8vFanI

Rising rates of interest have been a boon to Enterprise Growth Corporations, often called BDC’s, over the previous 1 year-plus. A number of of them have reported report earnings, together with Golub Capital BDC (NASDAQ:GBDC), which noticed 55% progress in Funding Revenue and 49% progress in Web Funding Revenue, NII in its fiscal yr ending 9/30/23. 99% of its debt investments are at floating charges.

Firm Profile:

Golub Capital BDC is an externally managed, closed-end, non-diversified administration funding firm that has elected to be handled as a enterprise growth firm beneath the Funding Firm Act of 1940 and as a regulated funding firm, or RIC, beneath the Federal tax code. IT makes use of the established Loan origination channels developed by Golub Capital, a number one lender to middle-market corporations with over $65 billion of capital beneath administration as of January 1, 2024. (GBDC website)

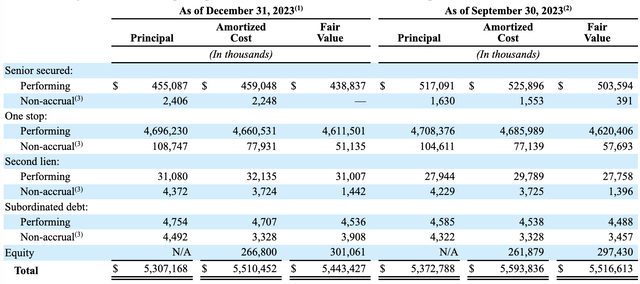

Holdings:

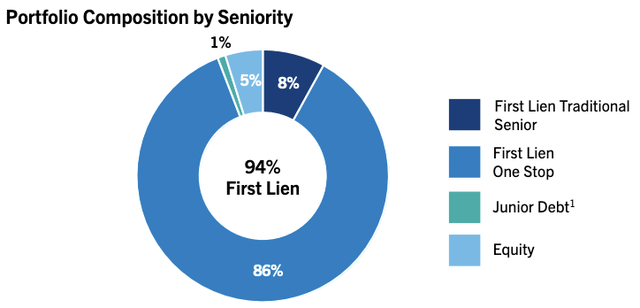

8% of GBDC’s $5.4B portfolio is in 1st Lien Senior Loans, with 86% in 1st Lien One Cease Loans, that are secured by a collateral curiosity. IT additionally holds 5% in Fairness, and 1% in Junior Debt.

GBDC website

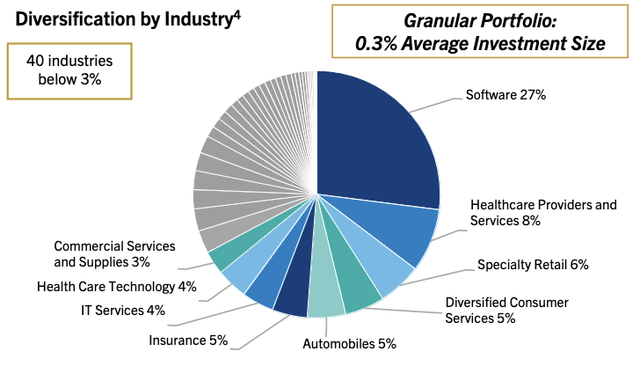

GBDC’s common borrower earns $73M in EBITDA/yr. 16% of its originations are with debtors with beneath $20M in annual EBITDA, whereas 76% of the originations are to debtors with beneath $100M in annual EBITDA.

GBDC website

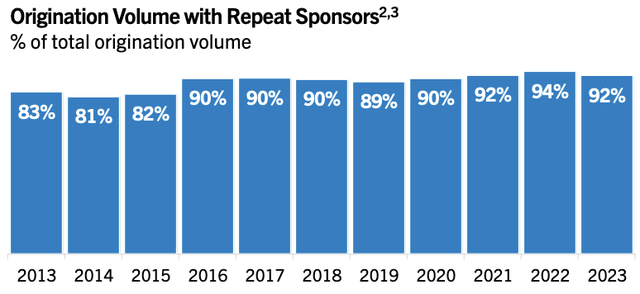

GBDC has long-term relationships with its sponsors, i.e., the businesses who make investments the lion’s share of funds within the underlying corporations. Repeat sponsorship has been 90% or above from 2020 on:

