cemagraphics Finance and Economic system Show” data-id=”1358927461″ data-type=”getty-image” width=”1536px” peak=”1024px” srcset=”https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1358927461/image_1358927461.jpg?io=getty-c-w1536 1536w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1358927461/image_1358927461.jpg?io=getty-c-w1280 1280w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1358927461/image_1358927461.jpg?io=getty-c-w1080 1080w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1358927461/image_1358927461.jpg?io=getty-c-w750 750w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1358927461/image_1358927461.jpg?io=getty-c-w640 640w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1358927461/image_1358927461.jpg?io=getty-c-w480 480w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1358927461/image_1358927461.jpg?io=getty-c-w320 320w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1358927461/image_1358927461.jpg?io=getty-c-w240 240w” sizes=”(max-width: 768px) calc(100vw – 36px), (max-width: 1024px) calc(100vw – 132px), (max-width: 1200px) calc(66.6vw – 72px), 600px” fetchpriority=”excessive”/>

Finance and Economic system Show” data-id=”1358927461″ data-type=”getty-image” width=”1536px” peak=”1024px” srcset=”https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1358927461/image_1358927461.jpg?io=getty-c-w1536 1536w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1358927461/image_1358927461.jpg?io=getty-c-w1280 1280w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1358927461/image_1358927461.jpg?io=getty-c-w1080 1080w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1358927461/image_1358927461.jpg?io=getty-c-w750 750w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1358927461/image_1358927461.jpg?io=getty-c-w640 640w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1358927461/image_1358927461.jpg?io=getty-c-w480 480w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1358927461/image_1358927461.jpg?io=getty-c-w320 320w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1358927461/image_1358927461.jpg?io=getty-c-w240 240w” sizes=”(max-width: 768px) calc(100vw – 36px), (max-width: 1024px) calc(100vw – 132px), (max-width: 1200px) calc(66.6vw – 72px), 600px” fetchpriority=”excessive”/>

The S&P 500 (SPY) has made some erratic strikes in current weeks however the increased timeframes have offered a constant bullish bias and stored us on the correct aspect of the current rally. Final week’s article concluded, “a new excessive above 5341 stays possible and 5400-412 is the possible goal.” Friday’s transfer reached 5375, which is getting shut…however near what?

This week’s article particulars what to search for if and when the goal space is reached, and what’s going to change the bullish bias. Varied strategies shall be utilized to a number of timeframes in a top-down course of which additionally considers the key market drivers. The intention is to supply an actionable information with directional bias, vital ranges, and expectations for future value motion.

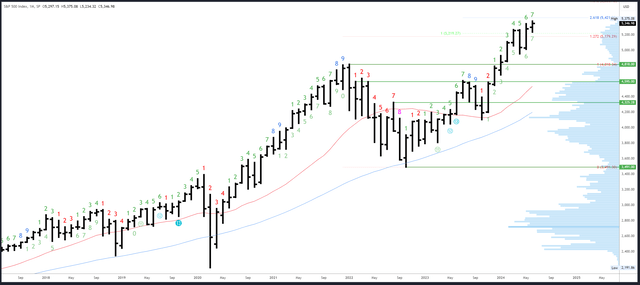

S&P 500 Month-to-month

As identified final week, the optimistic Could bar gave “the primary a part of June a bullish bias.” This has already performed out and we now want to consider how the June bar can both keep bullish or present indicators of weak point. At this early stage within the month, the Could shut of 5277 is related – June is bullish whereas above, impartial/bearish beneath. Because the month progresses, further ranges and issues could possibly be vital, however there isn’t any level overlaying each permeation with three weeks left within the month.

SPX Month-to-month (Tradingview)

The S&P500 is in blue sky once more, with measured strikes and Fibonacci extensions a information for targets. The subsequent of those is at 5421.

Could’s excessive of 5341 is noteworthy however is simply too near the present motion and shall be extra vital ought to the S&P500 distance itself from this stage after which return to IT. Could’s shut of 5277 is a bull/bear line, whereas April’s low of 4953 is minor assist.

June is bar 7 (of a doable 9) in an upside Demark exhaustion count. These counts can have an impact from bar 8 onwards so a doable response is getting nearer.

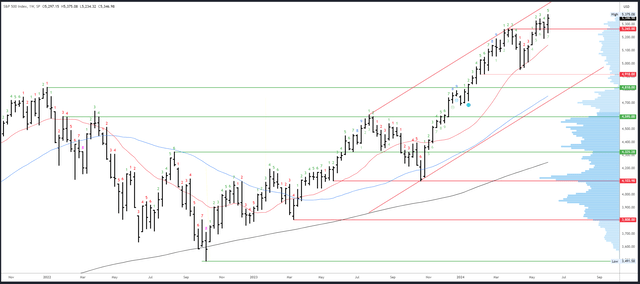

S&P 500 Weekly

The next low, increased excessive and all-time excessive shut negated any bearish tones to the earlier bar. Now that the March excessive of 5265 has been examined a number of occasions from above, IT ought to now act as a flooring for continuation increased.

