Saudi’s Crown Prince Mohammed bin Salman greets French Presidential Diplomatic Advisor Emmanuel Bonne

Jobs – with international penalties for contractors, economies and markets “/>

Writer: Martyn Cornell, Options Author

When the Public Funding Fund (PIF) sneezes, a really massive variety of corporations catch colds. And plunging oil costs have given Saudi Arabia’s huge sovereign wealth fund a particular case of the sniffles, with critical implications for an enormous swathe of issues.

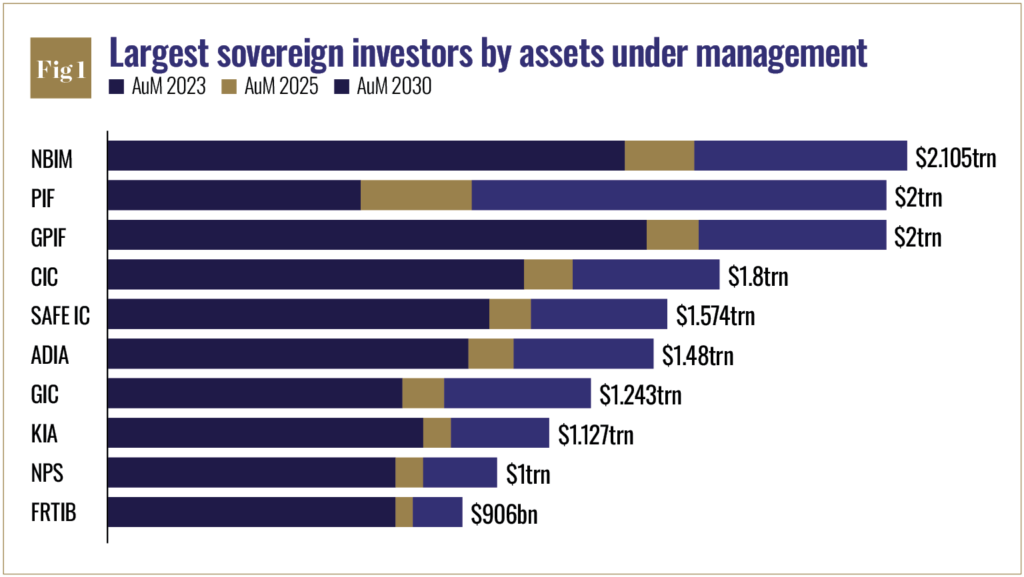

The PIF was price $941bn in 2024, in accordance with its newest annual report, making IT the sixth largest sovereign wealth fund on the planet. Its belongings rose virtually fivefold within the eight years since 2016, a compound annual progress charge of twenty-two p.c. IT has a acknowledged goal of seeing its belongings beneath administration move $1.1trn by the tip of 2025 and hitting $2trn by 2030 (see Fig 1). PIF has 4 international places of work, and greater than 2,500 staff.

Proper now, nonetheless, the PIF is slowing down and chopping again, with critical implications for the greater than 13 million overseas employees in Saudi Arabia and the numerous tons of of corporations that depend on the Saudi economic system to maintain going.

The fund, which was based in 1971, has round 170 subsidiaries, and has been credited with stakes price tons of of tens of millions of {dollars} at a time in family title corporations together with Fb proprietor Meta ($522m), Disney ($500m), BP ($830m), Boeing ($700m), Uber ($2.7bn) and Citigroup ($520m).

The largest single slice of its investments is within the power sector, at 23 p.c, adopted by property, at 17 p.c, IT at 9 p.c and financials and communications providers are at round seven p.c every.

IT invested greater than $100bn within the US alone between 2017 and 2023, producing, in accordance with its personal estimate, 103,000 US Jobs and $33bn in GDP. By 2030, PIF claims, IT and its portfolio corporations could have invested $230bn within the US and supported the creation of greater than 440,000 US Jobs.

