s-cphoto

Introduction

Corporations like NVIDIA (NVDA) have grow to be the apparent winners of the present AI growth.

Have you learnt who the key winners are?

The businesses anticipated to energy IT.

Bloomberg

In latest months, now we have more and more mentioned non-tech AI alternatives. This included {hardware} and energy.

In spite of everything, AI may be very power-hungry.

In accordance with The Brussels Times, AI searches require as much as 25x extra vitality than a easy Google search.

Nevertheless, ChatGPT consumes a variety of vitality within the course of, as much as 25 occasions greater than a Google search. Moreover, a variety of water can be utilized in cooling for the servers that run all that software program. Per dialog of about 20 to 50 queries, half a litre of water evaporates – a small bottle, in different phrases. – The Brussels Occasions

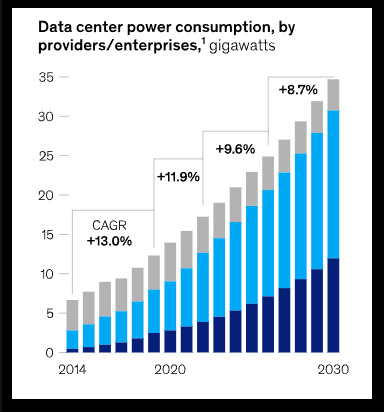

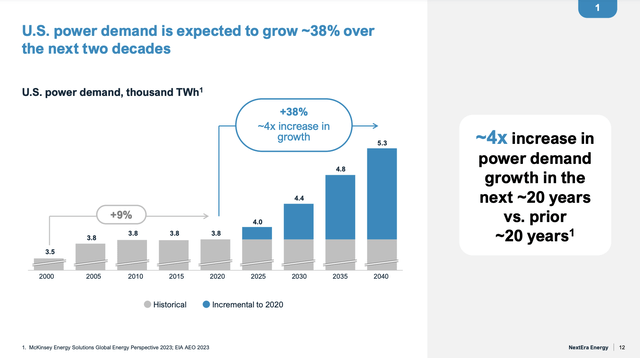

Utilizing the McKinsey information beneath, whole vitality demand for information facilities is anticipated to rise by excessive single digits via 2030, doubtlessly leading to a requirement of roughly 35 gigawatts by 2030.

McKinsey

This comes with one other main downside: emissions.

Large tech corporations don’t wish to smash their ESG footprint by inflicting rising demand for coal to gasoline their information facilities.

That is the place clean-energy utilities are available.

Entry to renewable energy sources additionally is a bonus. Aaron Dunn, co-head of worth fairness and portfolio supervisor at Morgan Stanley Funding Administration, likes NextEra Vitality Inc. as a result of IT builds renewable era for its personal utility unit and develops renewables for others.

“We imagine renewables and storage are a key enabler to assist meet this elevated demand” NextEra CEO John Ketchum mentioned throughout the firm’s first-quarter earnings name on Tuesday. “The U.S. renewables and storage market alternative has the potential to be 3x larger over the subsequent seven years in comparison with the final seven.” – IT” rel=”nofollow”>Bloomberg (emphasis added)

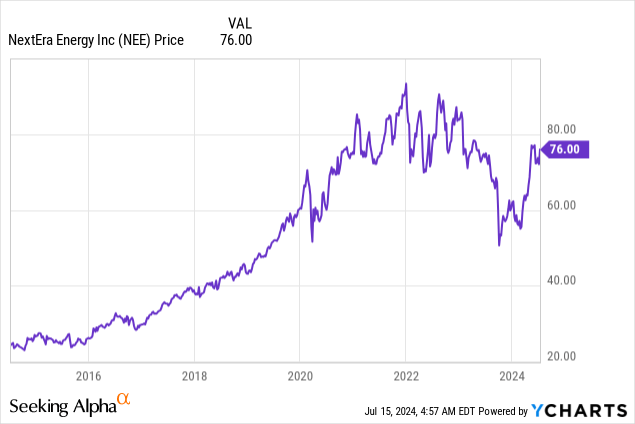

This brings me to NextEra Vitality (NYSE:NEE), an organization I began to pound the desk on throughout final yr’s inventory worth crash. Since then, shares have risen by 45%, together with dividends, beating the 33% return of the S&P 500.

