MmeEmil

Introduction:

The tobacco trade is one which has lengthy fascinated me and an trade which I have been bullish on for fairly a while, consequently, I will be initiating protection on quite a lot of tobacco firm’s, beginning with Altria (NYSE:MO).

Altria affords traders an unbelievable yield of round 8%, coupled with occasional buybacks and a sturdy enterprise with little menace to IT from new entrants, all issues which have made me very bullish on Altria at a number of instances once I thought the worth was opportune during the last variety of years.

That being mentioned, Altria’s cigarette gross sales volumes are beginning to present potential points for the enterprise going ahead that weren’t current prior to now. Moreover, the enterprise has rallied about 25% over the previous few months.

Going into this rally and prior to those income era challenges, I used to be of the view that Altria was doubtless considerably undervalued. Publish these latest occasions, I do consider that Altria remains to be undervalued, nevertheless the diploma to which Altria is undervalued is not important sufficient for me to have a adequate margin of safety to provide Altria a purchase score.

Therefore, my view is that traders ought to maintain on to their present shares, however look ahead to potential alternatives to extend their stake in Altria if the worth as soon as once more dips beneath $45, which might make IT a extra enticing purchase or beneath $40, at which level the inventory could be a raging purchase presuming the present fundamentals stay related.

Altria’s Quantity Points:

Over the previous few years, Altria’s adopted a well-known path, yearly, cargo volumes decline of their Smokeable merchandise section, which accounts for the overwhelming majority of income (of their most up-to-date quarterly report as of writing, Q1 2024, smokeable merchandise accounted for round 88% of complete income).

The corporate has, nevertheless, been capable of forestall a decline in income by elevating costs, and since nicotine merchandise are notoriously fascinating to their core shoppers, a big portion of their buyer base is prepared to proceed shopping for cigarettes and different smokeable merchandise at these elevated costs.

Not solely has this prior to now staved off a decline in income, IT‘s truly led to increasing margins and usually rising earnings, since related income is coming in, however much less product is having to be produced and offered, reducing prices.

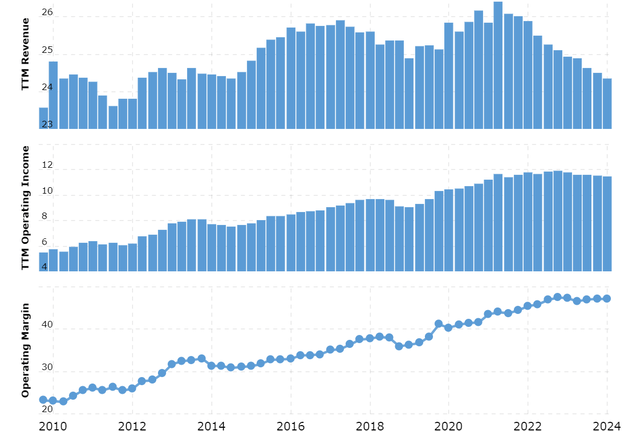

You’ll be able to observe this development within the following three charts beneath:

Altria Income, Working Revenue and Working Revenue Margins Time beyond regulation (Macrotrends)

The element of this chart which makes me query whether or not this technique which Altria has been implementing for therefore lengthy is prone to changing into much less efficient going ahead is the constant decline in income that is been occurring since roughly 2021.

Digging deeper into the figures to attempt to decide the supply of Altria’s income declines, IT‘s clear that the first difficulty is that Altria’s smokeable product cargo volumes are declining at an accelerated price, in different phrases, they’re promoting much less product, quicker.

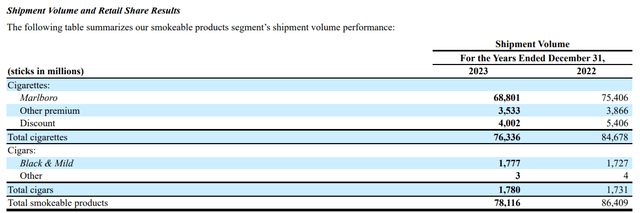

While over the previous a number of years Altria’s cargo volumes have been declining at a price which may very well be offset by value hikes, in 2023, complete cargo volumes of smokeable merchandise declined by almost 10% from the earlier 12 months, a decline giant sufficient that value will increase had been unable to stabilize revenues.

Smokeable Merchandise Annual Cargo Volumes (SEC)

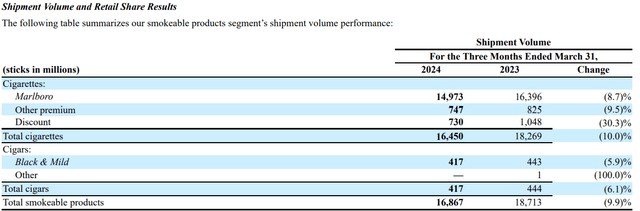

The newest quarterly figures from Q1 do not point out that this development is exhibiting indicators of reversing, the decline in cargo quantity was once more, about 10%.

Smokeable Merchandise Quarterly Cargo Quantity (SEC)

Administration consider that these sharper declines are attributable to low-income shoppers coming below strain on account of inflation, coupled with elevated proliferation of illicit e-vapor merchandise, which act as an alternative choice to cigarettes.

Stress on low revenue shoppers could or could not ease considerably within the close to to medium time period and the FDA does appear to be Health/illegal-e-cigarettes-new-task-force/index.html” rel=”nofollow” title=”https://version.cnn.com/2024/06/10/Health/illegal-e-cigarettes-new-task-force/index.html” goal=”_blank”>more and more cracking down on elicit e-vapor merchandise, however whether or not or not their efforts will have the ability to outpace the expansion in illicit gross sales stays to be seen.