Controlling budgets

Within the first half of 2024 the PIF was the world’s highest-spending state-owned investor, in accordance with the consultancy International SWF, and IT was anticipated to boost its annual spending to $70bn in 2025, a yr sooner than beforehand introduced, in accordance with the Worldwide Financial Fund.

One other option to increase cash within the face of falling oil revenues is to faucet the bond markets

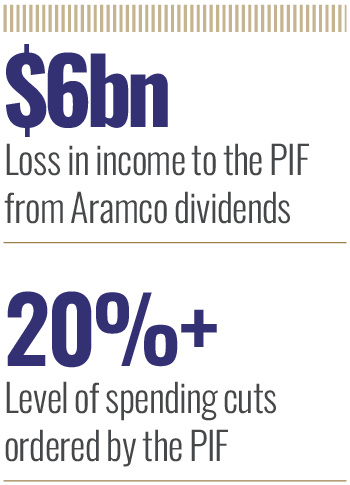

However this spring the PIF, which is chaired by Crown Prince Mohammed bin Salman, the de facto ruler of Saudi Arabia since 2015, ordered spending cuts of at the very least 20 p.c throughout these components of its portfolio the place IT can train management over budgets, which covers investments in round 100 completely different corporations starting from the Saudi start-up airline Riyadh Air to Newcastle United Soccer Membership. The end result has been layoffs, hiring freezes and challenge delays.

Some budgets have been minimize by as a lot as 60 p.c, in accordance with the web-based enterprise information service Arabian Gulf Enterprise Perception (AGBI). The 5 so-called ‘giga-projects,’ huge actual property schemes corresponding to Neom, a deliberate $500bn new metropolis meant, ultimately, to cowl greater than 10,000 sq. miles within the north-east of Saudi Arabia, and Pink Sea International, an enormous effort supposed to massively increase tourism to the nation by way of plans corresponding to a 1,500 sq. mile new vacationer vacation spot together with 25 new inns, have been notably badly hit by the cuts.

A $5bn contract at Neom was cancelled the day earlier than the signing ceremony was because of happen. A central a part of the Neom challenge is a linear metropolis referred to as ‘the Line,’ initially billed as 170km lengthy. After a bunch of delays, and amid claims reported within the Wall Avenue Journal of giant salaries for imported administration and a poisonous work tradition, the preliminary stage of the challenge has been scaled again to simply 5 kilometres to be accomplished by 2030.

There have additionally been studies of money circulate issues resulting in cost delays for contractors, notably within the development sector, with one main worldwide contractor reportedly claiming IT was owed $800m by Saudi shoppers. The corporate blamed extended cost delays as a big consider its resolution to reduce operations within the kingdom. One large European development firm has allegedly withdrawn from the Saudi market altogether, blaming cost dangers and monetary uncertainties.

Oil costs decimated

The massive drawback, on the monetary aspect, is the plunging worth of oil. The Worldwide Financial Fund has declared that oil must be $91 a barrel to steadiness Saudi Arabia’s finances. However oil has not been above $90 a barrel since August 2022. At Easter this yr the value of Brent crude was down beneath $67, and the US crude benchmark, West Texas Intermediate, had fallen to lower than $64, some 30 p.c beneath that Saudi break-even worth. Quickly after, at first of Could, Brent had dropped to $61.63, which is 30 p.c down on its 12-month excessive, and WTI to $58.56, additionally 30 p.c down. The result’s that the nation’s large state-owned oil firm, Saudi Aramco, has already slashed its estimate for its whole dividend payout for 2025 by virtually a 3rd, to $84.5bn, and will not even hit that. The PIF owns 16 p.c of Aramco, and can thus see its personal revenue from Aramco dividends drop by at the very least $6bn.

The PIF desires to, for instance, spend cash on the resorts being constructed alongside the Pink Coastline to ultimately herald 19 million vacationers a yr as a part of Saudi Arabia’s ‘Imaginative and prescient 2030’ challenge to cut back its reliance on oil income. The primary goal is to boost the personal sector’s contribution to the nation’s GDP from 40 p.c to 65 p.c by the beginning of the subsequent decade. However the irony is that Saudi Arabia wants the oil income to fund the developments that should get rid of the necessity for oil income.