My most up-to-date article on the inventory was written on April 3, after I went with the title “Neglect Tech Shares And Increase Your Portfolio: NextEra Vitality’s AI-Fueled Dividends.”

Since then, shares are up 22%.

On this article, I’ll replace my thesis utilizing the newest developments, together with its 2024 Investor/Analyst Day, which revealed lots about its potential.

So, let’s dive into the small print!

NextEra Makes The Case For A Brilliant Future

NextEra is in the precise place on the proper time.

Because the Bloomberg quote above confirmed, the corporate has clear vitality and extremely favorable demand markets.

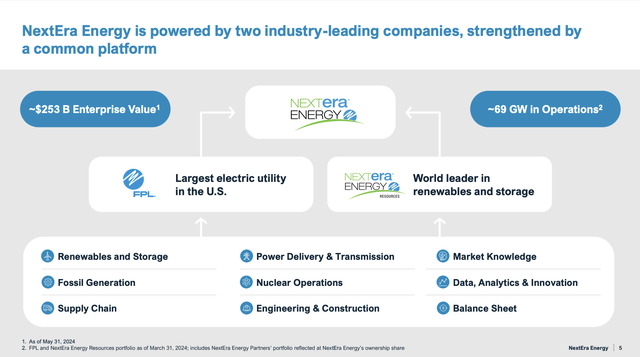

The corporate operates via two companies: Florida Energy & Mild (“FPL”), which is the most important rate-regulated utility in the US, and Vitality Assets, the worldwide chief in renewable vitality and storage.

NextEra Vitality

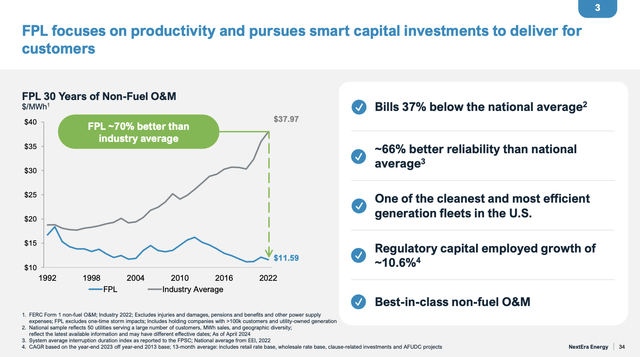

FPL is not simply giant, in accordance with NEE, however IT additionally has common electrical energy payments which might be 37% beneath the nationwide common, with among the finest reliability charges within the trade.

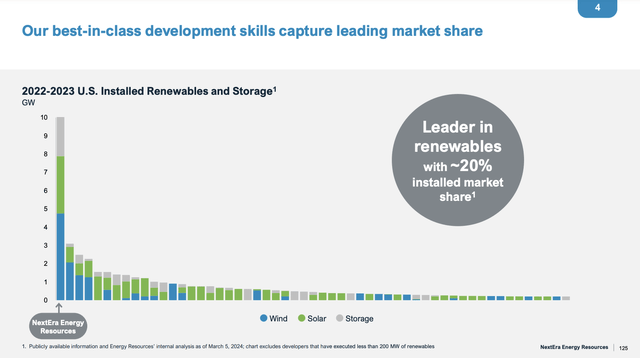

In the meantime, Vitality Assets has a 20% market share in renewables and storage.

