LindaJoHeilman/iStock Editorial by way of Getty Photos

December final yr, I issued a bull thesis on AT&T Inc. (NYSE:T) arguing that the then-current dividend in addition to the general funding case from a complete return perspective appear enticing sufficient to warrant a purchase.

There have been three basic drivers behind this:

- Depressed multiples at ranges which might be attribute for corporations with inherently risky money flows.

- Enhancing free money movement technology because of a extra balanced CapEx agenda together with rising enterprise outcomes.

- Enhanced sustainability of the dividend stemming from level two above in addition to the comparatively latest dividend lower.

Whereas articulating the purchase, I particularly highlighted that T undoubtedly deserves an additional low cost from its previous errors in destroying elements of the shareholder worth via sizeable however poorly performing M&A transactions. Within the efforts to develop horizontally and vertically, T assumed appreciable quantities of debt, which have actually not been coated by the extra money technology from, say, the entry in media enterprise by way of Warner Media. On prime of this, the latest dividend reductions don’t introduce consolation for buyers both, which, in flip, ought to be mirrored within the valuation metrics accordingly.

With that being mentioned, IT is obvious that the choice to go lengthy T again in late December final yr has paid off. Since then, T has registered a complete return efficiency of ~ 16%. Plus, after T circulated its This fall, 2023 earnings deck, I made a follow-up article by particularly dissecting the earnings dynamics, and nonetheless recommending a purchase.

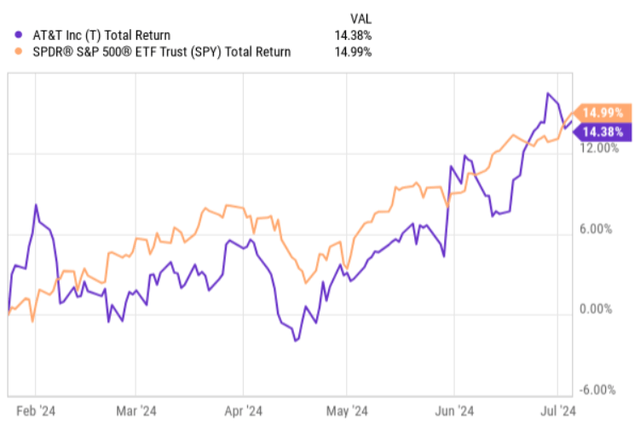

As we will see within the chart under, T has continued to ship sound returns after the issuance of This fall, 2023 and Q1, 2024 earnings report. Actually, the restoration course of has been so sturdy making T’s whole efficiency nearly precisely in keeping with that of the broader (progress targeted) market.

YCharts

Now, after seeing this that T has managed to recuperate a bit and likewise, there’s a Q1, 2024 deck on the market, let me know elaborate on why, for my part, buyers ought to nonetheless maintain on to their lengthy positions on this inventory.

Thesis assessment

All in all, T’s worth restoration may very well be deemed absolutely justified and supported by a continued momentum in enhancing the underlying fundamentals.

Earlier than I clarify this in a bit extra element, let me shortly plot the bear case.

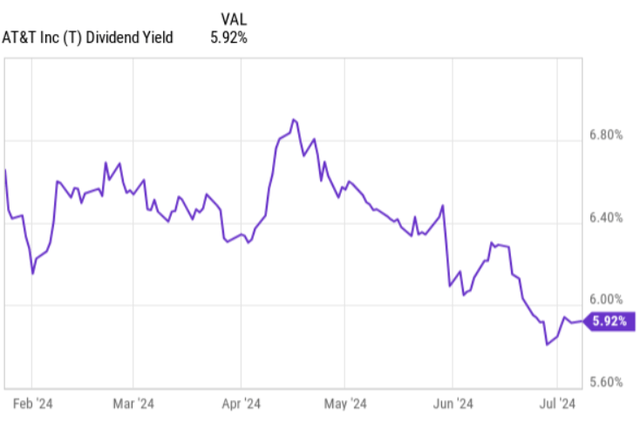

As most of T’s returns thus far have been pushed by the worth appreciation element, the dividend yield has decreased accordingly. The yield has dropped from round 6.5% to five.9%, which makes the inventory a bit much less enticing for yield-seeking buyers.

YCharts

Additionally, the TTM P/E ratio has elevated from 8.8x to circa 10x. Plus, the truth that T has correlated so strongly with the S&P 500 raises the query of how sustainable IT is and when this development may break.

Nonetheless, right here is the factor.

The Q1, 2024 earnings got here in sturdy, indicating a gradual strengthening in nearly all the main enterprise strains. By way of the top-line, the Q1, 2024 mobility service and fiber revenues have been up by 3.3% and 19.5%, respectively, relative to the identical interval final yr. Nonetheless, the enterprise wireline section, as anticipated, decreased by circa 8%, thus rendering the whole gross sales for Q1, 2024 flat.