GBDC website

Portfolio Firm Scores:

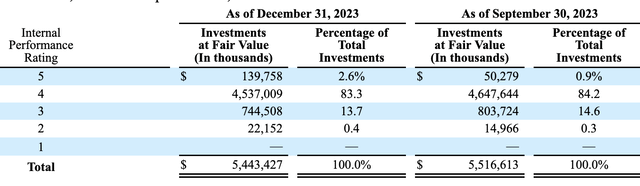

Like different BDCs, administration re-rates its holding quarterly. They use a 5-tier system, with 5 being the highest tier, and 1 the bottom.

Within the quarter ending 12/31/23, prime tier 5 holdings elevated by ~$89M, to 2.6% of the portfolio; wile tier 2 elevated by ~$7M, representing simply 0.4%.

GBDC website

Non-Accruals decreased by 10 foundation factors sequentially, to 1.1% of whole debt investments at truthful worth within the quarter ending 12/31/23. There have been no new defaults. Portfolio firm investments on non-accrual standing remained at 9 as of December 31, 2023.

GBDC had a 0.00% Cost Default Charge through the COVID-19 dislocation; and has a really low 0.01% Common annual loss price from Cost Defaults since 2004.

GBDC 10Q

Earnings:

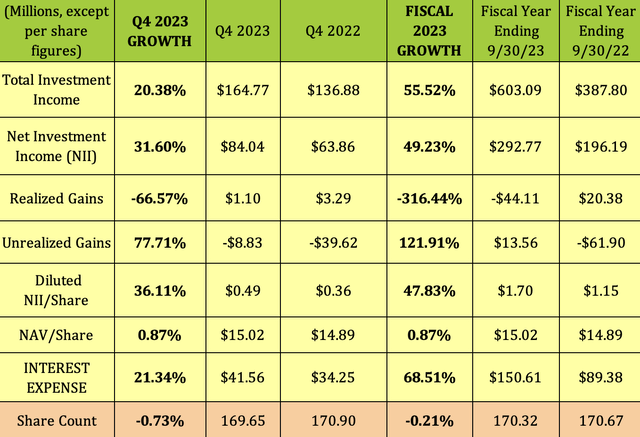

GBDC’s fiscal yr ends on 9/30. Its constructive outcomes stored going within the newest quarter, which ended 12/31/23, with 20% prime line progress, 31.6% NII progress, and 36% NII/Share progress. Adjusted web funding earnings per share was $0.50, tied with fiscal This fall 2023, (interval ending 9/30/23), for the corporate’s highest-ever adjusted NII per share.

Unrealized positive factors improved to -$8.8M, whereas Realized Beneficial properties fell to $1.1M. As seen with most different corporations, Curiosity Expense rose for GBDC within the quarter, up 21%. NAV/Share rose from $14.89 to $15.02.

Fiscal 2023 had 55.5% income progress, and 49% NII progress, with NII/Share rising ~48%.

Hidden Dividend Shares Plus

New Developments:

-GBDC entered right into a definitive merger settlement with Golub Capital BDC 3 Inc., with GBDC because the surviving firm topic to sure stockholder approvals and customary closing situations.

-GBDC’s funding advisor agreed to cut back GBDC’s earnings incentive charge and capital achieve incentive charge from 20% to fifteen% in reference to and in help of the proposed merger. The discount in incentive charges was made efficient as of January 1, 2024.

Dividends:

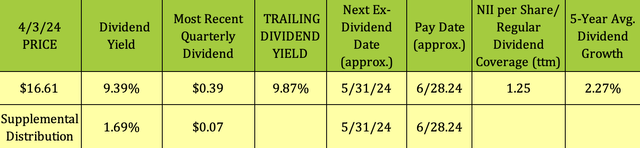

GBDC’s Board elevated the corporate’s common quarterly distribution from $0.37 to $0.39 per share, along side the proposed merger announcement and corresponding discount and incentive charge.

