Since we launched the Nasdaq IPO Pulse Index initially of the yr, IT’s been signaling an upswing in preliminary public providing (IPO) exercise. Now that we’re on the midpoint of the yr, we’re guessing numerous you needed to see how IPO exercise has truly fared!

The excellent news is that we’re seeing more IPOs this yr, and on a trade-weighted common, efficiency since IPO date has been constructive.

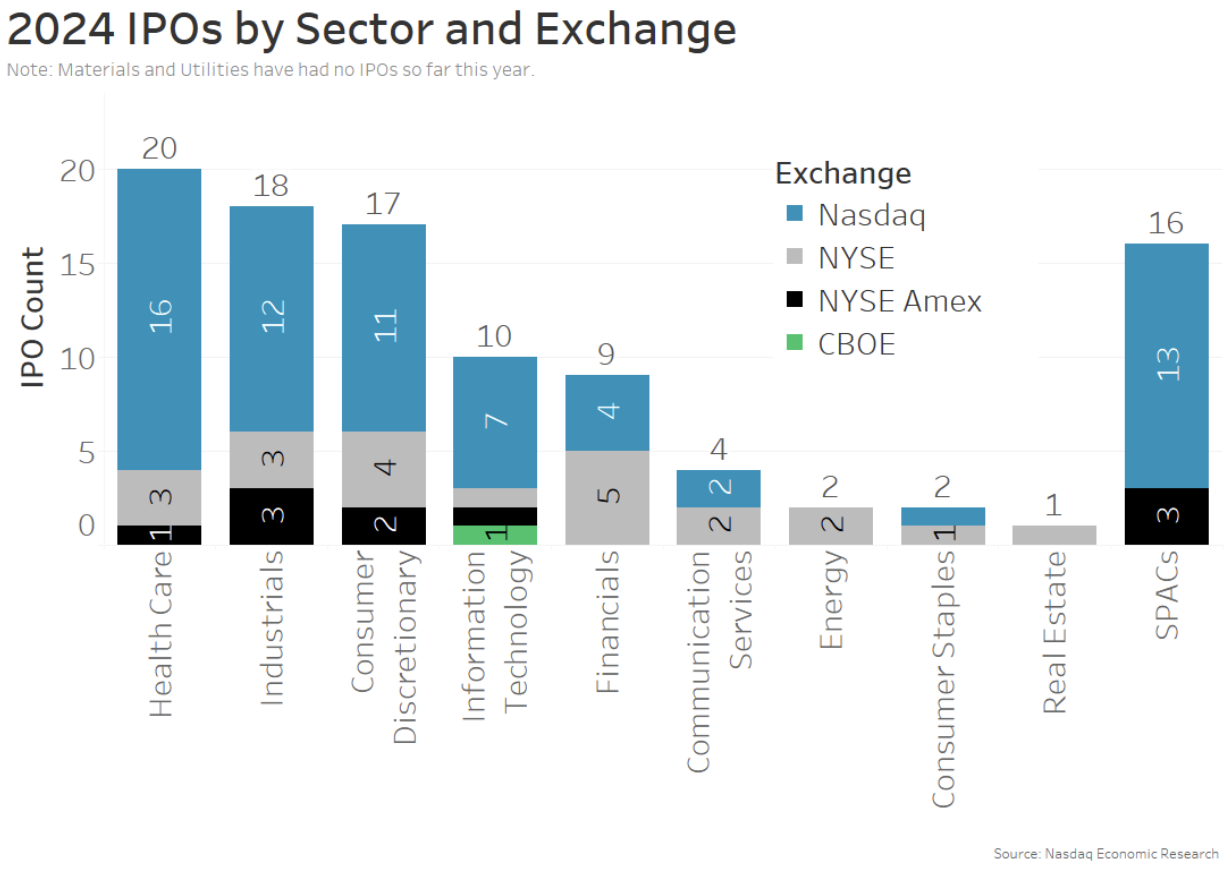

99 IPOs throughout 9 sectors… and SPACs are again?

The primary half of the yr has seen an uptick in IPOs. In reality, we have now seen 99 IPOs throughout 9 sectors, with Health Care, Industrials and Client Discretionary sectors main the way in which. This represents a 25% enhance in common IPO exercise over 2023.

The one sectors with out any IPOs but this yr are Supplies and Utilities. That stated, the supplies sector has additionally been one of many slowest sectors to see earnings get better.

Nearly all of firms proceed to select Nasdaq as their itemizing venue (blue parts of bars beneath).

One different noteworthy growth is that particular objective acquisition firms (SPACs) have made a (small) comeback currently. A complete of 16 IPOs have been SPACs, with seven occurring in June – essentially the most in a single month since April 2022.

