Lemon_tm Finance chart success industrial graph diagram or financial savings buying and selling worth.” data-id=”1500507449″ data-type=”getty-image” loading=”lazy”/>

Finance chart success industrial graph diagram or financial savings buying and selling worth.” data-id=”1500507449″ data-type=”getty-image” loading=”lazy”/>

Gold launched to contemporary all-time highs final week. The 4% advance got here as actual rates of interest dipped additional and the US Greenback Index completed close to its lowest mark because the center of January. Moreover, China has been a internet purchaser of gold for a whopping 16 straight weeks – its central financial institution now holds 72.6 million troy ounces, or about 2,257 tons. At house, the US nationwide debt is rising by $1 trillion about each 100 days. There are little question macro tailwinds for the valuable steel, however is gold’s thrust telling us one thing about the place the worldwide financial system could head within the months forward? That is still a scorching subject between the bulls, bears, and most macro strategists.

The plain method to play gold is thru the SPDR Gold Shares ETF (NYSEARCA:GLD). I’ve a purchase ranking on the ETF. The fund has a 0.4% annual expense ratio and at the moment sports activities an A ETF Grade by In search of Alpha. With excessive liquidity, however a unstable historical past, I see extra upside forward.

Later, I’ll element why $2600 in spot gold is doable from a technical perspective. Furthermore, with still-high inflation and central financial institution price cuts within the offing, IT could possibly be the best macro setup for gold and GLD itself. As macro pundits debate what IT all means for the worldwide financial system, bullish worth motion is getting louder.

For buyers, a pair of ETFs may fly below the radar, however each are efficient methods to achieve publicity to gold following the important thing technical breakout. Let’s dig into the WisdomTree Environment friendly Gold Plus Fairness Technique Fund (GDE) and the WisdomTree Environment friendly Gold Plus Gold Miners Technique Fund (GDMN).

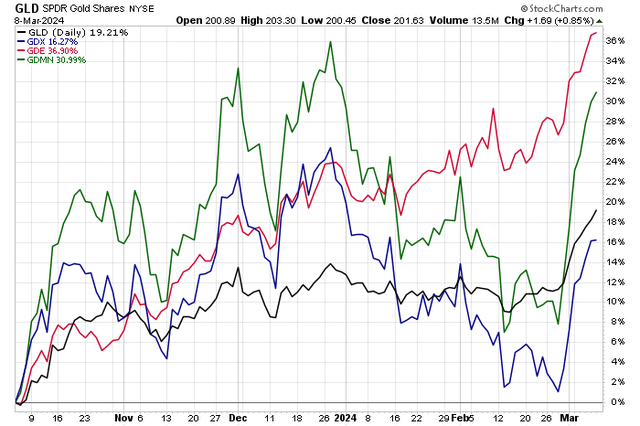

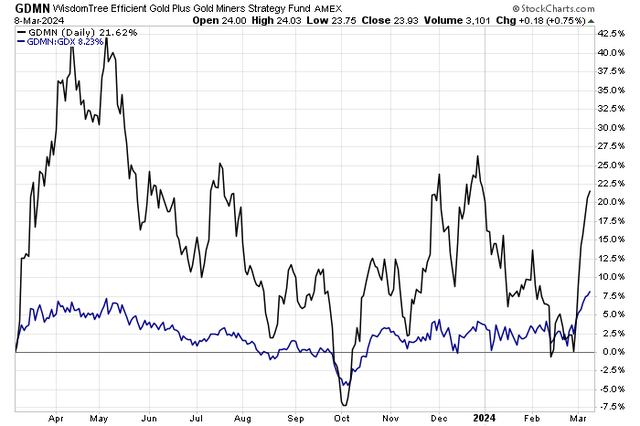

GDE, GDMN Have Outperformed GLD, GDX Over the Previous 12 months

Stockcharts.com

For background, GDE offers investors capital-efficient publicity to large-cap US equities and gold by means of leveraged futures contracts. IT can be utilized as an alternative to large-cap US fairness, multi-asset, or various methods and to reinforce portfolio diversification with gold futures as a possible inflation hedge.

GDMN, then again, seeks exposure to gold miners’ equities and enhanced gold publicity by means of leveraged futures contracts and goals to supply a substitute for gold miners methods with the added potential advantage of publicity to gold futures. Diversification with gold futures and gold miners appearing as a possible inflation hedge is seen as useful for a well-rounded international portfolio.