At $16.61, GBDC’s base yield is 9.39%, and its most up-to-date $.07 supplemental payout added 1.69%, for a complete yield of 11.08%. IT has a modest 5-year dividend progress price of two.27%, because of dividend reductions throughout COVID-challenged 2020-2021.

Hidden Dividend Shares Plus

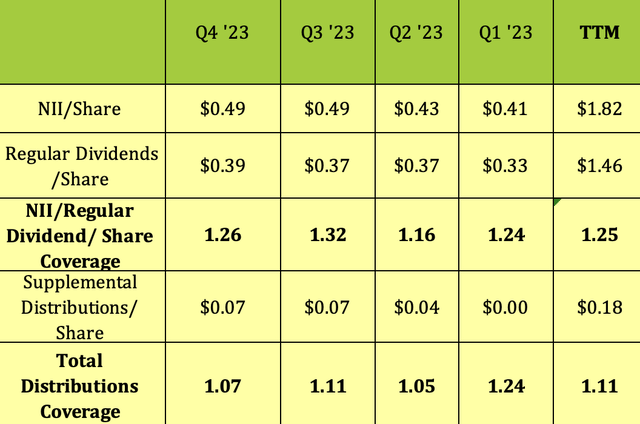

Dividend protection has been sturdy over the previous 4 quarters, hitting 1.26X within the quarter ending 12/31/23, and averaging 1.25X.

GBDC additionally paid 3 straight supplemental distributions in the newest 3 quarters – its whole distribution protection averaged 1.11X:

Hidden Dividend Shares Plus

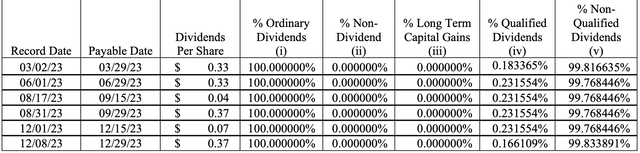

Taxes:

Distributions for fiscal yr ending 9/30/23 have been deemed ~99.8% non-qualified.

GBDC 10Q

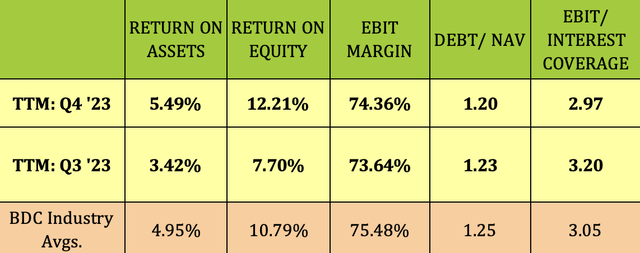

Profitability & Leverage:

ROA and ROE each improved markedly over the 4 quarter interval ending 12/31/23, with each above BDC business averages. Debt/NAV was roughly flat, whereas Curiosity protection was considerably decrease, however nonetheless according to business averages.

Hidden Dividend Shares Plus

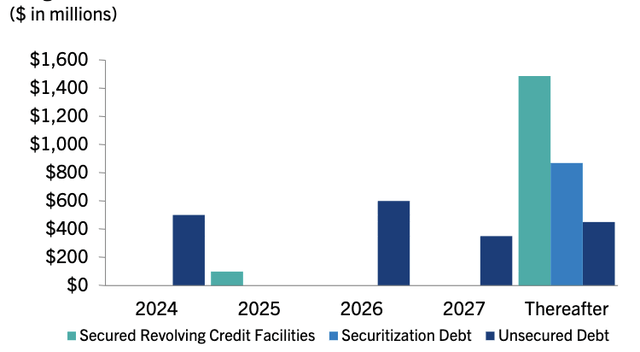

Debt & Liquidity:

As of 12/31/23, GBDC had $1.3B of liquidity from unrestricted money, undrawn commitments on its company revolver, and the unused unsecured revolver offered by its advisor.

IT has $500M of unsecured notes maturing in 2024.

On February 1, 2024, GBDC issued $600M of 2029 Unsecured Notes, which bear a set rate of interest of 6.000%, and mature on July 15, 2029. In reference to the 2029 Notes, they entered into an rate of interest swap settlement on the total principal quantity of the 2029 Notes the place GBDC receives a set rate of interest of 6.248%, and pays a floating rate of interest of one-month SOFR plus 2.444%.

