Finance, web community Technology idea” data-id=”1428709516″ data-type=”getty-image” width=”1536px” peak=”1024px” srcset=”https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1428709516/image_1428709516.jpg?io=getty-c-w1536 1536w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1428709516/image_1428709516.jpg?io=getty-c-w1280 1280w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1428709516/image_1428709516.jpg?io=getty-c-w1080 1080w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1428709516/image_1428709516.jpg?io=getty-c-w750 750w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1428709516/image_1428709516.jpg?io=getty-c-w640 640w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1428709516/image_1428709516.jpg?io=getty-c-w480 480w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1428709516/image_1428709516.jpg?io=getty-c-w320 320w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1428709516/image_1428709516.jpg?io=getty-c-w240 240w” sizes=”(max-width: 768px) calc(100vw – 36px), (max-width: 1024px) calc(100vw – 132px), (max-width: 1200px) calc(66.6vw – 72px), 600px” fetchpriority=”excessive”/>

Finance, web community Technology idea” data-id=”1428709516″ data-type=”getty-image” width=”1536px” peak=”1024px” srcset=”https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1428709516/image_1428709516.jpg?io=getty-c-w1536 1536w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1428709516/image_1428709516.jpg?io=getty-c-w1280 1280w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1428709516/image_1428709516.jpg?io=getty-c-w1080 1080w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1428709516/image_1428709516.jpg?io=getty-c-w750 750w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1428709516/image_1428709516.jpg?io=getty-c-w640 640w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1428709516/image_1428709516.jpg?io=getty-c-w480 480w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1428709516/image_1428709516.jpg?io=getty-c-w320 320w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1428709516/image_1428709516.jpg?io=getty-c-w240 240w” sizes=”(max-width: 768px) calc(100vw – 36px), (max-width: 1024px) calc(100vw – 132px), (max-width: 1200px) calc(66.6vw – 72px), 600px” fetchpriority=”excessive”/> vittaya25

Funding Thesis

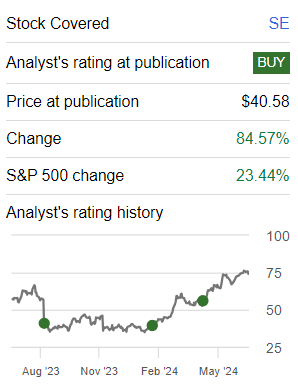

Sea Restricted (NYSE:SE) is a inventory that I have been recommending for some time, when few traders foresaw its potential. Nonetheless, now its prospects are priced at about 35x ahead EBITDA.

Accordingly, regardless that I consider that there is extra doubtless than not nonetheless some extra juice within the tank, I do not consider Sea Restricted’s risk-reward is as compelling as IT was this time final 12 months.

Due to this fact, I am now calling IT a day on this inventory and shifting to the sidelines.

Fast Recap

Again in April, I concluded my evaluation by saying,

Regardless of current hurdles, I consider Sea’s potential to stabilize and finally obtain profitability in [its ecommerce] phase may function a major catalyst for the inventory’s upward trajectory.

As my expectations align with Sea’s potential for enchancment, notably in its e-commerce operations, I discover the present valuation of the inventory to be a discount alternative.

Writer’s work on SE

Up to now 12 months, I have been constantly bullish on Sea. And the inventory has clearly outperformed the S&P 500 by almost 60%. However I now battle to see much more upside. Or higher stated, the asymmetry of this wager, is extra muted.

Sea Restricted Prospects Mentioned

Sea is a diversified firm working throughout ecommerce, digital monetary providers, and digital leisure.

Its e-commerce platform, Shopee, has proven exceptional progress, attaining its highest quarterly orders, gross merchandise worth, and income in Q1 2024. Sea’s digital monetary providers below SeaMoney have additionally seen sturdy progress, pushed primarily by its credit score enterprise, whereas its digital leisure division, Garena, continues to thrive with in style video games like Free Hearth.