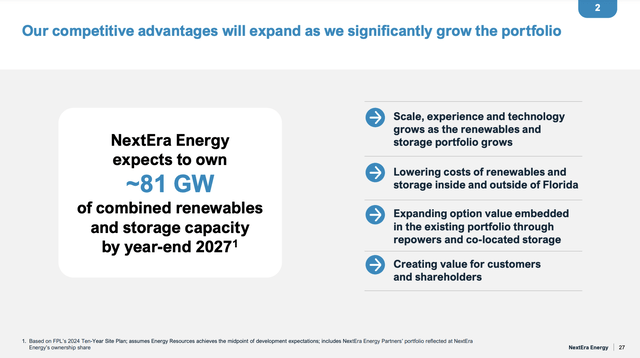

This scale is a big benefit, as IT has allowed the corporate to construct capabilities in sitting, creating, constructing, working, and financing renewable initiatives in and out of doors of Florida. When including its provide chain and technological benefits, IT is difficult to compete with NEE.

NextEra Vitality

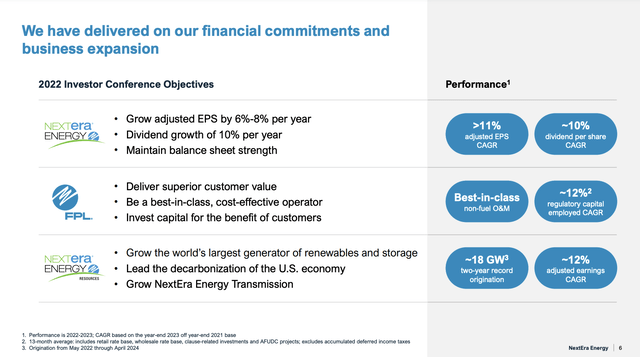

Even higher, the corporate has constantly delivered elevated returns.

Over the previous two years, NEE has achieved an adjusted earnings per share progress of greater than 11% and maintained a dividend progress price of 10%.

FPL has diminished its operations and upkeep (O&M) prices, which led to a 12% progress in rate-regulated capital employed. In the meantime, as we are able to see beneath, Vitality Assets has generated 12% earnings progress, marked by two consecutive document years of renewable manufacturing.

NextEra Vitality

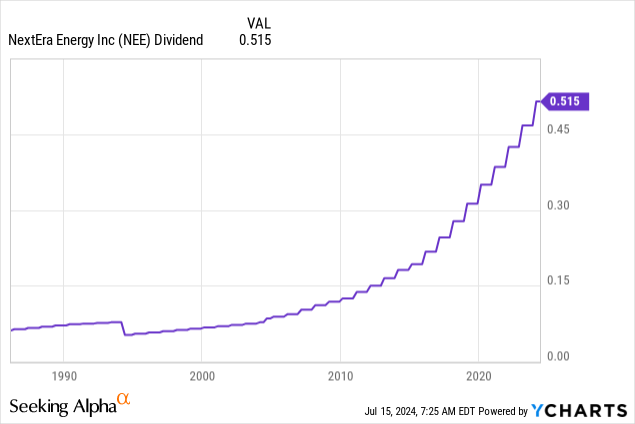

With regard to its dividend, NEE at present yields 2.7%. This dividend has a 59% payout ratio and a five-year CAGR of 10.7%. IT additionally comes with 28 consecutive annual dividend hikes.

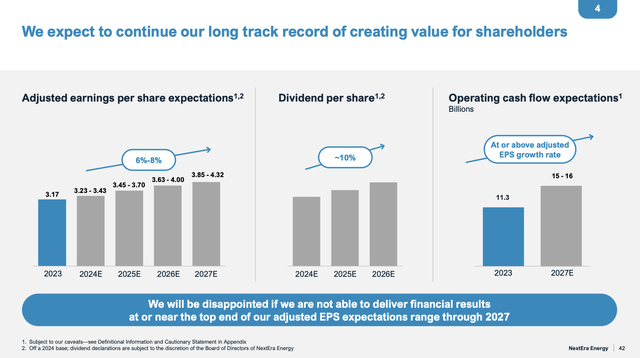

The corporate expects to develop this dividend by 10% yearly via a minimum of 2026, supported by 6-8% annual EPS progress and doubtlessly outperforming working money stream progress via 2027.