GBDC website

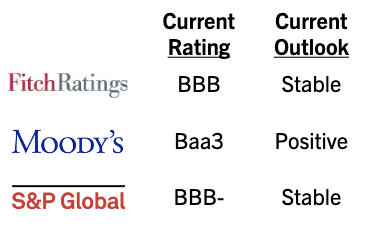

GBDC’s debt is rated funding grade by Fitch, Moody’s, and S&P World:

GBDC website

Efficiency:

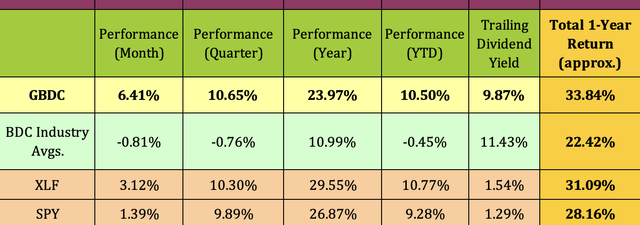

GBDC has outperformed the BDC business, the broad Monetary sector, and the S&P 500 on a complete return foundation over the previous yr. IT has additionally outperformed the BDC business and the S&P on a worth foundation up to now in 2024:

Hidden Dividend Shares Plus

Analysts’ Worth Targets:

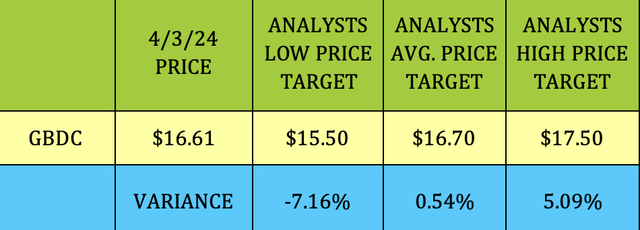

GBDC acquired an improve from B of A Securities on 3/25/24, from Impartial to Purchase.

At $16.61, GBDC is roughly even with road analysts’ $16.70 common worth goal, and 5% under their $17.50 highest goal.

Hidden Dividend Shares Plus

Valuations:

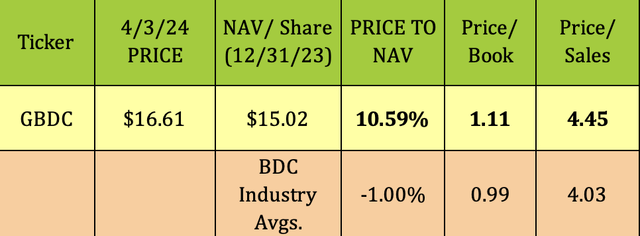

At $16.61, GBDC is getting a ten.6% premium worth to NAV per share from the market, a lot larger than the BDC business’s 1% low cost to NAV. IT‘s additionally larger on a P/Gross sales foundation.

Hidden Dividend Shares Plus

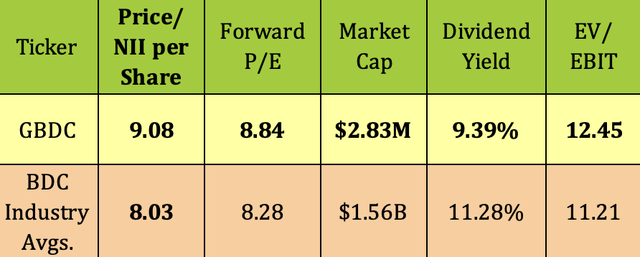

GBDC’s earnings multiples are additionally larger than business averages, on a trailing and ahead foundation, as is its EV/EBIT. Its base dividend yield is decrease than common.

Hidden Dividend Shares Plus

Parting Ideas:

Golub Capital BDC is buying and selling ~1% under its 52-week excessive. Clearly, Mr. Market is happy with the merger, and the motivation charge reductions, in addition to report earnings. We intend to attend for Mr. Market’s subsequent irrational hissy match, after which attempt to scoop up shares of Golub Capital BDC at decrease valuations.

All tables furnished by Hidden Dividend Shares Plus, until in any other case be aware