Each funds have outperformed spot gold because the begin of This autumn final yr, and have sharply crushed the favored, or notorious when you’ve seen its chart over the previous few years, VanEck Gold Miners ETF (GDX) over that stretch.

Certainly, buyers in a number of the largest treasured metals equities and ETFs have suffered whereas gold, the commodity, has soared. What offers? Weren’t gold miners supposed to supply, in impact, leveraged upside returns to gold? That’s what we witnessed within the 2000s and early 2010s, a time when the worth of an oz of gold rallied for a powerful 11 consecutive years ending in 2011.

Today’s a different environment, though. However new methods supply buyers searching for probably the most environment friendly and efficient publicity to the yellow steel higher options.

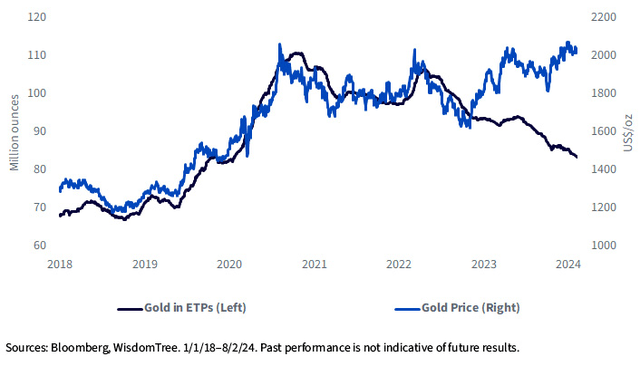

Gold Rallies as Gold ETP Holdings Dip

WisdomTree

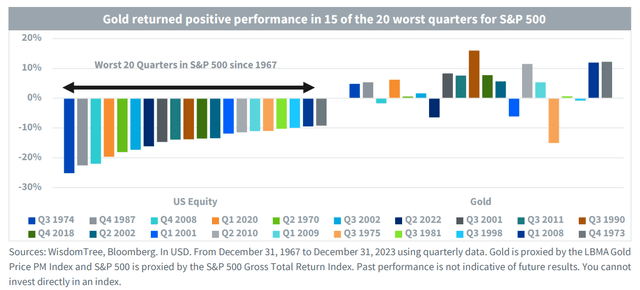

Whereas crypto catches a lot fanfare right now, gold stays a stalwart that has endured over millennia. The steel’s historic significance, coupled with its numerous attraction, makes IT a particular funding – even in 2024.