NextEra Vitality

The rationale why NEE is so upbeat about its potential to develop is elevated demand.

As we simply mentioned, demand is quickly rising.

In accordance with the corporate, U.S. energy demand is anticipated to develop by 38% over the subsequent 20 years. That price could be 4 occasions larger than up to now 20 years!

NextEra Vitality

Not solely is AI nice for energy demand, however IT additionally permits NEE to function extra effectively.

Throughout its Investor Day, the corporate famous IT has greater than 100 AI initiatives launched and even proprietary AI functions in use.

Basically, the combination of superior digital platforms and generative AI instruments permits the corporate to optimize website choice, improvement, and operations.

Even higher, the corporate’s footprint in battery storage, with greater than 50 gigawatts in its working portfolio and 34 gigawatts of standalone interconnection queue spots, permits IT to deal with growing demand.

That is necessary, as the corporate expects a 20% compound annual progress price in put in renewables over the subsequent decade. I added emphasis to the quote beneath:

Our aggressive benefits apply throughout our improvement platform. We expect a 20% compound annual progress price in put in renewables over the subsequent 10 years. So whereas Vitality Assets is rising, FPL is rising on the identical time. And with FPL, the renewables at present are roughly 5% of our capability. That is anticipated to develop to 38% and within the subsequent 10 years. Why? As a result of photo voltaic and storage are by far the bottom price choice for patrons, driving payments decrease every single day. And scale, expertise in Technology, IT grows as our portfolio grows. We’re anticipating an 81 gigawatt mixed renewable era portfolio by the top of 2027. – NEE 2024 Analyst/Investor Day

NextEra Vitality

IT additionally helps that the corporate has a brilliant wholesome stability sheet. Basically, that is necessary to assist multi-billion CapEx plans. Nevertheless, particularly in an setting of elevated charges, monetary Health is essential.

The corporate has a stability sheet ranking of A-. Though the corporate is expected to see a internet debt surge from $70.5 billion in 2023 to greater than $94 billion by 2026, IT is anticipated to maintain its internet leverage ratio beneath 5.0x EBITDA. In 2022, the leverage ratio was 7.4x EBITDA.

A wholesome stability sheet with favorable charges is without doubt one of the the explanation why IT can move on low charges to clients. The opposite is its “operational excellence,” as the corporate’s FPL operations have O&M prices which might be 70% decrease than common utility, creating $3 billion in annual financial savings for patrons.

NextEra Vitality

IT additionally has 482 energy buy agreements throughout 194 counterparties, which additional helps its secure and predictable money stream.

Over the previous decade, FPL has expanded so quickly that IT has added sufficient gigawatt hours to match 50% of one in every of California’s largest utilities, 40% of a serious Southeast utility, and 100% of Ohio’s largest utility.

Though the corporate didn’t point out the names of those friends, these are spectacular numbers nonetheless.

The corporate even makes the case that no utility within the U.S. has invested extra in new era and grid Technology over the previous 20 years than FPL.

This aggressive capital deployment has allowed the corporate to construct a “model new utility,” integrating extra photo voltaic and storage capability than every other operator in Florida.

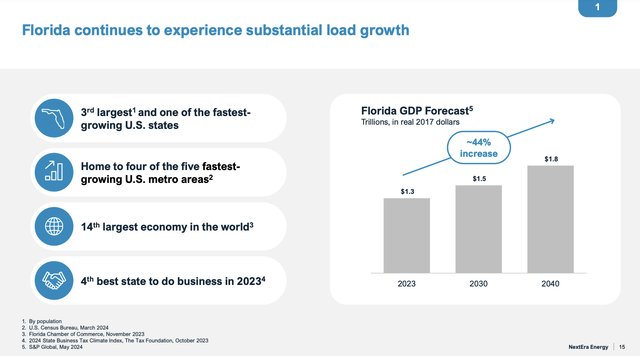

Talking of Florida, particularly after the pandemic, the state has grow to be an financial hotspot in the US, attracting folks and companies.