Chart 1: 2024 IPOs got here from a number of completely different sectors and have largely listed on Nasdaq

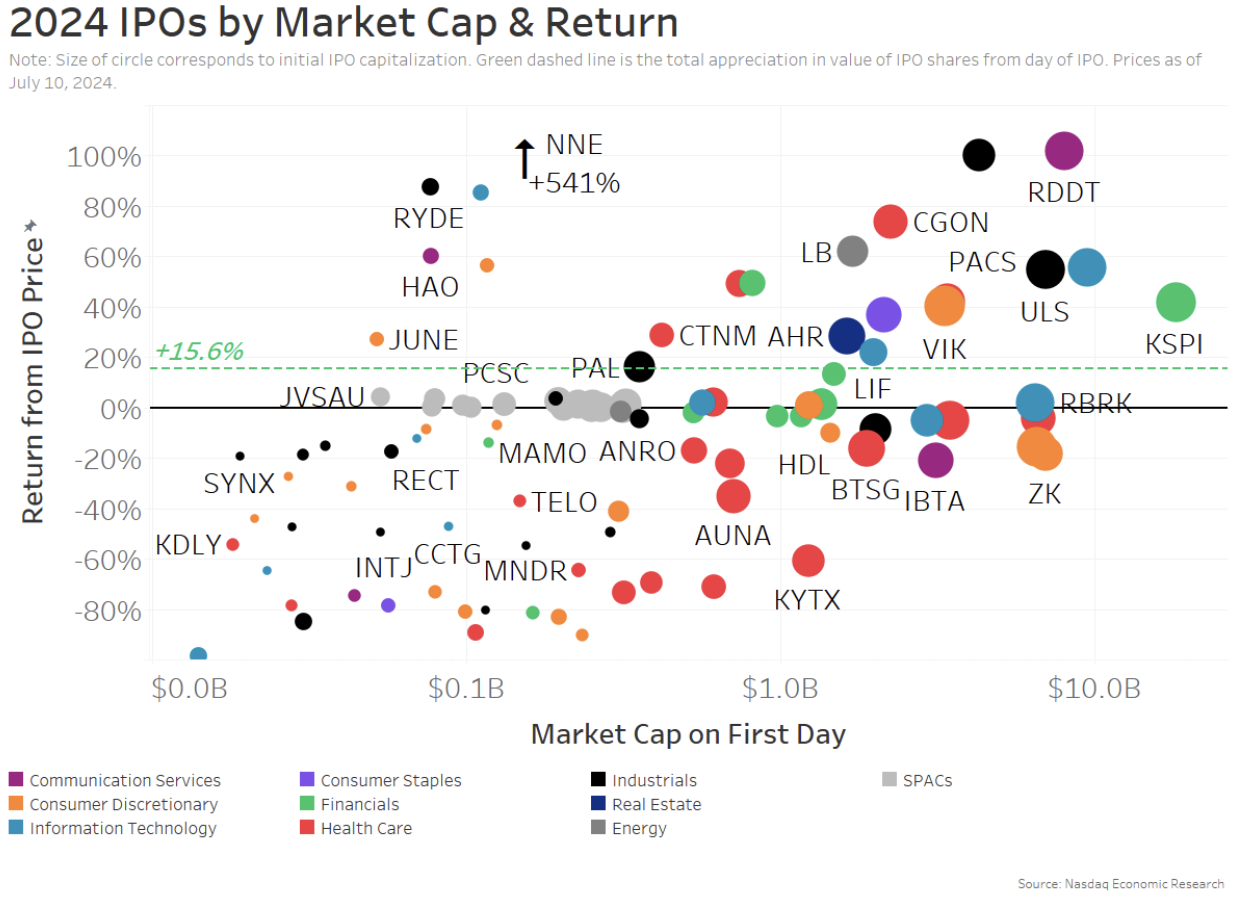

27% of IPOs this yr have been unicorns

The info reveals that over 1 / 4 of 2024 IPOs have been unicorns, with a first-day market cap over $1 billion. In reality, 8% had a market cap of at the least $6 billion.

Importantly for traders and corporations contemplating IPOs, this yr’s IPOs have carried out nicely.

The info reveals that the IPO-issue-weighted return on IPOs this yr is over 15% (dashed inexperienced line). Notably, IT has helped that the bigger firms have the vast majority of IPOs with one of the best year-to-date returns.

