Thanks to your assistant

Nike inventory crashed nearly 20% after the corporate reported strong outcomes for This autumn FY 2024, however provided weaker than anticipated steering: The world’s main sports activities attire and footwear firm mentioned that IT expects gross sales for FY 2025 to be down by about mid single digit. On a long-term foundation, nonetheless, I believe the sell-off creates a pretty alternative for buyers to purchase a top quality franchise at discount costs. In my opinion, Nike is poised to stay a winner within the sports activities trade, resulting from unparalleled model power, world market presence, and a best-in-class athlete endorsement technique. As a perform of valuation anchored on a residual earnings mannequin, I assign a “Purchase” ranking to Nike shares and set my goal worth at $91.

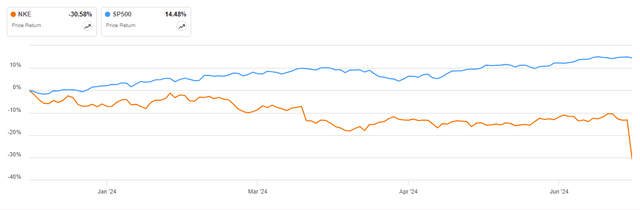

For context: Nike inventory has considerably under-performed the broader U.S. inventory market this 12 months. For the reason that starting of the 12 months, NKE shares are down by roughly 31%, in comparison with a acquire of almost 15% for the S&P 500 (SP500).

Searching for Alpha

Nike’s This autumn FY 2024 Outcomes Stable; However With Disappointing Steerage

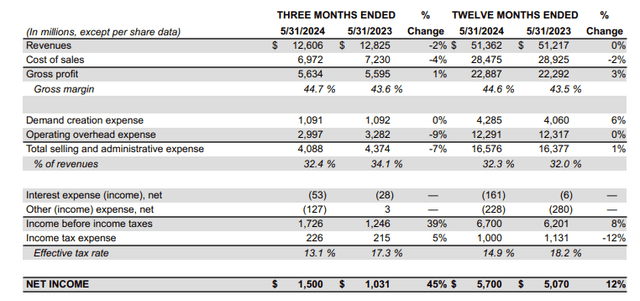

On Thursday, June twenty seventh, after market shut Nike launched its financial results for the most recent quarter, topping Wall Road’s expectations on each income and earnings: Through the interval from March to the tip of Might, the worldwide chief in sports activities attire and footwear reported gross sales totaling roughly $12.6 billion, marking a 2% decline YoY in comparison with $12.8 billion for identical interval one 12 months earlier, however beating analyst consensus by roughly $150 million, in keeping with information collected by Refinitiv. On a channel foundation, NIKE Direct revenues had been down 8% YoY, reported at $5.1 billion. Wholesale revenues got here in at $7.1 billion, up 5% YoY. This represents a unfavorable combine shift as a result of NIKE Direct, which usually instructions larger margins, noticed a lower in income YoY, whereas Wholesale, with usually decrease margins, skilled a rise.

By way of profitability, there was some excellent news for buyers, as gross margin expanded by about 110 foundation factors, to 44.7%, whereas complete promoting and administrative bills fell 7% YoY, to about $4.1 billion. On that be aware, working revenue got here in at $1.7 billion, up 39% YoY in comparison with $1.2 billion for a similar interval one 12 months earlier. Internet revenue was reported at $1.5 billion, up 45% YoY.

Nike This autumn FY 2024

Taking a look at Nike’s This autumn FY 2024 report, IT is obvious that the numbers had been really fairly strong; what scared buyers, nonetheless, was administration commentary surrounding the FY 2025 outlook. Within the convention name with analysts, Nike CFO Matthew Pal mentioned that income within the new fiscal 12 months will possible be down mid-single digit. To justify the weak steering, he highlighted fairly a number of notable headwinds (emphasis mine)

We’re managing a product cycle transition with complexity amplified by shifting channel combine dynamics. A comeback at this scale takes time. With this in thoughts, we have thought of a variety of elements and situations in revising our outlook for fiscal 2025. Most significantly, this contains timelines and pacing to handle market provide of our basic footwear franchises, decrease NIKE Digital development, particularly within the first half of the 12 months resulting from decrease site visitors on fewer launches, plan declines of basic footwear franchises given This autumn developments, in addition to diminished promotional exercise, elevated macro uncertainty, notably in higher China, with uneven client developments persevering with in EMEA and different markets all over the world, and promote into wholesale companions as we scale product innovation and newness throughout {the marketplace} and finalize second half order books.

Constructing on the decrease topline outlook, paired with a guided 10 -30 foundation factors gross margin enlargement, I estimate that Nike’s working revenue for FY 2025 will possible fall someplace between $5.2 and 5.4 billion, which means that Nike’s ahead P/EBT is buying and selling carefully according to the broader S&P 500, at about 22x.