IT is at present the 14th-largest financial system on the earth, the 4th-best state to do enterprise in (in accordance with S&P World), and the third-fastest rising state, with a GDP forecast of $1.8 trillion for 2040 – 44% above 2023 ranges!

NextEra Vitality

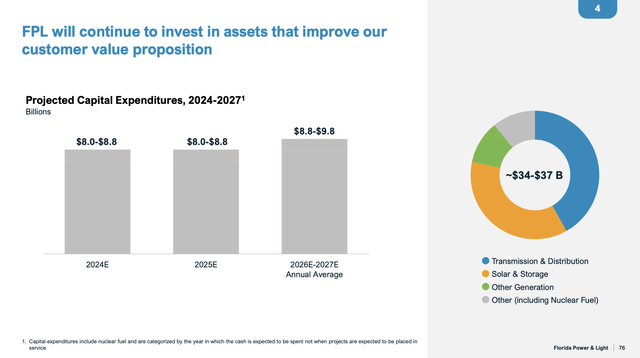

Going ahead, NextEra Vitality is poised for substantial progress, with an anticipated funding of $34 billion to $37 billion over the subsequent 4 years (see the chart beneath).

This funding is primarily aimed toward enhancing the corporate’s regulatory capital employed, which is anticipated to develop at a compound annual progress price of roughly 9% via 2027.

NextEra Vitality

Furthermore, the corporate plans to take a position $12 billion in photo voltaic vitality over the approaching years, aiming so as to add 20 gigawatts of photo voltaic capability over the subsequent decade.

Curiously, the corporate makes the case that photo voltaic installations have a capital income requirement, which is offset by gasoline financial savings and manufacturing tax credit, making solar energy practically zero price over its 35-year lifecycle when discounted to at present’s {dollars}.

In different phrases, preliminary prices are excessive. Whole prices are very low.

This is without doubt one of the the explanation why NEE believes IT can proceed to ship enticing costs for patrons.

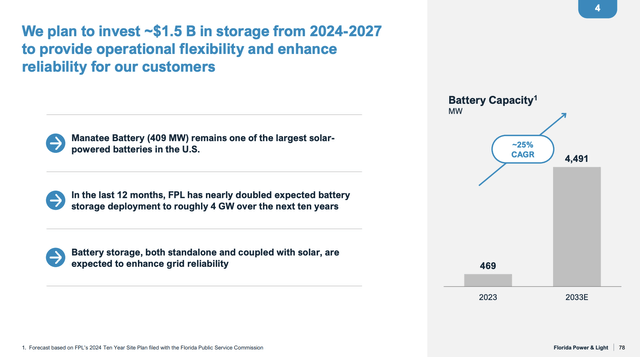

In the meantime, the corporate is doubling its battery storage capability from 2 GW to 4 GW over the subsequent ten years, with a $1.5 billion funding in battery storage deliberate for the subsequent 4 years. Whole battery capability is anticipated to develop by 25% per yr via 2033.

NextEra Vitality

Basically, this transfer makes positive that photo voltaic vitality might be saved and used successfully even when the solar shouldn’t be shining, which is without doubt one of the largest points photo voltaic vitality is battling (reliability).

Valuation

Up to now, now we have mentioned a variety of bullish developments.

The corporate has a price benefit, a wholesome stability sheet able to absorbing elevated future capital investments, sturdy demand, and a deal with dividends.