Within the close to time period, Sea’s ecommerce phase is well-positioned. Shopee has enhanced its worth competitiveness, strengthened its content material ecosystem, and improved its service high quality, resulting in enhancements in unit economics.

With initiatives just like the on-time assure program and direct administration of the return and refund course of, Shopee is reinforcing its popularity as a dependable buying vacation spot. These efforts recommend that Shopee will proceed to distinguish itself from rivals.

Nonetheless, Sea faces challenges too. For instance, in its ecommerce phase, sustaining profitability whereas managing aggressive pressures stays a priority, that I do not want to be complacent about.

Moreover, in its digital monetary providers, increasing the consumer base and use circumstances past the Shopee ecosystem whereas managing credit score danger is one thing to be attentive to.

Given this balanced background, let’s now delve into its fundamentals.

Income Progress Charges Are Transferring Greater, With a However…

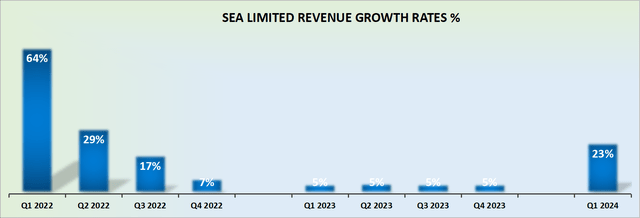

SE income progress charges

Sea’s income progress in Q1 2024 elevated by 23% y/y, which is a formidable consequence and exceeded my expectations.

This means that Sea is gaining market share not solely in e-commerce but in addition within the fintech sector.

Nonetheless, I stay impartial on this inventory. Regardless of the sturdy efficiency in Q1, IT have to be seen within the context of the earlier 12 months’s subdued progress charges.

This implies that Sea would possibly proceed to realize round 20% annual progress for the remainder of the 12 months, however will face more durable comparisons shifting ahead.

Moreover, because the market usually seems forward by six months, I consider IT’s vital to anticipate 12 months forward to remain forward of market tendencies. My expertise and efficiency present that this strategy is efficient, even when IT means my views are extremely unpopular.

Furthermore, I do not suppose Sea’s valuation offers a ample margin for error, which I’ll clarify additional beneath.

SE Inventory Valuation – 35x Ahead EBITDA

Sea’s stability sheet contains roughly $2.5 billion in internet money and short-term securities, together with long-term investments that, whereas not readily liquid, add to its monetary stability, however will not be included on this determine. This positions the corporate effectively for future progress investments.

Nonetheless, I estimate Sea is on monitor to realize roughly $1.2 billion in EBITDA, inserting its inventory at 35x ahead EBITDA.

This valuation isn’t excessively excessive, however as an inflection investor, I at all times suppose forward. My technique, as my subscribers know, focuses on retaining the returns I’ve made moderately than striving to time the market to get out on the high. Merely put, IT‘s not what you make that counts, however what you retain that issues.

Given this, I discover IT difficult to see how way more Sea’s a number of can increase additional. Whereas IT‘s attainable that Sea’s a number of may attain almost 40x ahead EBITDA, particularly if rates of interest drop in 2025, if that is the core of the funding thesis, hoping for a a number of growth on the again of rates of interest dropping, there are different significantly better alternatives elsewhere.

The Backside Line

Given Sea’s present valuation of roughly 35x ahead EBITDA, I consider the inventory’s upside potential is already largely priced in. Regardless of the corporate’s spectacular progress in e-commerce and fintech, and its sturdy efficiency in Q1 2024, the context of the earlier 12 months’s subdued progress charges means that Sea’s near-term progress could face more durable comparisons shifting ahead.

Furthermore, I discover IT difficult to see how way more Sea Restricted’s a number of can increase from right here. Though there is a chance that Sea’s a number of may attain almost 40x ahead EBITDA, particularly if rates of interest drop in 2025, counting on a number of growth pushed by potential rate of interest drops will not be a sturdy funding thesis. Given these elements, I do not suppose Sea’s valuation offers a ample margin for error.