Chart 2: Greater than 1 / 4 of IPOs have been unicorns and bigger IPOs have carried out finest

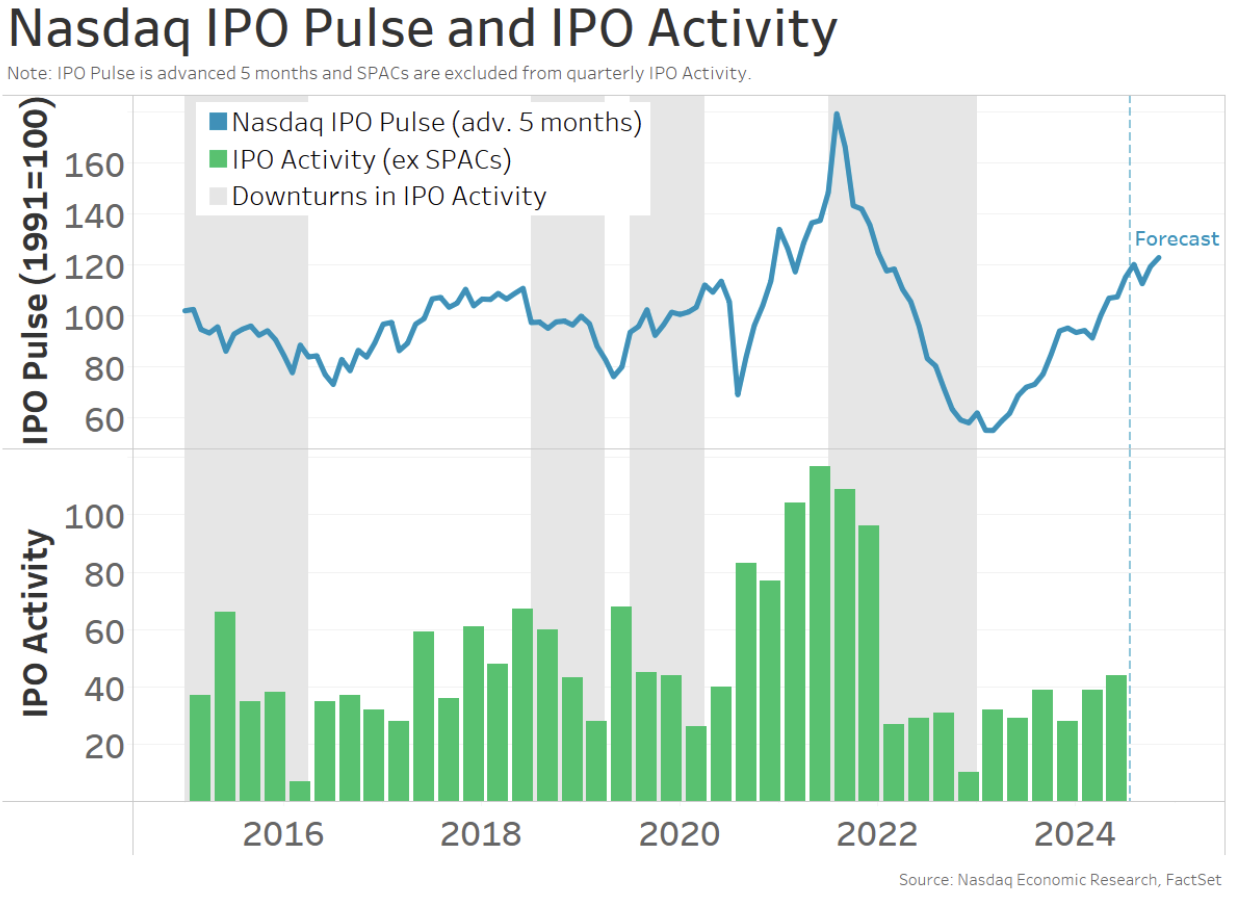

IPO Pulse stays constructive for the second half of 2024

The advance within the IPO market is in step with the message from the Nasdaq IPO Pulse since its launch.

Wanting towards the second half of 2024, IT seems to be just like the rebound in IPOs we noticed to start out the yr ought to proceed nicely into the second half of this yr. In reality, we see that in June the IPO Pulse rose to an almost three-year excessive (Chart 3). That reveals that the cyclical drivers of IPO exercise stay supportive for IPOs by late 2024.

Chart 3: At an almost three-year excessive, the IPO Pulse factors to a continued rebound in IPO exercise

IT’s additionally value remembering that presidential elections typically lead some firms to IPO sooner than they’d in a traditional yr as a way to keep away from uncertainty across the election. That might enhance third-quarter IPOs, however we’ll have to attend and see if that holds true this yr.

Michael Normyle, U.S. Economist at Nasdaq, contributed to this text.

👇Observe extra 👇

👉 bdphone.com

👉 ultraactivation.com

👉 trainingreferral.com

👉 shaplafood.com

👉 bangladeshi.help

👉 www.forexdhaka.com

👉 uncommunication.com

👉 ultra-sim.com

👉 forexdhaka.com

👉 ultrafxfund.com

👉 ultractivation.com

👉 bdphoneonline.com

👉 Subscribe us on Youtube