We Are

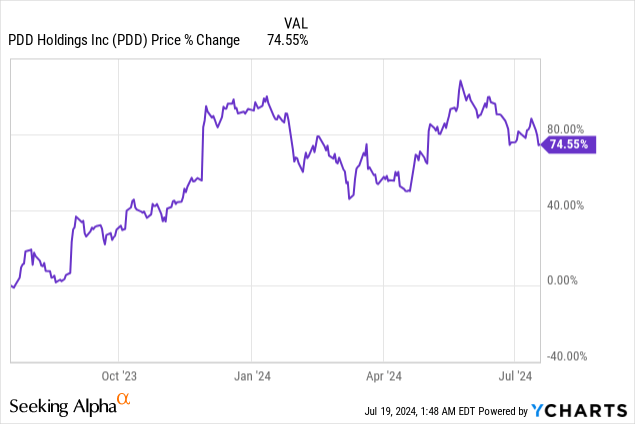

PDD Holdings (NASDAQ:PDD), also called Pinduoduo, is a number one e-Commerce platform in China and one of many prime three Chinese language e-Commerce firms, subsequent to Alibaba (BABA) and JD.com (JD), that dominate the market. PDD Holdings gives quite a lot of e-Commerce and associated companies similar to achievement and logistics and Pinduoduo owns the vastly common, deal-focused e-Commerce platform Temu. PDD Holdings is seeing sturdy tailwinds for its gross income and internet revenue and producing a ton of free money movement. Whereas not as low-cost as both Alibaba or JD.com, PDD Holdings is well-positioned to ship sustainable progress for shareholders and enhance its inventory buybacks sooner or later, making IT a possible capital return play for buyers!

PDD Holdings is a China-based e-Commerce progress play

China has a inhabitants of 1.4B and the quantity of customers shopping for services on-line is rising quickly. PDD Holdings is well-positioned to learn from this progress as the corporate is closely centered on the Chinese language e-Commerce market. PDD Holdings owns Temu.com, a discount- and discovery-focused buying web site that caters primarily to retail consumers, however not solely in China. Temu caters to the buying wants of a global viewers and permits Chinese language producers to straight promote to their clients. Temu was based in 2022 and competes straight with Alibaba’s Aliexpress. Temu gives {discount} offers for kitchen home equipment, garments, sneakers, jewellery and sweetness merchandise in addition to each different class that involves thoughts. With its concentrate on {discount} offers, PDD has gained a loyal following and is likely one of the fastest-growing e-Commerce firms in China.

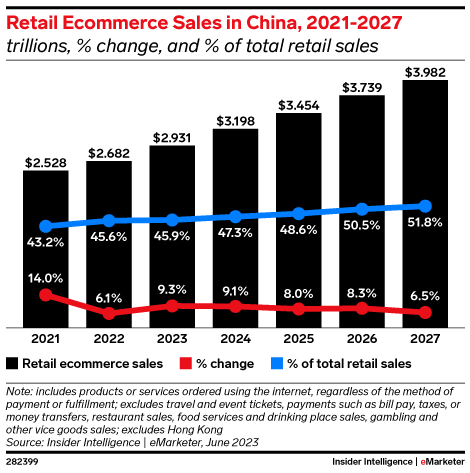

Clearly, with such an enormous inhabitants, China is a strong play for e-Commerce progress buyers. In China, based on eMarketer, the marketplace for retail e-Commerce gross sales is about to develop 8% yearly over the following 4 years which ought to present sustained tailwinds for gross revenue and EPS progress for PDD Holdings.