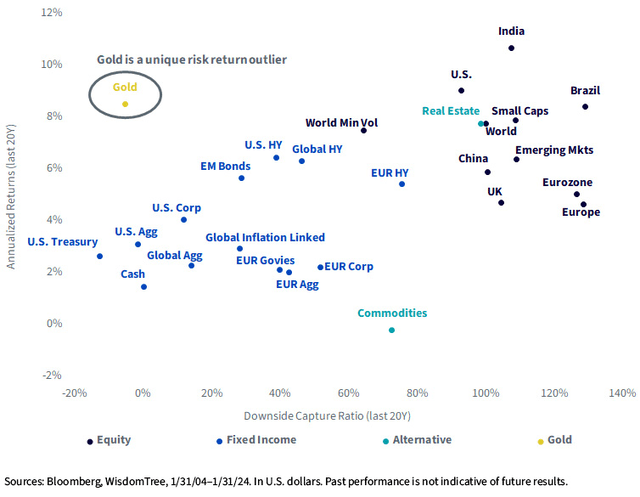

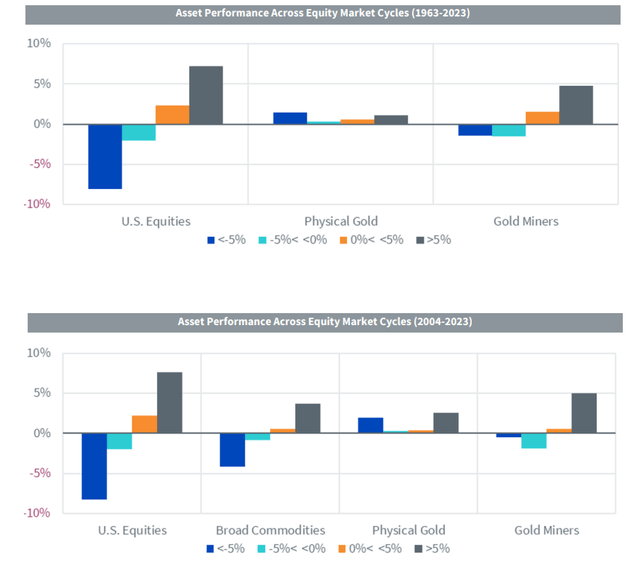

IT is a robust diversifier for portfolios because of its distinct behavioral traits, serving as an inflation and geopolitical shock hedge. Gold has exhibited equity-like returns with minimal draw back seize during the last 20 years, making IT a sexy choice for rising portfolio diversification and lowering danger.

Gold’s Diversification Advantages

WisdomTree

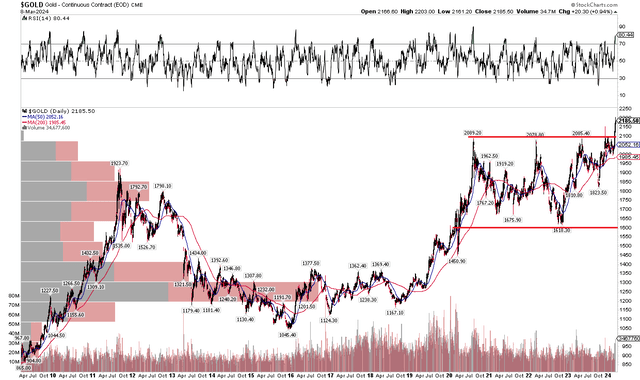

Regardless of latest bullish worth motion, gold has endured vital investor outflows. IT will probably be fascinating to see if that reverses now that new all-time highs are being made. Forward of imminent Fed price cuts and the potential for decrease actual rates of interest, gold’s trek above $2100 might quickly put $2600 on the doorstep primarily based on the years-long technical consolidation, illustrated under, that has now been breached.

Spot Gold: Bullish Breakout, Technical Goal $2600 Primarily based on the $1600 to $2100 Earlier Vary

Stockcharts.com

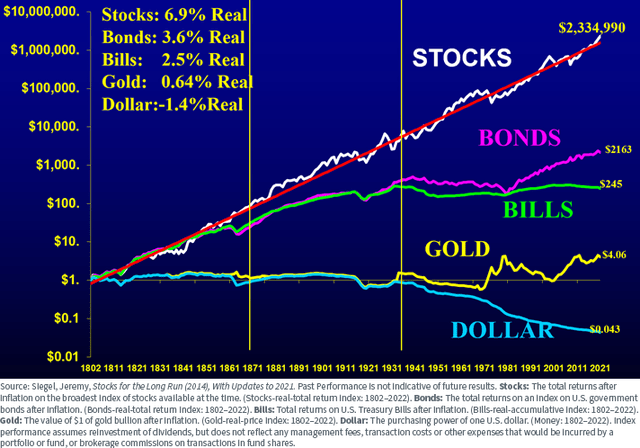

Driving improved gold efficiency stands out as the actuality that inflation will probably be greater than what buyers had been used to through the 2010s. If inflation stays a bit lofty, that could possibly be the perfect recipe for gold and gold miners, akin to the 1946 to 1981 interval when gold outperformed bonds when it comes to after-inflation returns.

Gold Has Crushed US Shares Since Early 2000

WisdomTree

Gold: Optimistic Actual Returns In the course of the 1946-1981 Inflationary Regime

WisdomTree

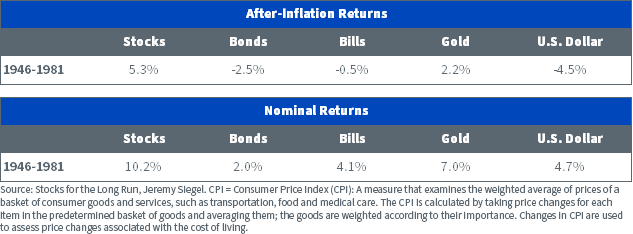

GDE seeks complete return by investing, both immediately or by means of a wholly-owned subsidiary, in a portfolio comprised of US-listed gold futures contracts and US large-cap fairness securities. Consider this ETF as a mix of large-cap US shares with a spice of gold.