Now, all of this isn’t to say that hope needs to be deserted in Altria. Altria is buying and selling at very low valuations that account for these challenges, and IT affords an incredible dividend yield, the core enterprise is very worthwhile, and though IT is prone to fade time beyond regulation, IT will present regular cashflows for Altria to return to shareholders for years to return.

That being mentioned, the persistence of those cargo quantity declines point out in my thoughts that this development may probably be right here to remain, if that is the case then value will increase won’t be able to offset declining cargo quantity and Altria’s present core operations will enter right into a section of declining income and declining earnings, which can necessitate a transition to extra future-oriented enterprise strains as a way to create better shareholder worth.

Future Development Alternatives:

Buyers and administration have been anticipating a decline within the cargo volumes of Altria’s smokeable merchandise section for a very long time now, this spurred Altria’s authentic acquisition of a large stake in Juul, a forward-thinking transfer that might’ve positioned Altria effectively within the e-vapor market and enabled them a possibility to develop considerably, making up for declines of their legacy enterprise strains.

Sadly for Altria, their funding in Juul needed to be written off almost completely after a regulatory crackdown by the FDA on practices core to Juul’s providing, corresponding to flavors, which the FDA argued elevated the probability of kids utilizing the product.

In gentle of this, Altria has lagged behind opponents corresponding to British American Tobacco (BTI) and particularly Phillip Morris (PM), each of which generate a considerably bigger portion of their complete revenues from new, development segments than Altria does.

In more moderen instances, nevertheless, Altria has been placing elevated efforts into changing into an actual competitor within the oral tobacco and e-vapor markets, with the addition of on!, an oral tobacco model that is been rising quickly, and NJOY, an e-cigarette firm.

Whether or not or not Altria will finally show to be below or overvalued right this moment hinges on how rapidly Altria can scale these companies.

Valuation:

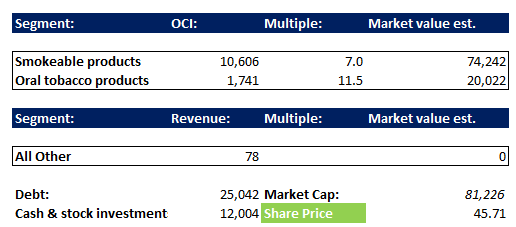

I might like to separate out Altria’s completely different enterprise segments and do a valuation this manner for illustrative functions. Firstly, I will do the valuation assuming that the “All different” section, below which NJOY falls, is price 0.

Altria Segmental Valuation (Made by Creator)

On this valuation, I’ve taken the working firm revenue of the completely different enterprise segments and utilized a a number of that I consider is within the right vary, 7x for the smokeable merchandise section, reflecting the amount challenges outlined above and the truth that IT shall be phased out over time and 11.5x for the Oral tobacco merchandise section, as a result of section as a complete remaining regular, however possessing some manufacturers inside the section which have proven development potential corresponding to On! and leaving the valuation of the NJOY all different section as 0.

Since these are working figures, after making use of the multiples I then alter out Debt and add again money, in addition to Altria’s investments in public equities.

The purpose of this valuation is to indicate that the majority of Altria’s present $50.43 value per share is accounted for utilizing solely the fairly secure, revenue producing segments of Altria. on this valuation, we come out to about $46 of IT being accounted for, you possibly can argue that this determine needs to be barely extra or barely much less, however I doubt any affordable investor would argue that the multiples needs to be massively completely different to these supplied.

That is why Altria to me begins to develop into an incredible purchase as soon as IT dips into the $40-$45 vary. The core, secure worthwhile segments cowl your buy and also you get the expansion potential of NJOY on prime of that.

That being mentioned, while there is a affordable estimate on the valuation ground, the present true worth of Altria is a query mark. NJOY is tiny in comparison with the enterprise as a complete, however utilizing Altria’s already established gross sales channels may result in fast income development.

Early indications look considerably constructive, however IT‘s too quickly to say for positive. Personally, I consider the present worth of this section to be round $6 a share, based mostly on the cashflows of the section mendacity far sooner or later, however bolstered by the robust focus administration are inserting on IT.

Including $6 onto the valuation of the opposite segments comes out to roughly $52 per share, a slight undervaluation in comparison with the present value, however nothing that screams purchase to me.

A easy and fast Discounted Cashflows evaluation with conservative estimates together with income declines of about 2% every year over the medium time period, coupled with margin growth and a conservative terminal development price of -1% p.a., predicated on Altria’s poor positioning for the long run relative to opponents, in addition to the truth that future nicotine merchandise, and significantly e-cigarettes seem to supply decrease margins than their predecessors seems to align roughly with our conclusions, forecasting a value goal of $56 per share.

Conclusion:

To conclude, Altria is a stable dividend firm and a very good defensive inventory. That being mentioned, quantity points plague IT‘s core legacy enterprise and future growth plans lag behind opponents as a result of unlucky end result of Altria’s funding in Juul a few years in the past.

Regardless of these points, Altria is affordable sufficient that I nonetheless suppose IT‘s most likely barely undervalued, however not sufficient for IT to be price taking a chew.

I like to recommend that traders maintain and look ahead to both a downtrend in Altria’s value, permitting them to get in at a greater value, or future filings exhibiting progress on development initiatives, which can current a possibility for traders to purchase with an elevated margin of security.

👇Observe extra 👇

👉 bdphone.com

👉 ultraactivation.com

👉 trainingreferral.com

👉 shaplafood.com

👉 bangladeshi.help

👉 www.forexdhaka.com

👉 uncommunication.com

👉 ultra-sim.com

👉 forexdhaka.com

👉 ultrafxfund.com

👉 ultractivation.com

👉 bdphoneonline.com

👉 Subscribe us on Youtube