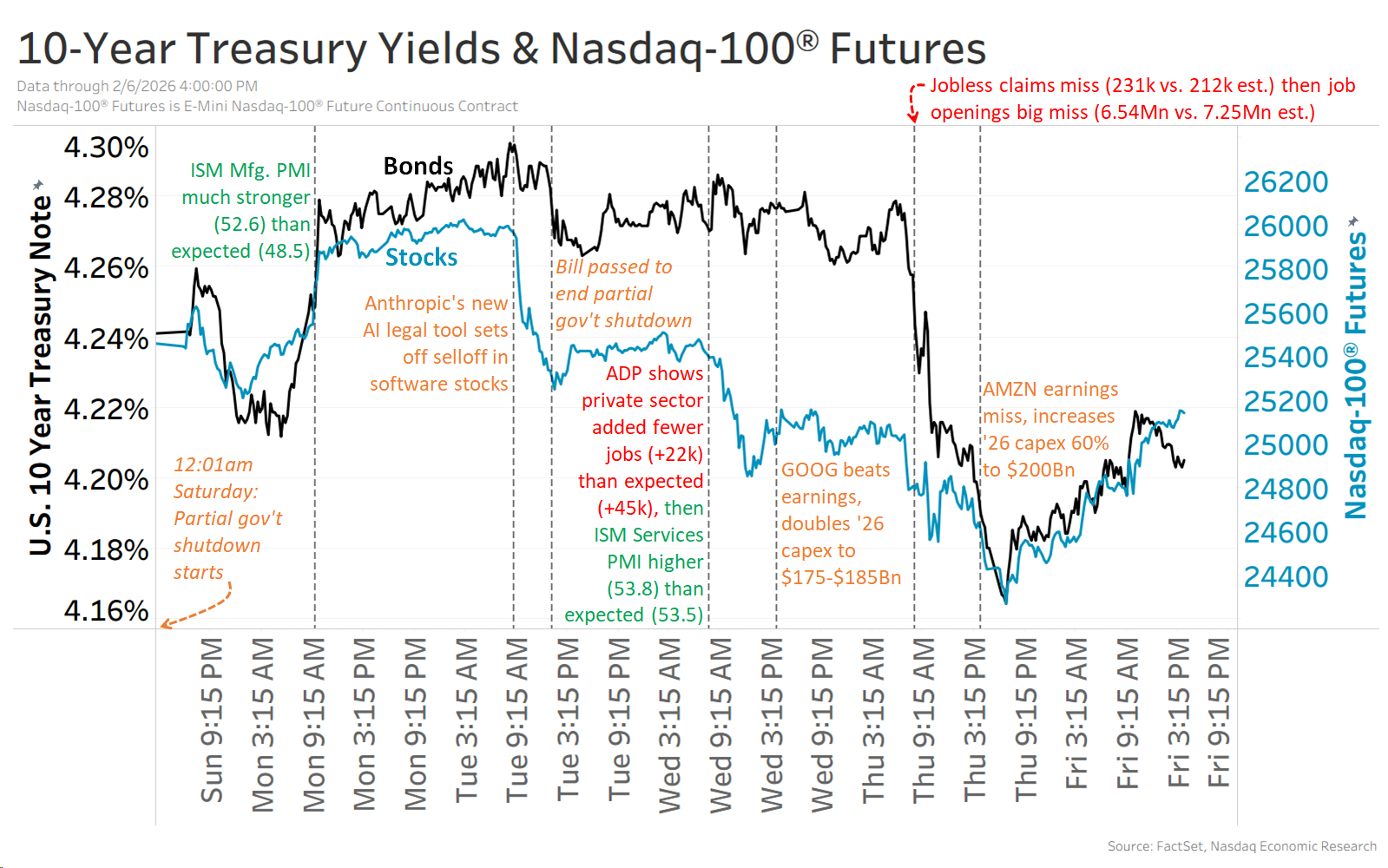

- AI as disruptor: Anthropic’s new Finance/investing/software-slump-drags-down-private-fund-managers-6f840d0c?mod=article_inline” data-outlook-id=”55ab5b3b-bcdc-48f3-b609-106abe6bacb1″ data-mce-href=”https://www.wsj.com/Finance/investing/software-slump-drags-down-private-fund-managers-6f840d0c?mod=article_inline”>AI authorized software drove a selloff (particularly) in software program (together with Finance/investing/private-markets-ai-panic-when-recurring-revenue-isnt-37a8b46d?mod=panda_wsj_custom_topic_alert” data-outlook-id=”cf23e4dd-ae5e-45c3-b2c0-30579230e3ea” data-mce-href=”https://www.wsj.com/Finance/investing/private-markets-ai-panic-when-recurring-revenue-isnt-37a8b46d?mod=panda_wsj_custom_topic_alert”>non-public markets) over fears AI will disrupt their companies.

- AI is EXPENSIVE: GOOG introduced plans to double its capex in 2026 to $175-$185 billion, whereas AMZN plans to spice up capex in 2026 practically 60% to $200 billion, renewing worries in regards to the potential profitability of AI.

Except for AI, there have been additionally three damaging(ish) labor market reviews (all with caveats):

- ADP confirmed the non-public sector added fewer Jobs (+22,000) than anticipated in January (+45,000), however revised month-to-month features have Jobs-in-january-adp-says” data-outlook-id=”e37c20e4-4b1b-49c4-8cda-610974421ef6″ data-mce-href=”https://www.bloomberg.com/information/articles/2026-02-04/us-companies-added-22-000-Jobs-in-january-adp-says”>improved since final spring and stabilized at low ranges.

- Preliminary claims rose (231,000) far more than anticipated (212,000), however this can be partly as a consequence of winter storm Fern and unusually chilly climate.

- JOLTS job openings got here in 700,000 decrease than anticipated, however this doesn’t match Jobs-day-data-is-on-hold-and-the-labor-market-may-be-too/” data-outlook-id=”0cd1193c-2d16-48f5-8535-5ef88724d430″ data-mce-href=”https://www.hiringlab.org/2026/02/03/Jobs-day-data-is-on-hold-and-the-labor-market-may-be-too/”>non-public information like Certainly, and the hiring price rose, whereas the layoff price was regular at very low ranges.

So, after a bounce right now, software program shares are Finance.yahoo.com/quote/IGV/” data-outlook-id=”a3c2b748-057b-450f-9b49-d3897ef25fc8″ data-mce-href=”https://Finance.yahoo.com/quote/IGV/”>down 9% for the week, the Nasdaq-100® is down 2% (blue line), and 10-year Treasury yields are down ~5bp to 4.2% (black line).

Subsequent Week

Listed here are 5 occasions I’m watching subsequent week:

- January nonfarm Jobs report on Wednesday

- January CPI report on Friday

- December retail gross sales on Tuesday

- This fall employment price index on Tuesday

- January NFIB small enterprise optimism on Tuesday

👇Comply with extra 👇

👉 bdphone.com

👉 ultractivation.com

👉 trainingreferral.com

👉 shaplafood.com

👉 bangladeshi.help

👉 www.forexdhaka.com

👉 uncommunication.com

👉 ultra-sim.com

👉 forexdhaka.com

👉 ultrafxfund.com

👉 bdphoneonline.com

👉 dailyadvice.us