Nike Is Poised To Stay A Winner In Sportswear

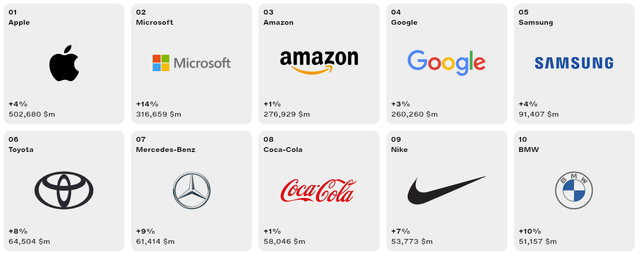

Wanting past brief time period development headwinds, in my opinion, Nike is poised to stay a long-term winner within the sports activities trade because of the firm’s unparalleled model power (ranked 9th for the world’s Most worthy manufacturers), in depth world market presence, and top-tier athlete endorsement technique.

Interbrand

Though the product cycle for Nike is at present a priority, IT mustn’t be long-term. The truth is, Nike is specializing in accelerating its tempo of innovation and scaling new merchandise throughout its portfolio. This contains introducing new efficiency and life-style fashions akin to Pegasus Premium, Vomero 18, and new iterations of Dynamic Air. On that be aware, the upcoming Paris Olympics presents a serious alternative for Nike to spotlight its improvements and improve model distinction by way of storytelling and retail activation. On operational effectivity and value administration, IT is vital to notice that Nike is doing an excellent job unlocking financial savings by way of decreasing achievement prices, consolidating provider and optimizing Technology spending, That is highlighted by the 100 foundation level gross margin enlargement in FY 2024, and guided 10-30 foundation level enlargement anticipated for FY 2025.

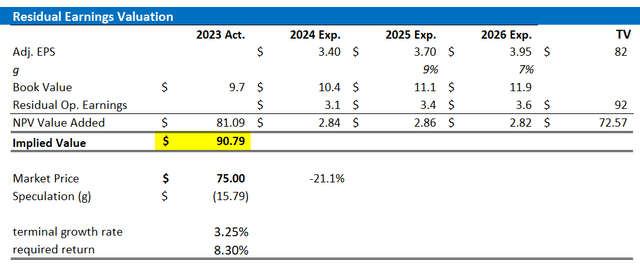

Valuation: Truthful Worth Doubtless At $91 Per Share

To discover a valuation anchor for shares, I’m a terrific fan of utilizing the residual earnings mannequin strategy. This mannequin relies on the precept that an organization’s valuation ought to equal its discounted future earnings after accounting for the capital cost. In accordance with the CFA Institute:

Conceptually, residual revenue is internet revenue much less a cost (deduction) for widespread shareholders’ alternative value in producing internet revenue. IT is the residual or remaining revenue after contemplating the prices of all of an organization’s capital.

For my valuation mannequin of Nike inventory, I make the next assumptions:

EPS Forecast: I exploit the consensus analyst forecast from the Bloomberg Terminal by way of 2026. Past 2026, I think about estimates too speculative to be dependable. Nevertheless, the 2-3 12 months analyst consensus is usually correct.

Capital Cost: I exploit the CAPM mannequin to estimate Nike’s value of fairness, which suggests a charge of 8.3%.

Terminal Progress Price: I apply a terminal development charge of three.25% post-2026, which, I imagine, is cheap (round 50 – 100 foundation factors above nominal GDP development to replicate franchise power).

Based mostly on these assumptions, I calculate a base-case goal worth for Nike of roughly $90.79 per share.

Firm Financials; Bloomberg & Creator’s EPS Estimates; Creator’s Calculation

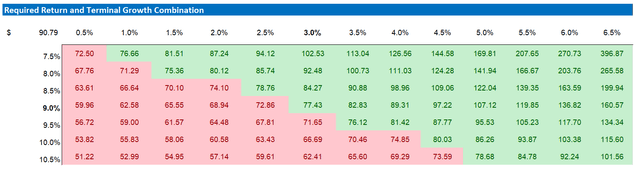

For buyers with completely different assumptions referring to Nike’s value of fairness and terminal development charge, I spotlight enclosed sensitivity desk.

Firm Financials; Bloomberg & Creator’s EPS Estimates; Creator’s Calculation

Investor Takeaway

Nike inventory plummeted almost 20% after the corporate reported sturdy This autumn FY 2024 outcomes however supplied weaker-than-expected steering. The world’s main sports activities attire and footwear firm indicated that IT expects gross sales for FY 2025 to say no by about mid-single digits. Regardless of this short-term setback, I imagine the sell-off presents a pretty shopping for alternative for buyers looking for a high-quality franchise at a reduced worth. In my evaluation, Nike is well-positioned to stay a dominant pressure within the sports activities trade resulting from its unparalleled model power, in depth world market presence, and distinctive athlete endorsement technique. At any time when Mr. Market provides you a prime 10 world model for a 20% low cost, you must in all probability take the deal. This time ought to be no completely different. Based mostly on a valuation anchored on a residual earnings mannequin, I assign a “Purchase” ranking to Nike shares and set my goal worth at $91.

👇Comply with extra 👇

👉 bdphone.com

👉 ultraactivation.com

👉 trainingreferral.com

👉 shaplafood.com

👉 bangladeshi.help

👉 www.forexdhaka.com

👉 uncommunication.com

👉 ultra-sim.com

👉 forexdhaka.com

👉 ultrafxfund.com

👉 ultractivation.com

👉 bdphoneonline.com

👉 Subscribe us on Youtube