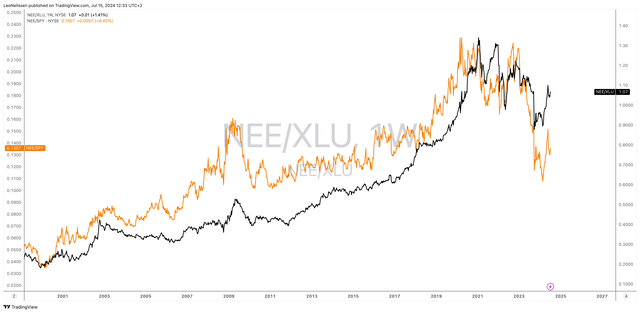

As such, the chart beneath exhibits that the corporate has constantly crushed each the Utilities ETF (XLU) and the S&P 500, because the NEE/XLU (black) and NEE/S&P 500 (orange) ratios beneath present.

TradingView (NEE/XLU, NEE/SPY)

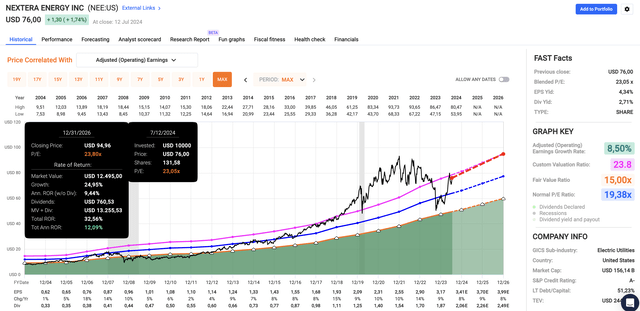

Valuation-wise, NEE inventory trades at a blended P/E a number of of 23.1x.

The corporate’s 20-year normalized P/E ratio is nineteen.4x. The ten-year P/E ratio is 23.8x, barely above the present valuation. Utilizing the FactSet information within the chart beneath, EPS is anticipated to develop by 8-9% per yr via a minimum of 2026.

If the Fed is ready to discover a approach to decrease charges, I imagine its 23.8x a number of proceed to be warranted, which might indicate a good inventory worth of $95, 25% above the present worth.

FAST Graphs

IT would indicate a theoretical annual return of 10-12%.

Since 2004, NEE has returned 12.6% yearly, which is a very spectacular return.

The one cause I do not personal IT anymore is my deal with extra unstable dividend shares within the vitality area. I at present don’t personal any utilities. That is merely primarily based on my danger profile, not as a result of I do not imagine any of the bullish issues I wrote on this article.

Takeaway

NextEra Vitality emerges as a powerhouse within the quickly evolving panorama of AI and clear vitality demand as IT capitalizes on its large portfolio in renewables and storage.

With a monitor document of sturdy financials and strategic progress initiatives, together with important investments in photo voltaic and battery storage, NEE is in a fantastic spot to satisfy escalating vitality calls for whereas delivering constant shareholder worth via dividends and potential capital appreciation.

Because the utility sector adapts to new challenges, I imagine NEE stands out for its operational excellence and its aggressive edge over lots of its friends.

Professionals & Cons

Professionals:

- Sturdy Progress in Clear Vitality: NEE is a number one participant in renewables and storage, poised for important progress.

- Monetary Stability: The corporate has a wholesome stability sheet, sturdy money stream, and constant dividend progress.

- Operational Effectivity: Decrease prices and dependable service improve aggressive edge.

Cons:

- Sector Challenges: Utilities face pressures from rising inflation and vitality transition prices, impacting profitability and progress potential.

- Debt and Leverage: Though the corporate has a stellar stability sheet, the impression of doubtless extended elevated rates of interest might harm its future progress plans.

👇Comply with extra 👇

👉 bdphone.com

👉 ultraactivation.com

👉 trainingreferral.com

👉 shaplafood.com

👉 bangladeshi.help

👉 www.forexdhaka.com

👉 uncommunication.com

👉 ultra-sim.com

👉 forexdhaka.com

👉 ultrafxfund.com

👉 ultractivation.com

👉 bdphoneonline.com

👉 Subscribe us on Youtube