Whereas the top-line dynamics have been secure, the actual enhancements may very well be observed within the bottom-line components, with T having the ability to obtain a margin growth in nearly all the key enterprise strains. For instance, the whole adjusted EBITDA ticked larger by 4.3%.

The commentary within the latest earnings name by John Stankey – Chief Government Officer – offers a pleasant colour on how T has been targeted on enhancing its working leverage to drive the margin growth, which actually is the important thing sauce to create worth in a mature telco enterprise.

The continued adoption of AI isn’t solely serving to us make progress on this purpose, but additionally benefiting our worker and buyer experiences. This deal with effectivity is translating into improved working leverage regardless of continued elevated inflation. You may see this in our money working bills, which have been down year-over-year within the first quarter contributing to adjusted EBITDA margin growth of 170 foundation factors.

One other vital aspect that’s value underscoring right here is T’s free money movement profile, which has lastly stabilized at ranges the place the administration can actually begin executing on the plans to deleverage the enterprise.

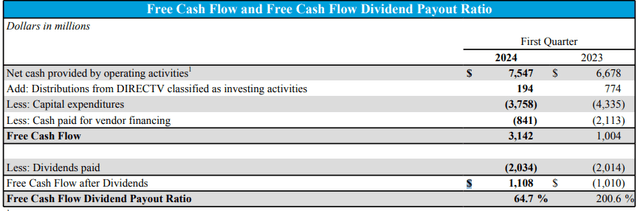

The desk under signifies, throughout Q1, 2024 retained about $1.1 billion in contemporary liquidity after making the required CapEx and dividend distributions.

Monetary and Operational Schedules & Non-GAAP Reconciliations

On account of the FCF retention, we will already now see progress in how T optimizes its stability sheet. The Q1, 2024 ended with a web debt to adjusted EBITDA of two.9x, offering a pleasant trajectory of assembly the communicated goal of two.5x in Q1, 2025. Within the meantime, as T pays down a part of its excellent debt (though we have now to contemplate that a part of the stability sheet optimization revolves round rising the adjusted EBITDA technology), we must always count on a decrease stress on the curiosity expense entrance. Throughout the quarter, the money paid for servicing the debt (with out amortization) elevated by ~5% (in comparison with Q1, 2023), which works hand in with T’s well-laddered debt maturity profile. But, given the deal with debt discount and the presence of properly distributed debt maturities, we must always not assume a significant stress on T’s money technology from larger curiosity prices.

As an alternative, for my part, we may slowly begin factoring in a possible dividend improve, particularly ranging from the following yr, when the leverage goal is predicted to be met. IT is obvious that sustaining a FCF dividend payout of ~ 65% for such a well-established enterprise in a structurally mature business doesn’t make sense offered that the capital construction in the precise stability.

Furthermore, in the identical earnings name the remark by John Stankey about dividend stability provides a further layer of confidence that the monetary threat will probably be managed, and the incremental dividend hikes can even be balanced:

I’d provide you with some characterization proper now, as we have labored actually laborious during the last couple of years to make sure we shield the dividend. And I believe you’ve got seen that we have completed that, and we have put ourselves in a extremely sturdy monetary place. That is paramount and vital to us, as we transfer into this.

The underside line

In my view, T has arrived at some extent in its technique, the place IT has lastly delayered sufficient to deal with enhancing the operational efficiency of its core companies, whereas directing surplus money technology in direction of stability sheet optimization. The latest monetary information verify this, the place the adjusted EBITDA continues to slowly however absolutely tick larger with the leverage profile steadily converging to 2.5x goal degree by Q1, 2025.

These dynamics ought to justify the latest run-up in T’s share worth, in addition to render the general funding case enticing, particularly from a dividend investor perspective. Whereas the present yield isn’t the very best IT has been for T, we have now to contemplate the dividend hike potential ranging from Q1, 2025 when the capital construction is predicted to be at its optimum. In the meantime, if T continues to register 3-5% in EBITDA progress (which is probably going given the CapEx spend and deal with enhancing working leverage), experiencing an additional upside within the share worth ought to be a sensible state of affairs.

On account of this, I stay bullish on AT&T Inc.

👇Comply with extra 👇

👉 bdphone.com

👉 ultraactivation.com

👉 trainingreferral.com

👉 shaplafood.com

👉 bangladeshi.help

👉 www.forexdhaka.com

👉 uncommunication.com

👉 ultra-sim.com

👉 forexdhaka.com

👉 ultrafxfund.com

👉 ultractivation.com

👉 bdphoneonline.com

👉 Subscribe us on Youtube