As all the time, we must always ask ourselves the place the bias adjustments. A detailed beneath 5265 at this stage could be a transparent crimson flag.

SPX Weekly (Tradingview)

This week’s excessive of 5375 is minor resistance. The weekly channel excessive is simply too distant to be related.

5191 is minor assist. The 20-week MA is a key stage and shall be round 5165 subsequent week.

Subsequent week shall be bar 6 (of 9) of an upside Demark exhaustion rely. As famous earlier, these counts can have an impact from bar 8 onwards so a doable response is getting nearer.

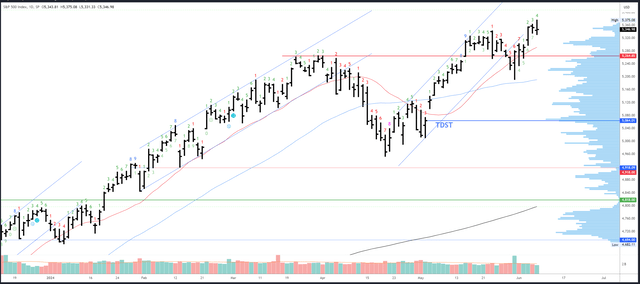

S&P 500 Every day

On the face of IT, the motion was textbook bullish this week with a take a look at decrease on Monday placing within the low of the week and new all-time highs Wednesday onwards. Wednesday’s session triggered an intraday inverse head and shoulders sample which has a goal of 5400.

Friday’s fade from 5375 is a minor dent to the bullish story, however one erratic session is not important by itself. Friday’s low of 5331 and the pre-market low of 5319 are vital for short-term route. A break of this space would goal 5265-81. A maintain targets 5400-412.

SPX Every day (Tradingview)

Friday’s 5375 excessive is the one resistance.

5319-31 is near-term assist. The 20dma shall be at 5298 on Monday and rising round 7 factors a day. 5291-97 is potential assist, however the weekly stage just under at 5265 is extra vital.

An upside Demark exhaustion sign shall be on bar 5 (of 9) on Monday, which suggests IT may have an impact from Thursday onwards.

Drivers/Occasions

Extra gentle information drove the motion within the first a part of the week, with ISM Manufacturing PMI in contraction at 48.7 and JOLTS Job Openings lacking expectations of 8.37M with a studying of 8.06M. Yields and the US greenback fell, whereas shares rose. Friday’s sturdy Jobs Report was anticipated to indicate extra cooling, however a shocking sturdy launch reversed the strikes. Yields and the greenback reversed increased, whereas shares, alternatively, have been in all places.

The erratic strikes in shares stem from the blended drivers. Do they need weak information / extra easing or sturdy information / much less easing? I feel they will rally beneath each situations, however each additionally include doable negatives so markets are undecided on the right way to react. Moreover, the info can shift the scenario from one to the opposite within the area of a day like IT did on Friday.

Subsequent week’s important occasions are on Wednesday with the discharge of CPI and the June FOMC assembly. CPI must be simple sufficient for shares – the decrease the higher. The Fed, in the meantime, possible hold choices open.

PPI and Unemployment Claims are launched on Thursday, with UoM Shopper Sentiment due out on Friday.

Possible Strikes Subsequent Week(s)

The larger image view has labored effectively and continues to level increased. The bias will solely change ought to there be a weekly shut beneath 5265.

Quick-term, Friday’s turbulent session makes the route early within the week unclear. A drop by means of Friday’s lows may goal 5265-81 however this could set the low of the week and create a shopping for alternative for additional highs.

If and when the 5400-412 goal is reached, IT shall be time to re-assess. The rally from the April low is displaying momentum divergence and poor breadth so there are affordable odds a reversal unfolds within the 5400 space, particularly when exhaustion alerts mature within the coming weeks. The intention shall be to acknowledge whether or not any response from this space is simply one other small dip in an ongoing development (a shopping for alternative), or if a a lot bigger decline will unfold. For the time being, the latter will solely be confirmed by a transfer beneath 5265, however clearly IT will not be ultimate to attend for a 150 level decline earlier than taking motion. Fortunately, there must be an opportunity to maneuver inflection ranges increased within the coming weeks as new patterns take form.

👇Observe extra 👇

👉 bdphone.com

👉 ultraactivation.com

👉 trainingreferral.com

👉 shaplafood.com

👉 bangladeshi.help

👉 www.forexdhaka.com

👉 uncommunication.com

👉 ultra-sim.com

👉 forexdhaka.com

👉 ultrafxfund.com

👉 ultractivation.com

👉 bdphoneonline.com