eMarketer

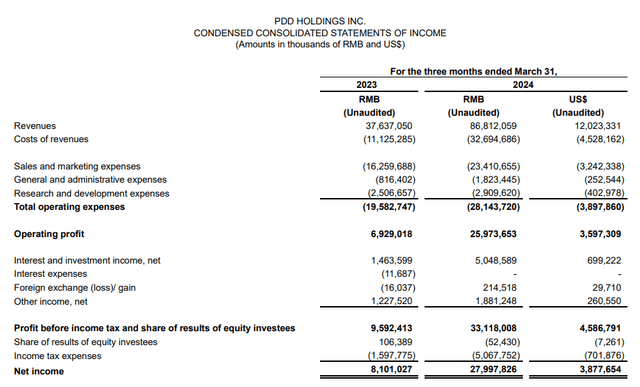

PDD Holdings generated 86.8B Chinese language Yuan ($12.0B) in revenues within the first fiscal quarter, exhibiting a yr over yr enhance of 131%. Income from on-line advertising and marketing companies surged 56% yr over yr to 42.5B Chinese language Yuan ($5.9B) whereas transaction-related income reached 44.4B Chinese language Yuan ($6.1B), exhibiting a rise of 327% yr over yr.

PDD

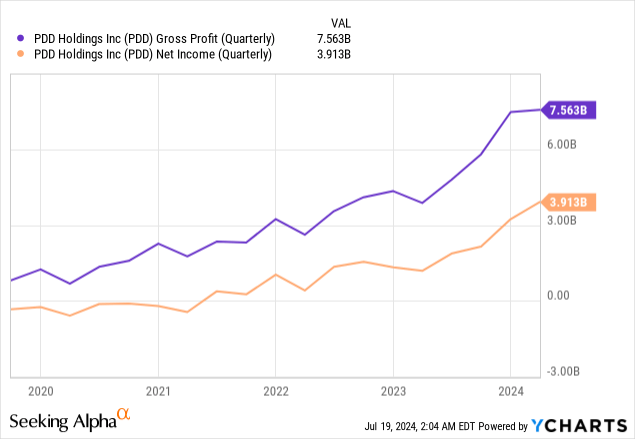

Pinduoduo’s concentrate on {discount} offers has allowed the corporate to construct a loyal buyer base and the e-Commerce platform has achieved spectacular progress within the final a number of years. PDD Holdings’ gross and internet income are each in a long run uptrend given the corporate’s continuous enlargement within the e-Commerce market, innovation and use of synthetic intelligence with a purpose to optimize its discovery-based buying ideas. The efficient use of synthetic intelligence, for instance within the context of buy suggestions and tailor-made buying feeds, may very well be conversions drivers for e-Commerce platforms going ahead.

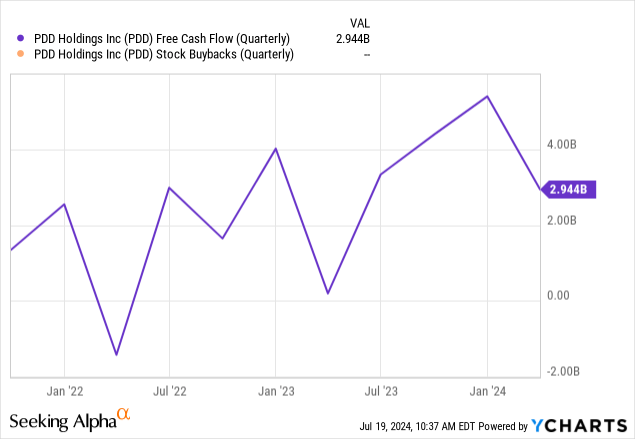

Free money movement and capital return potential

Pinduoduo generates quite a lot of extra money from its e-Commerce operations. A few of this money is invested in constructing massive language fashions which is able to help conversion initiatives on the corporate’s e-Commerce platforms. Nevertheless, Pinduoduo isn’t actually shopping for again any shares which stands in distinction to Alibaba, for instance, which licensed a $25B inventory buyback earlier this yr. Since Pinduoduo is already worthwhile when it comes to free money movement, I can positively see the e-Commerce firm comply with into the footsteps of Alibaba and provoke inventory buybacks sooner or later, which, given the low P/E shares commerce at, could be a superb use of money movement.

Valuation of PDD Holdings

PDD and different Chinese language large-cap e-Commerce platform are low-cost as a consequence of a variety of components together with structural points in China’s financial system and rising competitors within the e-Commerce market. China’s GDP only grew 4.7% within the second-quarter, under expectations of 5.1%, as a consequence of slowing shopper spending and a troubled property sector that has suffered as a consequence of extreme hypothesis lately.