Pat Thaker, editorial director for Center East and Africa on the Economist Intelligence Unit, advised FDI Intelligence that she anticipated “a number of large-scale initiatives could also be re-evaluated, postponed and even scrapped because of monetary limitations.”

World Cup dedication

One reply is to attempt to get extra overseas funding into PIF initiatives. Cash is required for a number of large and prestigious initiatives within the coming decade that Saudi Arabia has dedicated itself to, together with worldwide occasions such because the Asian Winter Video games in 2029, Expo 2030 and the soccer World Cup in 2034. The nation seems to be at the moment struggling to draw abroad curiosity: general FDI flows within the third quarter of 2024 have been down by 21 p.c on the identical interval a yr earlier, at $4.27bn, Saudi Arabia’s Normal Statistics Authority mentioned.

Nonetheless, in March, the PIF signed a memorandum of understanding (MoU) with Goldman Sachs to create funds to put money into Saudi Arabia and the broader Gulf area. The identical month IT struck an settlement price $3bn with Italy’s export credit score company, Sace, saying that the deal offered “assist for co-operation between Italian corporations within the personal sector and PIF and its portfolio corporations.” IT has additionally signed MoUs with Japanese monetary establishments together with Mizuho Financial institution, MUFG Financial institution and Sumitomo Mitsui Monetary Group price as much as $51bn to assist assist funding by way of its native capital markets.

One other option to increase cash within the face of falling oil revenues is to faucet the bond markets. In January this yr, the PIF unloaded $4bn of bonds in a sale that was 4 instances oversubscribed, after attracting buyers with credit score spreads 95 and 110 foundation factors above US Treasury bonds. On the finish of April the fund shifted $1.25bn in seven-year sukuk, or shariah-compliant bonds, with the supply greater than six instances over-subscribed. The eagerness with which buyers have snapped up the bond points at the very least eases fears that the information of enforced budgetary cutbacks might hit investor confidence within the giga-projects and the broader Saudi economic system.

Phenomenal job creation

The PIF’s significance as a generator of employment can’t be exaggerated. By 2024, IT is reckoned to have contributed to the creation of multiple million Jobs in three years and supported the institution over the identical interval of virtually 50 corporations in 13 strategic sectors. Nonetheless, the impact of falling oil costs, a report by the consultancy JLL Center East predicts, will likely be that employment progress in Saudi Arabia will plunge after hitting a excessive of practically 10 p.c in 2022, slowing to 3 p.c by 2026 as the dominion reins in spending.

This can have an effect on a bunch of nations within the Center East and South Asia which were sending surplus employees to Saudi Arabia, and having fun with the wages they ship again house. Practically two million expatriates, expert and unskilled, have joined the Saudi workforce in Saudi Arabia over the previous two years. The nation’s development business has greater than doubled in dimension. However the slowdown implies that employees at the moment are in search of Jobs elsewhere within the area, even when IT means taking a pay minimize to relocate or shift to different PIF-backed corporations, in accordance with Shyam Visavadia, the founding father of WorkPanda Recruitment, a specialist in development hiring primarily based in Dubai.

Along with the plunge in oil revenues, Visavadia advised AGBI, “Giga-projects are scaling too rapidly with out long-term planning or clear technique.” Now, future phases are “both postponed, remastered, or not receiving finances approvals,” he mentioned.

One more drawback is that the size and complexity of the assorted giga-projects implies that prices can simply exceed preliminary estimates. IT seems the PIF could now be seeking to prioritise initiatives with extra speedy financial returns, and/or these which are additional alongside in improvement.

👇Observe extra 👇

👉 bdphone.com

👉 ultractivation.com

👉 trainingreferral.com

👉 shaplafood.com

👉 bangladeshi.help

👉 www.forexdhaka.com

👉 uncommunication.com

👉 ultra-sim.com

👉 forexdhaka.com

👉 ultrafxfund.com

👉 bdphoneonline.com

👉 dailyadvice.us