Its prime 10 holdings embody most of the acquainted home mega-caps, however there’s a barely greater than 10% allocation to gold futures. GDE owns the five hundred largest US shares by market cap with $90 invested in equities for each $100 invested. Publicity to gold futures is completed utilizing leverage, so there’s $180 of complete publicity to shares and gold.

GDE: Massive-Cap US Entry with a Gold Futures Overlay

WisdomTree

With only a 0.2% annual expense ratio and an A+ Momentum Grade by In search of Alpha, I assert that GDE an environment friendly method to personal each the home inventory market and gold in a single automobile. Returns have been stellar – the ETF is up 40% from a yr in the past and 23% over the previous six months. IT has outpaced the S&P 500 by greater than three proportion factors up to now this yr.

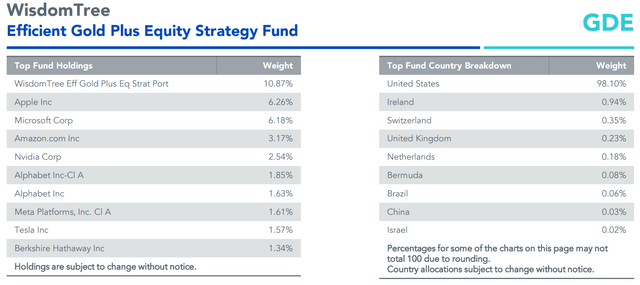

Among the many major advantages to proudly owning GDE right now is that not solely is IT capturing alpha because the SPX rallies, however ought to volatility strike, the layer of gold futures might assist buoy returns versus the broader market. Discover within the chart under that gold, whereas not resistant to selloffs throughout fairness bears, has constructive returns in 15 of the 20 worst quarters for the S&P 500. Thus, GDE has the potential to function a compelling portfolio diversifier.

Gold Has Held Up Effectively Throughout Market Turmoil

WisdomTree

Now let’s flip to GDMN, which provides gold futures to a portfolio of gold mining shares. Contemplate this ETF as a extra centered strategy to gold trade publicity, whereas GDE is efficient for a broader inventory allocation. Put frankly, GDMN corresponding to GDX, however with the additional benefit of proudly owning gold futures.

GDMN has outpaced GDX over the previous 52 weeks, which shouldn’t come as a shock primarily based on what I described earlier – that the commodity has trounced gold miners’ collective fairness efficiency.

GDMN, up 22% YoY, Has Outpaced GDX

Stockcharts.com

GDMN seeks complete return by investing in gold miners and gold futures contracts. Its main inventory holdings embody the acquainted names: Barrick Gold (GOLD), Newmont (NEM), and Agnico Eagle Mines (AEM), amongst different diggers. In contrast to GDE, there’s a big quantity of publicity to non-US markets: Canada, Australia, and South Africa are vital geographical holdings. GDMN beat the NYSE ARCA Gold Miners Index final yr, and extra energy has been seen to date in 2024.

GDMN pays a dividend yield of 1.9%, about 40 foundation factors above that of the S&P 500 and its 0.45% annual expense ratio is cheaper than that of GDX. The fund employs leverage, too – for each $100, the GDME seeks to take a position roughly $90 within the gold miners fairness basket and $10 in short-term collateral. To assist enlarge the potential advantages of the asset allocation, in keeping with WisdomTree, $90 in gold futures are layered on prime for $180 of complete gold-oriented publicity.

The issuer also points out that “gold miners have been a comparatively disappointing funding during the last twenty years, with excessive volatility and subpar returns, however the rise in gold costs is bettering the outlook for gold miners’ profitability. Gold miners’ internet revenue margins have constantly been rising since 2016, in lockstep with will increase of their stage of capital expenditures. Importantly, gold miners can also supply engaging dividend yields amid the backdrop of a rising price setting.”

Gold Miners Have Traditionally Provided Diversification Advantages

WisdomTree

The Backside Line

Traders have new, higher methods to achieve publicity to gold. With a brand new bull market doubtlessly underway following a 4% surge final week, the valuable steel may, in the end, be on the uptrend after greater than 12 years of uneven worth motion amid a bull market in US massive caps.

GDE and GDMN are two revolutionary and low-cost ETFs that transcend primary spot gold funds and treasured metals miner funds.