Moreover, U.S. buyers are scared to the touch Chinese language large-cap firms, largely as a result of Beijing has a historical past of involving itself in company affairs. Questions in regards to the rule of legislation and company governance have overly negatively affected investor attitudes in direction of Chinese language firms.

Whereas these dangers aren’t completely unjustified, e-Commerce progress in China could be very low-cost. China has the second-largest market by inhabitants dimension (after India) which clearly makes IT a pretty long run e-Commerce progress play.

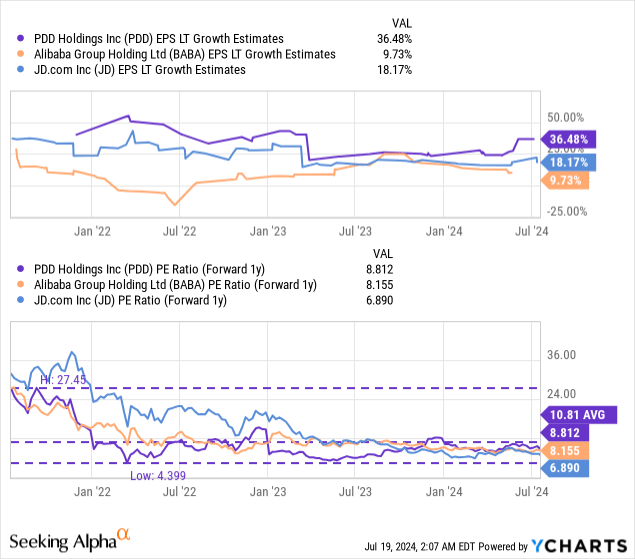

PDD Holdings is at the moment valued, regardless of a projected long run EPS progress price of 36%, at a P/E ratio of solely 8.8X… which is about 19% under the corporate’s long term valuation common. I consider that Chinese language e-Commerce platforms might not less than commerce at 10X FY 2025 earnings given their progress potential and customarily optimistic gross revenue momentum.

A 10X P/E ratio is probably going a low estimate for PDD, given its stronger than common EPS progress. A 10X earnings multiplier additionally implies solely 14% upside revaluation potential and a good worth of $150. In the long term, I can see Pinduoduo revalue to a 12-13X P/E ratio — akin to what I consider is affordable for Alibaba, additionally due to its sturdy free money movement — which suggests a a lot larger truthful worth of $180-195.

Dangers with PDD Holdings

The largest threat for PDD Holdings is a sluggish restoration in China’s financial system which can weigh on shopper spending and subsequently on e-Commerce gross sales. This threat is partially offset by what I count on to be an aggressive roll-out of AI merchandise that would assist drive conversions and common order values. What would change my thoughts about Pinduoduo is that if the e-Commerce firm have been to see detrimental gross revenue momentum or declining free money movement.

Remaining ideas

There are many issues to love about Pinduoduo, the proprietor of the broadly common Temu e-Commerce web site. The corporate is producing very sturdy prime line progress as its concentrate on {discount} and discovery-based buying offers is paying off. Pinduoduo can also be seeing optimistic gross revenue momentum and will comply with into the footsteps of Alibaba which is extra closely centered now on returning free money movement to shareholders, primarily by its inventory buyback plan. What I like most about Pinduoduo is that the e-Commerce firm’s shares commerce at an enormous {discount} to truthful worth whereas PDD is anticipated to keep up appreciable EPS progress momentum going ahead. With a P/E ratio of 8.8X, inventory buybacks would additionally make a ton of sense!

👇Comply with extra 👇

👉 bdphone.com

👉 ultraactivation.com

👉 trainingreferral.com

👉 shaplafood.com

👉 bangladeshi.help

👉 www.forexdhaka.com

👉 uncommunication.com

👉 ultra-sim.com

👉 forexdhaka.com

👉 ultrafxfund.com

👉 ultractivation.com

👉 bdphoneonline.com

👉 Subscribe us on Youtube